Introduction

Read our annual report to learn how we continued to improve Queensland’s CTP insurance scheme in the 2024-25 financial year.

See how we’ve met the annual report requirements for Queensland Government agencies and statutory bodies.

MAIC annual report 2024-25

( pdf 2.10 Mb )Accessibility and copyright

Print: ISSN:1837-1450

Online: ISSN: 1837-1469

The Motor Accident Insurance Commission is committed to providing accessible information and services to Queenslanders from all cultural and linguistic backgrounds. To talk to someone about this annual report in your preferred language call 1800 CTP QLD (1800 287 753).

Motor Accident Insurance Commission

GPO Box 2203, Brisbane QLD 4001

Phone: 1800 CTP QLD (1800 287 753)

Email: maic@maic.qld.gov.au

Web: www.maic.qld.gov.au

Nominal Defendant

GPO Box 2203, Brisbane QLD 4001

Phone: 07 3035 6321

Email: nd@maic.qld.gov.au

Web: www.maic.qld.gov.au/nominal-defendant

Visit www.maic.qld.gov.au to view this annual report. Copies of the report are also available in paper format. To request a copy, please contact us using the details above.

© Motor Accident Insurance Commission 2025

Licence: This annual report is licensed by the State of Queensland under a Creative Commons (CC BY) 4.0 International licence.

CC BY Licence Summary Statement: In essence, you are free to copy, communicate and adapt this annual report, as long as you attribute the work to the Motor Accident Insurance Commission. To view a copy of this licence, visit: http://creativecommons.org/licenses/by/4.0/.

Attribution: Content from this annual report should be attributed as: The Motor Accident Insurance Commission Annual Report 2024-25.

Letter of compliance and certification of financial statements

10 September 2025

The Honourable Ros Bates MP

Minister for Finance, Trade, Employment and Training

GPO Box 15483

CITY EAST QLD 4001

Dear Minister

I am pleased to submit for presentation to the Parliament the Annual Report 2024–25 and financial statements for the Motor Accident Insurance Commission and the Nominal Defendant.

I certify that this Annual Report complies with:

- the prescribed requirements of the Financial Accountability Act 2009, the Financial and Performance Management Standard 2019, the Motor Accident Insurance Act 1994 and the National Injury Insurance Scheme (Queensland) Act 2016, and

- the detailed requirements set out in the Annual report requirements for Queensland Government agencies.

A checklist outlining the annual reporting requirements is provided at page 89–90 of this annual report.

Yours sincerely,

Neil Singleton

Insurance Commissioner

About us

Queensland compulsory third party insurance scheme

Queensland’s compulsory third party (CTP) insurance scheme is governed by the Motor Accident Insurance Act 1994 (MAI Act).

The scheme protects motor vehicle owners, drivers and passengers from being held financially responsible if they injure someone in a motor vehicle crash. It also enables people who are injured to claim fair and timely compensation for their injuries and access prompt and reasonable medical treatment and rehabilitation.

Motor vehicle owners pay their CTP insurance premium when they pay their vehicle registration through the Department of Transport and Main Roads (DTMR). DTMR remits the applicable premium to the licensed CTP insurer nominated by the motor vehicle owner. This minimises administration costs, is convenient for motorists and reduces the incidence of uninsured vehicles.

Motor Accident Insurance Commission

The Motor Accident Insurance Commission (MAIC or Commission) is the regulatory authority responsible for ongoing management of Queensland’s CTP insurance scheme.

MAIC’s functions include:

- licensing and supervising CTP insurers and monitoring their compliance

- regulating the CTP insurance scheme

- establishing and revising standards about the proper management of claims

- keeping the statutory insurance scheme under review and making recommendations for its amendment

- developing and maintaining a claims register and statistical database for the purpose of providing management information

- fixing the range within which each insurer must file their premium

- monitoring the availability, adequacy and use of rehabilitation services for people injured in crashes

- recommending to government the levies and administration fees payable to cover the costs involved in delivering different components of the CTP insurance scheme

- contributing funds towards research and education to reduce the frequency and severity of motor vehicle crashes and to facilitate rehabilitation of people who are injured in crashes

- maintaining a helpline service from which the public may obtain information on the CTP insurance scheme.

Nominal Defendant

The Nominal Defendant (ND) is a statutory body which acts as a licensed insurer in the CTP insurance scheme for claims that involve motor vehicles that are unidentified or uninsured. It also meets the claims costs associated with licensed insurers that become insolvent.

National Injury Insurance Agency, Queensland

Queensland’s CTP insurance scheme is complemented by the National Injury Insurance Scheme, Queensland (NIISQ), which was established on 1 July 2016. NIISQ provides necessary and reasonable lifetime treatment, care and support to people who sustain eligible serious personal injuries in motor vehicle crashes on Queensland roads, regardless of who was at fault. MAIC also has a legislative function pursuant to Chapter 5 of the National Injury Insurance Scheme (Queensland) Act 2016 (NIISQ Act) to monitor the efficiency and effectiveness of the National Injury Insurance Agency, Queensland (NIISQ Agency), which administers NIISQ.

The Insurance Commissioner of MAIC is also the Chief Executive Officer responsible for managing the NIISQ Agency. In line with statutory requirements of the NIISQ Act, the NIISQ Agency is required to produce its own annual report, which can be viewed at https://niis.qld.gov.au/news-and-research/annual-reports.

Our location

MAIC has been located in Brisbane since it commenced operations on 1 September 1994 as a statutory body reporting to the Treasurer and is located at 275 George Street. MAIC and the Nominal Defendant are positioned within the Economics and Fiscal division of Queensland Treasury.

Our purpose

We boldly lead our scheme to support injured claimants and motorists, while ensuring strong and efficient governance.

Our vision

By 2026, claimants and motorists will benefit from improved experiences and outcomes through our leadership of an aligned, intelligent and empowering scheme.

Our objectives

We strive to deliver our objectives:

- improved experience for claimants, motorists and stakeholders

- smart and responsive regulatory functions

- a highly engaged team that strives for excellence.

Our contribution to government objectives for the community

We also actively support the Queensland Government’s objective for the community of fostering ‘Safety where you live’ by focusing on trauma mitigation, early intervention and strong rehabilitation support, helping injured claimants and motorists recover from accidents.

Our opportunities

We embrace the opportunity to:

- develop a robust and dynamic workforce that consistently delivers high-quality services

- improve collaboration and co-design with stakeholders to deliver better claimant outcomes and reduced incidence and effects of road trauma

- leverage emerging innovations and technologies to educate stakeholders, influence decision-making and improve outcomes for injured people

- influence and invest in specific health systems to improve outcomes for seriously injured people.

Our key risks

We mitigate risks such as:

- failure to respond appropriately to economic pressures and unethical practices

- failure to protect the agency’s core information assets against cyber-attacks or data breaches

- failure to provide a safe and supportive work environment to protect the wellbeing of our workforce and ensure excellence in service delivery.

Our success measures

Our success is indicated by:

- stakeholder feedback and claimant satisfaction

- scheme efficacy measures and process digitisation

- Commission compliance and reputation measures

- team diversity and engagement measures.

Insurance Commissioner's report

I am pleased to report that Queensland road users continue to benefit from the protection of our CTP scheme, which is long regarded as stable, fair and affordable.

That said, I note that after several years of steady reductions in claim frequency, the number of new claims is now rising. Higher claim frequency sadly means more people being injured, and typically flows through to higher premiums. MAIC will be monitoring this trend closely.

