Introduction

The Motor Accident Insurance Commission reports to the State Parliament through the Treasurer and prepares an annual report, as required by the Motor Accident Insurance Act 1994 and the Financial Accountability Act 2009.

Compliance checklist

The compliance checklist outlines the governance, performance, reporting and other specific requirements for agency annual reports.

Complete Annual Report

Complete 2015-16 Annual Report (PDF 1,130 K)

Viewing and printing PDF files

Adobe Reader is required to open and print Portable Document Format (PDF) files and is free to download from the Adobe website.

If you experience any difficulties with accessing PDF files on this website, please refer to our PDF help page.

Contact us

If you have any enquiries regarding the annual report, please email maic@maic.qld.gov.au.

Disclaimer

The electronic versions of the Motor Accident Insurance Commission Annual Report 2013-14 provided on this site are for information purposes only and are not recognised as the official or authorised version. The official copy of the Annual Report, as tabled in the Legislative Assembly of Queensland, can be accessed from the Queensland Parliament tabled papers website.

MAIC Annual Report 2015-16

( pdf 2.99 Mb )Accessibility and copyright

ISSN:1837-1450

The Queensland Government is committed to providing accessible services to Queenslanders from all culturally and linguistically diverse backgrounds. If you have difficulty in understanding the annual report, you can contact us on the CTP enquiries line 1800 CTP QLD (1800 287 753) and we will arrange an interpreter to effectively communicate the report to you.

Motor Accident Insurance Commission

GPO Box 2203, Brisbane Qld 4001

Phone: 1800 CTP QLD (1800 287 753)

Email: maic@maic.qld.gov.au

Nominal Defendant

GPO Box 2203, Brisbane Qld 4001

Phone: 07 3035 6321

Email: nd@maic.qld.gov.au

Visit https://maic.qld.gov.au/ to view this annual report.

© Motor Accident Insurance Commission 2016

License: This annual report is licensed by the Motor Accident Insurance Commission under a Creative Commons Attribution (CC BY) 4.0 Australia license.

CC BY License Summary Statement: In essence, you are free to copy, communicate and adapt this annual report, as long as you attribute the work to the Motor Accident Insurance Commission. To view a copy of this license, visit: http://creativecommons.org/licenses/by/3.0/au/deed.en

Attribution: Content from this annual report should be attributed as: The Motor Accident Insurance Commission Annual Report 2015-16.

Letter of compliance

The Honourable Curtis Pitt MP

Treasurer, Minister for Aboriginal and Torres Strait Islander Partnerships,

Minister for Sport

GPO Box 611

Brisbane Qld 4001

Dear Treasurer

I am pleased to present the Annual Report 2015-2016 and financial statements for

the Motor Accident Insurance Commission and the Nominal Defendant.

I certify that this Annual Report complies with:

- the prescribed requirements of the Financial Accountability Act 2009, the

Financial and Performance Management Standard 2009 and the Motor

Accident Insurance Act 1994, and - the detailed requirements set out in the Annual report requirements for

Queensland Government agencies.

A checklist outlining the annual reporting requirements can be accessed at

www.maic.qld.gov.au.

Yours sincerely

Neil Singleton

Insurance Commissioner

Last reviewed 4 October 2016

About the CTP Scheme

Queensland’s CTP scheme

Queensland’s Compulsory Third Party (CTP) scheme is ccommon law, fault-based scheme currently underwritten by four licensed private insurers who accept applications for insurance and manage claims on behalf of their policyholders. The scheme has operated since 1936 and provides motor vehicle owners, drivers, passengers and other insured people with an insurance policy that covers their unlimited liability for personal injury caused by, through or in connection with the use of the insured motor vehicle in incidents to which the Motor Accident Insurance Act 1994 (MAI Act) applies.

The Queensland scheme is governed by the MAI Act and underwritten by private licensed insurers who accept applications for insurance and manage claims on behalf of their policyholders. Compensation is paid to accident victims from the respective insurer’s premium pool. Since 1994, the scheme has had an increased focus on the rehabilitation of injured people and places certain obligations on insurers and claimants.

The Motor Accident Insurance Commission (MAIC) and the Nominal Defendant are statutory bodies established under the MAI Act to regulate and support the CTP scheme. MAIC regulates insurance premium costs by setting floor and ceiling premium bands for each vehicle class within which CTP insurers must set premiums.

The Nominal Defendant determines liability for and manages claims by injured people where the ‘at fault’ vehicle is uninsured or unidentified. It also acts as insurer of last resort if a licensed insurer becomes insolvent. To achieve efficiencies for Queensland motorists, CTP premiums are collected during vehicle registration with the Department of Transport and Main Roads (DTMR). Combining the process reduces administrative burden and associated costs of the scheme, ensuring levies remain sustainable.

About the Motor Accident Insurance Commission [MAIC]

About MAIC

Established under the MAI Act, MAIC has been located in Brisbane since it commenced operations on 1 September 1994.