To preserve scheme stability, MAIC is working with stakeholders to explore reform options arising from the 2023 scheme review. We also remain focused on deterring claim farming activities.

In terms of key statistics, scheme affordability is the best in Australia with Class 1 car and sedan CTP premiums below 20% of average weekly earnings. The scheme also remains very efficient with 73% of premiums being delivered as a claimant benefit.

On 1 September 2024, MAIC celebrated its 30th anniversary. It was pleasing to reflect on the many collaborations and partnerships that have developed over three decades, with many still in place today.

The MAIC Innovation Research Action Awards (MIRAA) announced on the day attracted an overwhelming number of applications. It is pleasing to see so many opportunities out there to reduce the effects of road trauma.

Also in September, MAIC successfully completed the reallocation of all 1.4 million policyholders from RACQ Insurance to alternative insurers, ensuring no disruption to policy coverage, no impact on claims, and no additional cost to motorists. I thank the team at MAIC and DTMR for their commitment to achieving this outcome.

During the year, MAIC commenced engagement with insurers on their adoption of emerging technology, particularly artificial intelligence. MAIC needs to remain abreast of how this technology is being deployed across CTP insurance. We want to see opportunities for improvement benefit all scheme stakeholders in a fair and transparent manner, while also ensuring that insurers have appropriate compliance and control regimes in place.

The Nominal Defendant continues to perform strongly and maintains an appropriate balance in managing unmeritorious claims, while also achieving excellent performance in the management and resolution of claims. With a very sound financial position, the sustained performance of the team has enabled the Nominal Defendant levy for 2025-26 to be reduced.

MAIC continues to fund a range of research and innovation initiatives. Since 2017, we have funded a world-leading spinal cord nerve project led by Professor James St John at Griffith University. The amazing work of Professor St John and his team has now progressed to the clinical trial phase, while also identifying even more opportunities to improve outcomes for seriously injured people.

While there are many positives to call out, there is one area where MAIC considers improvement is needed. During recent audits, MAIC identified that some licensed insurers have sought to settle claims made on behalf of children without a court or the Public Trustee first approving the settlement terms. This is a longstanding legal requirement insurers are well aware of. MAIC will be developing a Claims Management Standard to formally ensure such conduct is clearly called out as inappropriate for a licensed insurer.

In 2025-26 MAIC will maintain a focus on continuing and improving the Queensland CTP scheme, including:

- working with government to explore scheme reform opportunities and progressing the 2023 CTP scheme review

- commencing an ‘insurer of the future’ project to explore digital claims management opportunities

- exploring opportunities to further boost scheme efficiency and encouraging insurer premium competition

- funding initiatives to help detect and deter impaired driving

- investing in transitional rehabilitation services and infrastructure to better enable injured people to transition from hospital to home

- continuing our investment in initiatives and research to reduce the effects of road trauma, through enhanced data collaborations and insights

- strengthening our monitoring and auditing of licensed insurers and maintaining our oversight of the National Injury Insurance Agency.

I thank all stakeholders for their support and contribution to scheme performance during the year. My special thanks to the MAIC team who have remained absolutely committed to our Purpose and our goals, recording a very high level of engagement at 84% in the latest Working for Queensland survey. I also pay a very special thank you to Mr Henry Smerdon AM, who stepped away after many years of providing MAIC with advisory services and support. I am indebted to Henry for sharing his exceptional insight, wisdom and guidance throughout my time as Insurance Commissioner.

MAIC is committed to working with all stakeholders to deliver Queensland road users a CTP scheme that remains stable, fair and affordable.

Neil Singleton

Insurance Commissioner

Report card

| Highlights | Performance indicators | Notes | Target | Outcome |

|---|---|---|---|---|

| Objective | 1. Improved experience for claimants, motorists and stakeholders | |||

Develop faster and simpler systems and processes |

Undertake discovery on insurer monitoring and reporting system |

On track | On track | |

Implement enhancements to the end-to-end digital claims process |

On track | On track | ||

Uplift MAIC enquiries and complaints systems and services |

On track | On track | ||

Implement digitised information requests |

Achieved | Achieved | ||

Support research focused on reducing the incidence and effects of road trauma |

Continued support of the Griffith Spinal Cord project |

Achieved | On track | |

Future funding determinations processed efficiently and effectively |

Achieved | Achieved | ||

Genuinely collaborate with and leverage strategic partnerships to deliver better outcomes |

Continue to build and grow external partnerships with key stakeholders aligned to scheme operations |

On track | On track | |

Co-design initiatives that embed representative voices of claimants and motorists |

Agree and implement CTP experience initiatives (QUT Sprint) milestones |

On track | On track | |

Best practice Nominal Defendant claims management |

Implement legal panel and investigator performance monitoring activities by June 2025. |

Achieved | Achieved | |

| Objective | 2. Smart and responsive regulatory functions | |||

Sustain confidence through prudent financial management |

Improve, and simplify corporate processes, policies and frameworks to identify opportunities for improved alignment and service delivery |

Achieved | Achieved | |

Deliver strong procurement and contract management services to improve business outcomes and agency value for money |

Achieved | Achieved | ||

Leverage technology including Artificial Intelligence (AI) in innovative ways, rising to meet new challenges |

AI strategy and roadmap developed and socialised |

Achieved | Achieved | |

Identify and explore AI use cases and participate in AI labs and forums across the Queensland Government |

Achieved | Achieved | ||

Harness data and insights to inform actions |

Develop and agree on an organisational data strategy |

Achieved | Achieved | |

Effective systems, regulatory tools, techniques and practices |

Review and refresh MAIC guidelines and information sheets |

On track | On track | |

Prepare and improve templates, registers and workflow notifications |

On track | On track | ||

| Objective | 3. A highly engaged team that strives for excellence | |||

Empower a safe, capable and engaged team |

Working for Queensland action plan developed and implemented |

Achieved | Achieved | |

Implement 'Safe staff, safe customers' policy for internal and external use |

Achieved | Achieved | ||

Develop and implement ongoing intern program |

Achieved | Achieved | ||

Learning and development strategy actions implemented |

On track | On track | ||

Cultivate a bold and innovative culture, championing our people as they deliver outstanding services |

Reshape the new starter onboarding program, including refreshed culture activities |

Achieved | Achieved | |

Develop and implement new starter first impressions survey |

Achieved | Achieved | ||

Continuously enhance and grow innovative functionality to improve ways of working |

Review and enhance user experience for Analytics reports and insights |

Achieved | On track | |

Conduct MAIC data literacy assessment and agree on an uplift plan |

Achieved | Achieved | ||

Levies and administration fee

Queensland’s CTP insurance premium contains levies and an administration fee to help cover the costs involved in delivering different components of the CTP insurance scheme.

These levies and the administration fee are calculated annually and include:

- the statutory insurance scheme levy

- the Nominal Defendant levy

- the hospital and emergency services levy

- the National Injury Insurance Scheme, Queensland levy

- an administration fee.

In setting these levies, advice is sought from the receiving agencies and the State Actuary’s Office.

Statutory insurance scheme levy

The statutory insurance scheme levy covers the estimated operating costs of MAIC in administering the MAI Act. It also provides funding for research into crash prevention and injury mitigation. From 1 July 2024, the levy remained unchanged at $2.00 per policy and collected $11.0 million across 2024–25.

Nominal Defendant levy

The Nominal Defendant levy varies by vehicle class and covers the estimated costs of the Nominal Defendant in managing and funding claims arising from motor vehicle accidents involving uninsured (unregistered) or unidentified vehicles. The levy is determined based on an actuarial assessment of claim trends. From 1 July 2024, the levy for Class 1 vehicles remained flat at $4.00 with $20.3 million collected in 2024–25.

Hospital and emergency services levy

The hospital and emergency services levy covers a reasonable proportion of the estimated cost of providing public hospital and public emergency services to people who are injured in motor vehicle crashes, who use such services and who are claimants or potential claimants under the CTP insurance scheme. The levy amount calculated varies by vehicle class. From 1 July 2024, the hospital and emergency services levy decreased by $4.80 to $9.20 for a Class 1 vehicle. The collected income from the levy for the financial year was $47.8 million of which $40.6 million was apportioned to Queensland Health, $2.4 million to Queensland Fire and Emergency Services (QFES) and $4.8 million was allocated to Queensland Police Service (QPS). Collecting the levy in this way removes the need for hospitals and emergency services to issue invoices to CTP insurers for each treatment provided to victims of road crashes. This saves a significant administrative burden for service providers and licensed CTP insurers, providing an efficient means of funding agencies which provide critical services to people injured or killed in motor vehicle accidents.

National Injury Insurance Scheme, Queensland levy

The National Injury Insurance Scheme, Queensland levy (NIISQ levy) varies by vehicle class and covers the estimated costs of the NIISQ which provides necessary and reasonable lifetime treatment, care and support to people who sustain eligible serious personal injuries in motor vehicle crashes in Queensland. The NIISQ levy increased by $4.80 to $123.80 for a Class 1 vehicle in 2024–25 and collected $662.0 million.

Administration fee

The administration fee is the fee payable to DTMR for delivering administrative support to the CTP insurance scheme, such as providing CTP-related customer service and processing CTP premiums as part of the motor vehicle registration process. The administration fee remained unchanged at $8.60 per policy in 2024–25 and collected $45.6 million.

Premium levy and fee collection

1 July 2024 to 30 June 2025

| Description* | $ (‘000) |

| Total insurance premiums collected** | 2,074,236 |

| Nominal Defendant levy | 20,307 |

| Statutory insurance scheme levy | 10,963 |

| Hospital and emergency services levy^ | 47,827 |

| Administration fee (DTMR fee) | 45,620 |

| NIISQ levy+ | 662,003 |

| Insurer’s premiums# | 1,287,516 |

Notes: * Levies received for the period 1 July 2024 to 30 June 2025 are on a cash basis.

** Net of cancellations.

^ From 1 July 2016, emergency levies collected were remitted separately to relevant entities. In the past the emergency levies were remitted as one payment

+ National Injury Insurance Scheme, Queensland levy.

# Includes GST.

Achievements

Protecting the interests of vulnerable claimants

MAIC plays a critical role in ensuring compliance with legal requirements under the Public Trustee Act 1978 and the Motor Accident Insurance Regulations. These laws are designed to safeguard the interests of child claimants and others under a legal disability, ensuring fair and legally binding claim settlements.

Under the Public Trustee Act, any settlement involving a person under a legal disability must be approved by a court or the Public Trustee to be legally binding.

Without this approval, resolved claims could potentially be reopened in the future, creating uncertainty for the scheme. By prioritising compliance, MAIC not only protects vulnerable claimants but also ensures the ongoing stability and integrity of Queensland’s CTP insurance scheme.

30th anniversary inspires innovative collaborations

In September 2024, MAIC proudly hosted its 30th anniversary event, bringing together key stakeholders to reflect on three decades of achievements. Since its establishment in 1994, registered vehicles have grown from 1.9 million to over 5 million in 2024, with more than 225,000 claimants benefiting from the CTP scheme.

The stakeholder event featured inspiring presentations from leading researchers who have significantly advanced road safety and road trauma outcomes. They highlighted ongoing programs focused on prevention, treatment, and rehabilitation – all aimed at improving outcomes for Queensland road users.

The event also marked an exciting step forward with the announcement of the MAIC Innovation Research Action Awards (MIRAA). This one-off funding initiative is designed to foster new collaborations, validate innovative ideas, and support emerging researchers. MIRAA projects aim to reduce claims and costs within the scheme, ensuring its long-term affordability.

MAIC received 44 project concepts spanning prevention, trauma response, rehabilitation, and disability management, presenting a challenging selection process. By partnering with Queensland Government agencies and universities, MAIC remains committed to driving impactful research and education initiatives. We eagerly anticipate the outcomes of these projects over the next 12–18 months, furthering our ongoing commitment to preventing road trauma and enhancing recovery for injured Queenslanders. You can view the successful MIRAA recipients at https://maic.qld.gov.au/maic-innovative-research-action-awards-miraa-winners-announced.

Successful medical information management experiments enhance claimant experience

MAIC is driving innovation to streamline the CTP process, aiming to reduce delays, improve access to rehabilitation, and ease financial pressures on claimants. Following a comprehensive review of data, MAIC launched three key experiments to address these challenges:

- Experiment 1: in partnership with independent medical provider mlcoa, MAIC introduced telehealth-based medical certificates. This enabled claimants to access MAIC-funded medical certificates via video calls following referral by MAIC, the CTP insurer, or a law firm. This enabled faster and more convenient access to medical documentation.

- Experiment 2: insurers trialled the acceptance of alternative information in cases where obtaining a CTP medical certificate is difficult or costly. This included hospital discharge summaries, WorkCover medical certificates, or certificates completed by Nurse Practitioners or via telehealth. This offers greater efficiency, accessibility, flexibility and is cost-effective for claimants.

- Experiment 3: we added a CTP medical certificate rich text file (RTF) to our website, allowing medical centres to integrate it into their systems and further streamline the process.

Inspired by a successful 2023 innovation sprint with Queensland University of Technology (QUT), early results of these experiments show promise in reducing the average time to lodge a claim, which dropped from 43 days in 2023 to 40 days in 2024. MAIC is now working to cut this further, enabling quicker access to insurer-funded rehabilitation and supporting claimants’ recovery, mental health, and return to work. Feedback and data from these experiments will shape future co-design initiatives to improve the CTP experience.

Our digital products streamline insurer interactions

In 2024-25, we commenced a significant digital project focused on improving insurer monitoring and reporting, set to make interactions with us quicker, easier, and more secure. The release of a new online portal, CTP Secure, will serve as a one-stop platform, integrating key systems such as the Personal Injury Register (PIR), the CTP Premium Filing system, and the Queensland CTP Portal. It will also introduce MAIC Exchange, a new application enabling insurers to securely exchange notifications and documents. This transition from manual, email-based processes to a single digital portal will reduce duplication, minimise errors, and improve visibility of actions and statuses.

Early iterations of the platform were soft launched at the end of June with cost and claim-sharing reporting, with additional features including self-audits, business plans, fraud referrals, and breach reporting to follow in early 2025-26. These improvements will not only simplify routine tasks but also enhance security and efficiency for MAIC and insurers.

We also commenced a refresh of our website, which will be informed by user feedback, to better support claimants and motorists in understanding the scheme. Additionally, after exploring insurers’ use of artificial intelligence and emerging technologies, we are committed to expanding the digitisation of regulatory services, automating processes, reducing administrative costs, and ensuring safer data exchanges.

Through co-design and test-and-learn approaches, MAIC looks forward to collaborating with claimants, insurers, lawyers, health providers, and other stakeholders to drive innovation and deliver smarter solutions for the CTP scheme.

First on Scene pilot program improving rural road safety

In 2022, MAIC provided funding to the Queensland Trucking Association (QTA) to develop and implement First on Scene, a pilot program incorporating first aid and crash scene management training tailored to heavy vehicle drivers. With the assistance of the Queensland Ambulance and Police services, Energy Australia and St John’s Ambulance, the pilot successfully delivered training to 129 truck drivers across Queensland.

Heavy vehicle drivers are often the first to arrive at crash scenes, particularly on rural and remote roads, and their ability to secure crash sites, provide first aid, and activate emergency care systems is vital in these areas.

To evaluate the program’s impact, Associate Professor Darren Wishart from Griffith University was engaged to conduct independent research. The findings were overwhelmingly positive, with participants reporting significant improvements in their knowledge, skills, and confidence to manage crash scenes and provide first aid. While crashes in regional Queensland are less frequent, they often result in severe injuries, leading to higher costs for the Queensland CTP scheme.

A key outcome of the project was the creation of The Glovebox Guide, a resource booklet reinforcing key crash scene management steps. Over 700 copies have been distributed, extending the program’s reach and ensuring ongoing benefits for the heavy vehicle industry.

Managing Nominal Defendant claims prudently

The Nominal Defendant continues to deliver important protection for Queensland road users who are injured by an unidentified or uninsured vehicle. Nominal Defendant claims require a particularly stringent approach to claims management, especially where the involvement of an unidentified vehicle is alleged.

In October 2024, the Nominal Defendant successfully defended an injury claim in a Cairns court case involving an unregistered dirt bike incident in 2017.

Thorough investigation revealed inconsistencies in the plaintiff’s account which included a ‘clothesline’ or ‘coat hanger’ action, leading to the dismissal of the case. This outcome underscores our commitment to maintaining financial sustainability, funded by a levy in motor vehicle registration fees, thus ensuring that resources are available for genuine victims by deterring fraudulent claims. Additionally, the rigorous scrutiny of claims can encourage more responsible driving behaviour, contributing to safer road conditions. The aim is to ensure that only valid claims are paid, balancing the needs of accident victims with the broader interests of Queensland’s public.

Over the past decade, the Nominal Defendant levy paid by all motorists has decreased or remained stable each year, evidencing the efficiency of the Nominal Defendant Fund.

Monitoring the NIISQ

In line with the NIISQ Act, we monitor the efficiency and effectiveness of the NIISQ Agency which administers the NIISQ. The NIISQ Agency assesses, decides and funds necessary and reasonable lifetime treatment, care and support for people who sustain an eligible serious personal injury in a motor crash in Queensland, on or after 1 July 2016.

The cost of administering NIISQ during 2024–25 was $906 million. As at 30 June 2025, NIISQ has 675 interim and lifetime participants. Further information about NIISQ and NIISQ Agency’s operations can be found in the NIISQ Agency Annual Report at https://niis.qld.gov.au/news-and-research/annual-reports.

Compliance and enforcement: safeguarding Queensland’s CTP scheme

In 2024-25, we undertook a range of compliance and enforcement activities to uphold our responsibilities in monitoring and supervising Queensland’s CTP insurance scheme. These initiatives reflect our commitment to ensuring the scheme remains fair, transparent and affordable.

Insurer significant breach reporting protocol

This year, we introduced a protocol requiring licensed insurers to report significant legislative breaches. Developed in consultation with stakeholders, the protocol promotes transparency, accountability, and proactive risk management within the CTP scheme. It ensures compliance, minimises harm, and fosters continuous improvement among insurers.

Fraud prevention and prosecutions

Fraud and dishonest conduct pose significant risks to the integrity and affordability of Queensland’s CTP scheme. To combat these risks, we collaborate with licensed insurers on claims data analysis, early detection initiatives, and the referral of potential fraud cases for investigation and prosecution.

In 2024-25, we successfully prosecuted three fraud cases and assessed 14 additional referrals. These actions reinforce deterrence and ensure that compensation is reserved for genuinely injured claimants, safeguarding the scheme’s integrity and public trust.

Improving complaints management

We also implemented a protocol to guide licensed insurers in managing CTP complaints. This protocol provides clear expectations for handling complaints efficiently and fairly while offering claimants a pathway to escalate concerns through internal dispute resolution mechanisms.

A significant number of complaints relate to disagreements over rehabilitation funding, often arising when the parties to a claim cannot resolve disputes informally. By fostering fair complaint management practices, we can ensure claimants have access to clear and transparent processes.

Auditing insurer practices

MAIC’s direct claimant audits aim to promote fairness and transparency. This year, audits identified instances where two insurers provided unclear and incomplete information to legal guardians, leading to misunderstandings about entitlements. The audit found direct claims involving children were deliberately paid and finalised without obtaining a sanction from the Public Trustee or the Court as required by the Motor Accident Insurance Regulation 2018 and the Public Trustee Act 1978.

In response, MAIC directed insurers to take immediate remediation on the claims affected, including amending their processes to ensure the practice ceased and is considering further enforcement actions. These efforts highlight MAIC’s commitment to protecting claimants and ensuring insurers’ compliance with their legislative obligations.

Improving breach reporting

MAIC also introduced a new Significant breach reporting protocol in March this year. The protocol guides insurers to report to MAIC breaches of the Motor Accident Insurance Act 1994 that have legislative penalties attached, as well as reportable breaches to other Australian and Queensland regulators. Early reporting of breaches helps us to deliver on our insurer monitoring and supervisory functions and ensures any issues are quickly identified and addressed.

Claim farming investigations and prosecutions

Combatting claim farming, which involves cold-calling individuals to solicit or induce them to make personal injury claims, remains a priority for MAIC. Since legislative amendments in 2019 were introduced, we have closely monitored and investigated claim farming reports.

As a result of our efforts, in 2024-25, claim farming complaints dropped to just 28, down from over 1,300 in 2019. MAIC has prosecuted five parties for claim farming offences, with one corporate entity fined $1 million. Additional prosecutions commenced in 2024 and remain ongoing.

MAIC is committed to preserving the rights of genuinely injured individuals and maintaining the integrity of Queensland’s CTP scheme, which is recognised as one of the most stable and affordable in the country.

MAIC Exchange development

This year we also began developing MAIC Exchange, a secure reporting platform for insurers to exchange information and documents in compliance with regulatory requirements.

The platform will streamline reporting, improve visibility of actions and statuses, and enhance security and privacy for insurers, policyholders, and claimants. The first application, focused on managing multiple insurer claims disputes, will be piloted in early 2025-26.

AI and emerging technology review

We completed a review of how insurers are using artificial intelligence (AI) and other emerging technologies within the CTP scheme. The review identified varying levels of adoption and governance among licensed insurers.

MAIC will continue engaging with insurers to monitor emerging risks and opportunities as the use of AI evolves.

Regulatory document review

After consulting with insurers, we rescinded Guideline 3: Surcharge of racing authority on 30 June 2025. Introduced in 1995, the guideline was outdated and no longer aligned with the Motor Accident Insurance Regulation 2018.

Looking ahead

As we continue to strengthen our compliance and enforcement framework, our focus remains on fostering trust, transparency, and innovation.

Key priorities for us in 2025-26 include:

- piloting the MAIC Exchange platform to improve insurer reporting and collaboration

- continuing to monitor and address fraud and claim farming activities to protect the scheme’s integrity

- engaging with insurers to ensure robust and transparent business plan reporting

- enhancing business plan reporting to promote clarity and consistency across the scheme.

Investing in road safety and rehabilitation

| Institution | Title |

| University of Sunshine Coast (UniSC) |

|

| Queensland University of Technology (QUT) |

|

| Griffith University |

|

| Police Citizens and Youth Welfare Association (PCYC) |

|

| Department of Transport and Main Roads (TMR) |

|

| Transport New South Wales |

|

Prevention of road crashes

In line with our legislative functions, MAIC supports a range of ongoing and one-off initiatives that contribute to the ongoing viability and affordability of the Queensland CTP scheme. This investment focuses on preventing road crashes and minimising the impacts of road trauma by making improvements in the treatment, care, and rehabilitation of those injured.

In 2024–25, our road safety program formalised a new research collaboration with Griffith University, which commenced on 1 January 2025 and will be led by Associate Professor Darren Wishart. We also negotiated continued funding arrangements with QUT, to establish the MAIC/QUT Road Safety Research Collaboration, building on the legacy of our long- standing partnership with QUT through the Centre for Accident Research and Road Safety – Queensland (CARRS-Q). These commitments build on our ongoing partnership with the University of the Sunshine Coast through the MAIC/UniSC Road Safety Research Collaboration. This has enabled the establishment of the Queensland Road Safety Research Collaboration (QRSRC).

A QRSRC Steering Group has been created to stimulate opportunities for enhanced communication and collaboration, utilising the research expertise of each university.

This will provide a multi-pronged approach to road safety research, with each collaborative partner bringing different perspectives. By building future research capacity, reducing duplication, and identifying future priorities in road safety research, QRSRC will play a critical role in providing an evidence base for road safety policy and interventions in Queensland.

As of 31 December 2024, PCYC’s Braking the Cycle (BTC) learner driver mentor program, of which MAIC is the main funder, has helped an estimated 6,000 people obtain their licence and engaged over 10,000 drivers across 59 locations in Queensland.

A recent evaluation commissioned by MAIC and undertaken by QUT highlighted the program’s success. Analysis of crash rates and traffic infringements showed that BTC participants had lower involvement compared to a randomly controlled group of young drivers. This is particularly impactful when it is considered that BTC participants often face several areas of socio-economic disadvantage, which place them at heightened risk of risk-taking behaviours. As a result of this, MAIC has agreed to extend its funding to PCYC for an additional three years commencing 1 July 2025.

As part of the funding extension, our agreement with PCYC will also incorporate continued support for the Changing Gears program, a first peoples specific adaptation of Braking the Cycle in Napranum, Yarrabah, and Palm Island.

During this financial year we also extended our funding to support a continued Data Linkage Fellowship for Associate Professor Angela Watson at QUT for a further three years.

To date, this Fellowship has significantly advanced the linkage of road safety-related data from Queensland Police, MAIC, TMR and Queensland Health, culminating in the creation of a serious injury dashboard for the first time. This dashboard offers additional insights, particularly into crashes not reported to Queensland Police, with a focus on vulnerable road users such as cyclists and motorcyclists.

The Fellowship has also contributed strongly to the formalisation of data-sharing agreements, enhancing research through co-location within TMR’s Road Safety Data Bureau, and contributing to national data linkage initiatives. This work has informed critical policies, such as the Queensland Road Safety Strategy, and continues to shape priorities and countermeasures to reduce road trauma.

Maximising recovery

| Institution | Title |

| University of Queensland |

|

| Griffith University |

|

| Metro North Hospital and Health Service (MNHHS) |

|

| Spinal Life Australia |

|

| Queensland Brain Institute |

|

| Children’s Health Queensland Hospital and Health Service and University of Queensland |

|

| Emergency Medicine Foundation (EMF) |

|

| Bionics Gamechangers Australia |

|

| Retrieval Services Queensland |

|

The activities we support in rehabilitation research reflect the spectrum of injuries that can result from road crashes, from musculoskeletal injuries through to severe and lifelong injuries, including spinal cord and brain injuries. In addition, we fund research that focuses on improving healthcare from point of injury through to emergency department, hospital care, and community-based rehabilitation services.

For over 25 years, MAIC has partnered with the University of Queensland to support the RECOVER Injury Research Centre. The Centre focuses on technology-enabled rehabilitation and improving health outcomes after musculoskeletal injury. RECOVER drives innovative research to optimise recovery, particularly for road traffic crash victims, by improving treatments during the critical subacute phase.

The Centre’s innovative tool, My Whiplash Navigator, continues to expand rehabilitation reach by assisting injured individuals experiencing physical symptoms such as neck pain, stiffness, or headaches. The tool also integrates Whip Predict, a risk stratification tool, to further enhance its effectiveness. As of October 2024, an estimated 47% of CTP claims involved whiplash injuries, highlighting the tool’s critical role in supporting recovery.

The Jamieson Trauma Institute (JTI), jointly funded by MAIC and MNHHS, provides comprehensive research services across all aspects of trauma care in Queensland. JTI continues to excel in delivering key services, with a strong focus on clinical care, systems capability, quality improvement, data, research, and translation activities. A notable achievement is the development of the injury-specific iTRAQI tool, created in collaboration with Retrieval Services Queensland. iTRAQI evaluates healthcare accessibility for serious injuries, as a means of examining optimal patient transfers to improve overall outcomes.

From 1 July 2024, MAIC confirmed continued support of our collaboration with the EMF for a further three years. In 2021, EMF, together with MAIC, established a special grants program to improve trauma care in regional, rural, and remote Queensland. The program provides the opportunity for clinicians to become involved in research for the first time in a supported environment. Notable research funded to date includes Imaging in head trauma, Rural/remote emergency pain relief, Interhospital transfer of mild traumatic brain injury and Effectiveness of pre-hospital fibrinogen administration for major hemorrhage. Regional and remote areas face unique challenges, particularly with road trauma, which remains a significant contributor to CTP claim costs.

Our funding of two major spinal cord projects with Griffith University has continued to progress strongly, advancing research, clinical trials, and innovation while fostering collaboration and inspiring future researchers.

The Spinal Injury Repair Project is due to commence its Phase I human clinical trial in July 2025 with 30 participants. The trial will test the combination of surgery and rehabilitation in terms of restoring function for those with spinal cord injury. Other advancements during this period include preclinical progress on peripheral nerve therapy, being awarded the National Health and Medical Research Council (NHMRC) 2025 award for Consumer Involvement, and strong collaboration between Griffith University, Gold Coast University Hospital, and Accelagen, with plans for a cell transplantation centre and new PhD researchers driving further innovation.

The BioSpine project has completed Phase 1 efficacy trials, showing improved mobility, independence, and quality of life for participants. Phase 2 commenced in early 2025 and Phase 3 is expected to begin by mid-2025. Technological advancements, including improved brain-computer interfaces and Smart BioWraps, continue alongside commercialisation efforts and extensive educational outreach, inspiring future researchers and expanding project impact.

This financial period, to commemorate MAIC’s 30th anniversary in 2024, we also announced a special one-off funding initiative, the MAIC Innovation Research Action Awards (MIRAA). This initiative was established to support innovative research and pilot programs aimed at reducing the frequency and impact of road trauma. 16 projects were funded in total with nine focused on maximising recovery and seven on road safety (see page 11, 30th anniversary inspires innovative collaborations).

These projects address a variety of issues, including improving trauma management such as fractures, blood loss, and rehabilitation, as well as collecting data on patient outcomes and advancing whiplash management. In the road safety domain, funded projects will focus on drink driving, speeding, tailgating, rear-end crashes, and motorcyclist safety.

A full list of successful recipients and grants is available at https://maic.qld.gov.au/maic-innovative-research-action-awards-miraa-winners-announced.

Governance

Our people

We strive to create a positive workplace environment where our people are engaged, committed and highly capable. In 2024–25, MAIC continued to embed flexible work practices that support business needs, while supporting staff to create a healthy balance between work and personal commitments.

Our leaders are role models and active supporters of inclusion and diversity in the workplace, regularly acknowledging external awareness events and days of significance, such as NAIDOC Week and Neurodiversity celebration week. MAIC staff have access to a range of diversity and inclusion employee networks coordinated by Queensland Treasury. They are also provided with the opportunity to immerse themselves in team showcases, cultural training, Innovation Day activities and other work programs.

The health and wellbeing of our team is essential and during 2024–25 we continued to encourage our staff to maintain an appropriate work-life balance.

We supported our employees through trauma-informed practice training and focused on building capability through training in positive performance management, good management practice and recruitment and selection. Staff engagement remained strong in 2024–25, with an 84% engagement score in the Working for Queensland survey, surpassing the public sector average in most areas.

We met our obligations under the Public Sector Ethics Act 1994 by ensuring our staff completed Queensland Treasury’s suite of mandatory online training modules, including code of conduct, right to information, information privacy and fraud and corruption. We also strive to further the objectives of the Human Rights Act 2019 through annual online training for all employees and leveraging Queensland Treasury’s human rights complaints management framework and human rights network.

Nil formal disputes arose during the 2024–25 period.

Nil formal employee grievances were lodged during the 2024–25 period.

Our employee expenses and key executive management personnel and remuneration information can be found in the Financial Information (page 44 for MAIC, and page 73 for the Nominal Defendant). To see MAIC’s workforce profile, including full-time equivalent (FTE) staff and permanent separation rate, view the annual report of Queensland Treasury.

Our values

We align our behaviour and operations with the five Queensland public service values:

- Customers first

- Ideas into action

- Unleash potential

- Be courageous

- Empower people

Human Rights

As part of our commitment to furthering the objectives of Queensland’s Human Rights Act 2019, we:

- completed Human Rights Certificates for the Motor Accident Insurance (Administration Fee and Levies) and Other Legislation Amendment Regulation 2025 and Motor Accident Insurance Indexation Notice 2025

- ensured all new staff learnt about their human rights obligations via our employee induction and orientation programs

- embedded a commitment to human rights into our strategic and operational plans

- continued our focus on employee health, safety, wellbeing and human rights by supporting flexible work arrangements for employees.

No human rights complaints were received during the 2024–25 reporting period.

Our leadership team

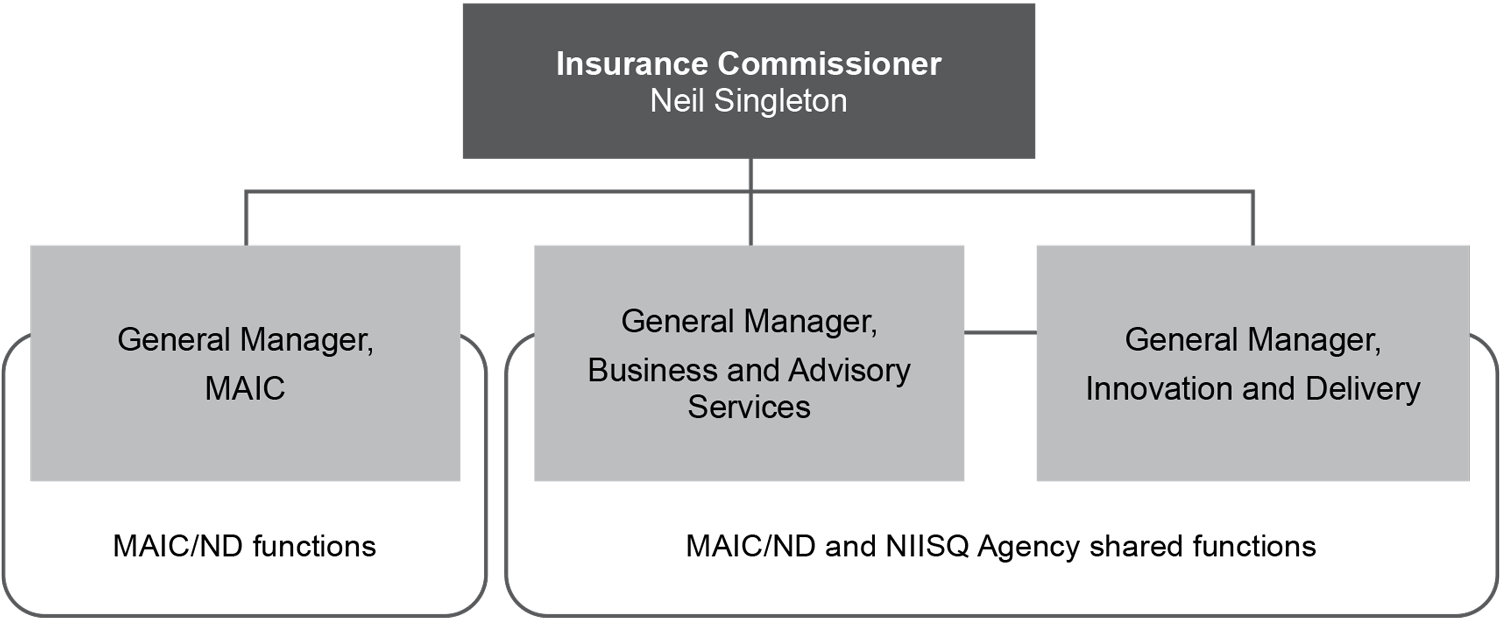

The Insurance Commissioner sets the direction for MAIC, the Nominal Defendant and the NIISQ Agency and reports to the State Parliament through the Treasurer, Minister for Energy and Minister for Home Ownership, as well as the Minister for Finance, Trade, Employment and Training.

He is supported by the leadership team, which includes General Manager, MAIC; General Manager, Business and Advisory Services; and General Manager, Innovation and Delivery.

Our leadership team is responsible for implementing the strategic direction of MAIC, the Nominal Defendant, and the NIISQ Agency, and overseeing operational performance, determining operational policy and project management.

The leadership team supports the Insurance Commissioner, as the accountable officer, to meet legislative requirements and accountabilities as well as to identify and manage key areas of risk. As at 30 June 2025, the leadership team comprised of:

Neil Singleton

Insurance Commissioner

B. Business (Insurance), MBA

Neil was appointed as Insurance Commissioner in December 2010. Neil has over 30 years of insurance experience across a broad range of management and executive positions. Neil’s responsibilities include providing strong strategic leadership to ensure a viable, affordable and equitable CTP insurance scheme in Queensland.

David Vincent

General Manager, Motor Accident Insurance Commission

David has over 30 years’ insurance experience including roles in personal injury claims management and underwriting, along with positions involving insurance regulation and government policy development. David is responsible for leading the strategic management of the Nominal Defendant claims unit. He also manages MAIC’s regulatory functions, including the supervision of licensed insurers and claim farming investigations and prosecutions.

Robert McLean

General Manager, Business and Advisory Services

BCom/LLB (Hons), Grad Dip ICAA, Dip Fin Planning

In his role, Robert leads a diverse range of corporate operational teams, encompassing finance, corporate governance, people and culture, procurement, business services and communications. A qualified accountant and member of Chartered Accountants Australia and New Zealand (CA ANZ), Robert brings over two decades of experience to his role. His career, which began in public practice, has spanned the Queensland workers’ compensation and non-profit sectors, equipping him with an extensive understanding of the unique challenges these industries face every day.

Robert is deeply passionate about fostering a proactive team environment that supports the business through the delivery of high-quality services.

Peter How

General Manager, Innovation and Delivery

Dip (Proj Mgt), B. Comm, Grad Dip (Commercial Computing), MBA, GAICD

Peter has comprehensive executive leadership experience in government and private enterprise across a range of industries with a particular focus on innovation and incubation, organisational performance, agility and growth. He is also a qualified company director and board advisor.

Organisational Structure

Risk management

The Financial Accountability Act 2009 outlines that an accountable officer, the Under Treasurer, has the responsibility to establish and maintain an appropriate system of internal control and risk management.

Identifying and responding to key agency risks in an explicit manner is an important pillar of good corporate governance.

We are committed to effective risk management and have adopted Queensland Treasury’s risk management framework, which includes the risk management policy and the risk management guide. The framework aligns with the principles contained in the Australian Standard AS/NZS ISO 31000:2018 ‘Risk management – principles and guidelines’, Commonwealth Risk Management Policy 2023 and other relevant standards. The Risk Management Framework includes appropriate governance arrangements and risk reporting and analysis.

A risk register is maintained and reviewed by the leadership team biannually. Risks are monitored with risk controls and treatment strategies assigned to risks where appropriate. Our risk management approach ensures:

- we meet our statutory responsibilities under the MAI Act, the NIISQ Act and other legislation

- risk management is integrated into organisational activity

- corporate governance processes, including systems of internal control, are assessed and enhanced.

Audit and Risk Management Committee

The Audit and Risk Management Committee (ARMC) supports Treasury’s accountable officer – the Under Treasurer – to meet the responsibilities under the Financial Accountability Act 2009 (QLD), the Financial and Performance Management Standard 2009 and other prescribed requirements.

The role of ARMC is to provide independent assurance and advice to the Under Treasurer on the appropriateness of Treasury’s financial reporting, risk management and internal controls and external accountability responsibilities as prescribed in the relevant legislation and standards.

The ARMC also provides oversight for select Treasury related entities that sit within Treasury’s broader portfolio (but prepare independent financial statements) which in 2024-25 included the Motor Accident Insurance Commission (MAIC) and the Nominal Defendant.

2024–25 Audit and Risk Management Committee

Chair:

- Karen Prentis (Independent member)

Members:

- Insurance Commissioner — resigned during the year

- Commissioner of State Revenue, Queensland Revenue Office — resigned during the year

- Domenico Licastro (Independent member)

- Georgina Crundall (Independent member).

During the year, there were several changes to the composition and membership of the Committee. The Insurance Commissioner and the Commissioner of State Revenue resigned as members and an additional independent member joined the Committee. These membership changes align with the requirements of a fully independent Committee, as per the Audit Committee Guidelines.

The Under Treasurer, Head of Corporate, Chief Finance Officer (CFO), Chief Risk Officer, Queensland Audit Office (QAO), Internal Audit providers, and Head of Internal Audit have standing invitations as observers to attend all ARMC meetings. Treasury officers are invited to attend meetings as required.

The three independent committee members received a combined total remuneration of $51,000 (excluding GST) for their role on the committee during 2024-25.

Key achievements for 2024–25

In 2024-25, the Committee met six times and fulfilled its responsibilities in accordance with its charter and approved work plan. Key achievements included:

- endorsing the 2023-24 Financial Statements for Queensland Treasury, MAIC and Nominal Defendant

- endorsing the three-year strategic Internal Audit Plans and monitoring 2024–25 internal audit activity

- reviewing the effectiveness of the department’s risk management framework and overseeing the management of material project risks

- monitoring progress of the implementation status of internal audit recommendations

- considering issues raised by the QAO, including the status of implementing recommendations from performance audits and Treasury-related reports to Parliament.

Internal and external accountability

Our governance framework includes both internal and external accountability measures. Internal audit is an integral part of the corporate governance framework by which Queensland Treasury ensures that internal controls are in place to mitigate the risks, and the governance processes are effective and efficient to meet organisational goals. Internal audit is designed to add value and improve operations by providing independent, objective assurance to the Under Treasurer that the financial and operational controls are efficient, effective and economical.

Externally, MAIC and the Nominal Defendant are audited by QAO in accordance with the Financial Accountability Act 2009. MAIC and the Nominal Defendant have achieved unqualified audits since the Commission commenced operations in 1994.

More information on Treasury’s Audit and Risk Management framework, including information about the committee is detailed in Queensland Treasury’s annual report.

Information systems and recordkeeping

MAIC and the Nominal Defendant are both within the scope of Queensland Treasury’s Information Security Management System (ISMS). Our recordkeeping framework aims to ensure our record management practices are consistent with other offices within the Queensland Treasury portfolio and are compliant with current legislation and best practice record keeping standards. These include Public Records Act 2023 (QLD), Information Privacy Act 2009, and the Records governance policy.

Information security attestation

MAIC and the Nominal Defendant are included in Queensland Treasury’s annual Information Security Return. As such, during the mandatory annual Information Security reporting process, the Under Treasurer attested to the appropriateness of the information security risk management within Queensland Treasury to the Queensland Government Chief Information Security Officer, noting that appropriate assurance activities have been undertaken to inform this opinion and Treasury’s information security risk position.

Statistics

We produce quarterly and annual CTP scheme insights reports to demonstrate key aspects of scheme performance. These reports inform our stakeholders and the broader community about the operation of the scheme and management of claims, as well as enhancing scheme awareness and understanding. These publications, including Annual CTP scheme insights: 2024–25, are available at https://maic.qld.gov.au/scheme-knowledge-centre/ctp-scheme-insights.

We support the Queensland Government Open Data Initiative. In 2024–25, we released 15 datasets in addition to CTP insurance scheme insights reports. Our Open Data sets are available at https://www.data.qld.gov.au/dataset/compulsory-third-party-ctp-statistics.

Motor Accident Insurance Commission

Summary of financial performance 2024–25

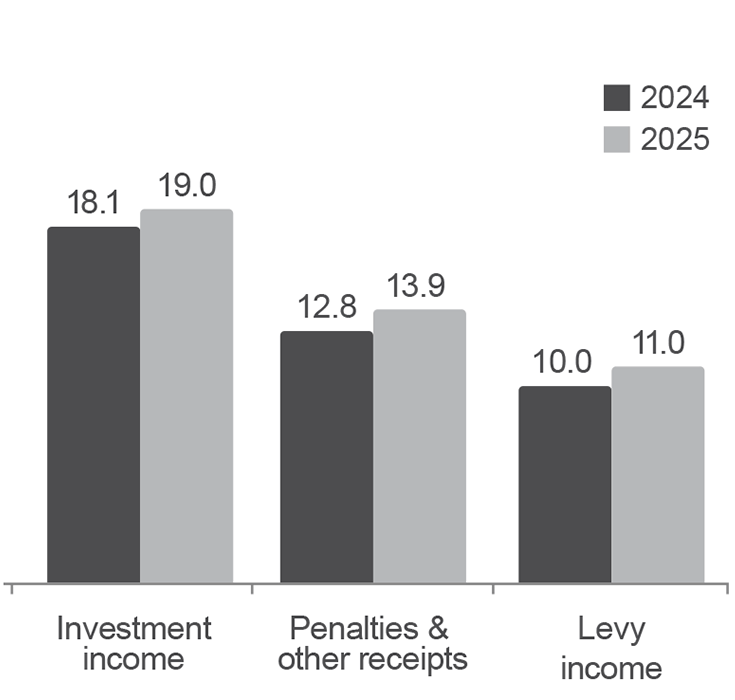

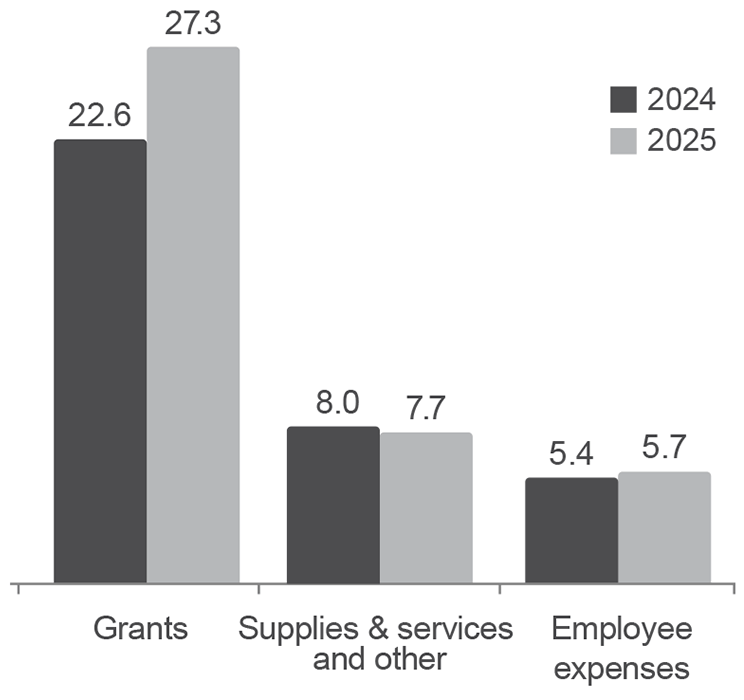

The operating result for MAIC for the year ended 30 June 2025 was a surplus of $3.1 million compared to the prior year’s operating surplus of $5.0 million. The decrease was driven by an increase in investment returns on financial assets, levy and penalty income, offset with the increase in total expenses.

The statutory insurance scheme levy per vehicle remained $2.00 per annum in 2024-25. Penalties, user charges and other revenue (penalties and other receipts) increased by $1.1 million to $13.9 million.

The investment returns on financial assets were gains of $19.0 million compared to the previous year’s gains of $18.1 million. This reflects improvements in the equity market.

Total expenses increased by $4.7 million to $40.7 million in 2024–25. MAIC’s largest expense item relates to grants spending $27.3 million for the continued funding of research programs to reduce the incidence and injury mitigation. The increase in grants expense of $4.7 million was due to an increase in proposed investment in targeted research and service delivery. Details of funding are provided in Appendix 4.

Income (millions)

Expenses (millions)

Motor Accident Insurance Commission financial statements

Nominal Defendant

Summary of financial performance 2024–25

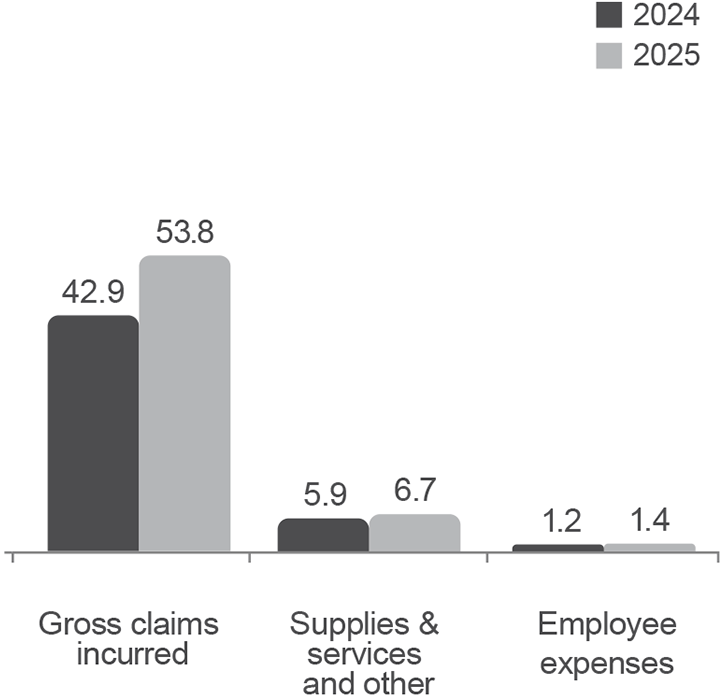

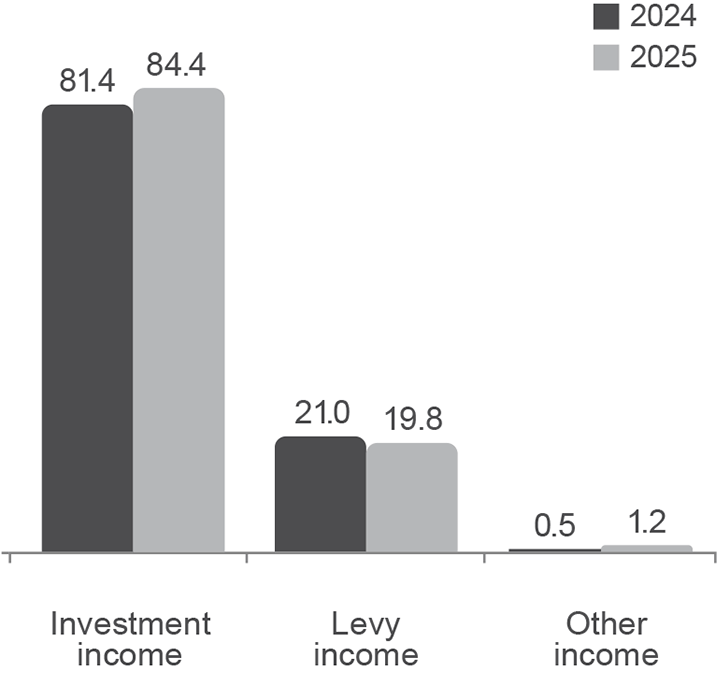

For the year ended 30 June 2025, the Nominal Defendant had a total income of $105.4 million and expenses of $62.0 million resulting in an operating surplus of $43.4 million, compared to the prior year’s operating surplus of $52.8 million.

The $43.4 million operating result was driven by positive investment returns on financial assets. Total investment gains on financial assets were $84.4 million compared to prior year’s gains of $81.4 million, reflecting an improvement in equity markets in 2024-25.

The Nominal Defendant levy remained unchanged at $4.00 per Class 1 vehicle in 2024-25 and generated income of $19.8 million, representing a $1.2 million decrease from the prior year. Actuarial assessments at 30 June 2025 resulted in an increase of $0.7 million in reinsurance and other recoveries from the prior year.

Total expenses increased from $50.1 million in 2023-24, to $62.0 million in 2024-25. This is primarily a result of higher claim costs. The Nominal Defendant’s gross claims incurred were $53.8 million, an increase of $10.9 million from the prior year.

The Nominal Defendant is in a fully funded position with financial assets more than sufficient to meet all obligations arising from the outstanding claims liability.

Income (millions)

Expenses (millions)