MAIC is the regulatory authority responsible for the ongoing management of the CTP scheme in Queensland. MAIC is funded by a statutory levy payable with the CTP insurance premium. Revenue from compliance fines and income earned on investment of the Motor Accident Insurance Fund are used to fund MAIC’s research initiatives.

Organisationally, as at 30 June 2016, MAIC and the Nominal Defendant were positioned within the Corporate Group of Queensland Treasury.

Vision

MAIC’s vision is to ensure financial protection that makes Queensland stronger, fairer and safer through:

• overseeing an affordable and efficient CTP scheme

• actively engaging and consulting with stakeholders on scheme performance and improvement opportunities.

Purpose

MAIC is responsible for regulating and improving Queensland’s CTP insurance scheme and managing the Motor Accident Insurance and Nominal Defendant funds.

Responsibilities

MAIC is responsible for:

• ensuring people injured in road accidents receive fair compensation

• compensating people who are injured as a result of the negligent driving of an unidentified or uninsured motor vehicle through the Nominal Defendant

• ensuring Queensland motorists receive affordable premiums

• the regulation of insurers’ activity and compliance

• meeting any claim costs of an insolvent insurer.

Functions

MAIC’s key functions involve:

• the licensing and supervision of CTP insurers

• monitoring the operation of the scheme

• setting the range within which each insurer’s premium must fall and recommending to Government the levies payable

• promoting research, education and the infrastructure to reduce the number of motor vehicle crashes and facilitate rehabilitation of injured people

• developing and maintaining a claims register and statistical database for the purpose of providing management information

• administering the MAI Act and Nominal Defendant Fund.

How MAIC contributes to the Queensland Government objectives for the community

MAIC contributes to building safe, caring and connected communities by investing in road safety initiatives to reduce the frequency of motor vehicle accidents and minimise their impact on the community. MAIC also supports quality front line services by investing in targeted research and service delivery initiatives to improve health outcomes for people injured in motor vehicle crashes.

Strategic opportunities

MAIC has the opportunity to:

• support broader technological or innovative changes in road safety, trauma injury management and claims management system processes

• reduce the incidence and severity of road trauma

• identify ways to improve MAIC and Nominal Defendant service delivery.

Strategic risks and challenges

Ongoing risks and challenges faced by MAIC and the Nominal Defendant:

• keeping the CTP scheme under review to guard against unexpected adverse developments

• maintaining prudential supervision of licensed insurers

• keeping CTP affordable while managing a competitive insurer premium filing model

• maintaining cost effective claims management of Nominal Defendant claims.

Insurance Commissioner's Report

The Queensland CTP scheme continues to meet the needs of Queensland motorists and road users in a stable, fair and affordable manner.

MAIC continues to support initiatives that will improve scheme experience while on a broader scale there are a range of reforms and programs that will shape the future of the CTP scheme.

During a year of highlights two are notable.

Firstly the introduction of the National Injury Insurance Scheme Queensland (NIISQ) is a significant milestone and beneficial reform – something the MAIC team is proud to have been a part of. The NIISQ complements the existing CTP scheme and ensures that catastrophically injured people – those who most need lifetime care and support – will receive this regardless of fault and in ways that support personal choice and independence. MAIC will continue to support the establishment of the NIISQ and to work with the many committed stakeholders who are keen to ensure the successful implementation and delivery of the scheme.

Secondly as part of the NIISQ implementation, a review of the CTP Scheme was announced by the Treasurer. MAIC has been directed to find ways to continue improving the CTP scheme – ensuring it is affordable, efficient, fair and flexible to meet immediate needs while also being well positioned to support and benefit from future innovation and improvement. It has been six years since the last scheme review, so this is timely as well as good governance to ensure the scheme remains contemporary, fair and affordable.

In response to a recent increase in the number of CTP claims, (despite anecdotal evidence that crashes on Queensland roads are reducing), MAIC has proactively engaged with CTP insurers and the legal profession on specific aspects of this trend and to identify whether any response is required. This work is ongoing into 2016-17.

My particular thanks to Ms Fanny Lau, Scheme Performance Manager at MAIC, who amongst her many responsibilities has led ongoing MAIC representation in relation to the National Heavy Vehicle Regulator reforms, and collaboration with Department of Transport and Main Roads in relation to the Opportunity for Personalised Transport Review and the National Transport Commission policy paper on autonomous vehicles. MAIC is well positioned to respond appropriately to these various developments and reforms.

I greatly appreciate the ongoing support from stakeholders in the performance and delivery of the CTP scheme along with the professionalism and service focus of MAIC staff. This has ensured Queensland motorists and road users continue to benefit from a stable, fair and affordable CTP scheme that is well positioned to meet current needs and take advantage of future opportunities for improvement.

Neil Singleton

Insurance Commissioner

Year in Review

Report card

| Highlights | Performance indicators | Notes | Target | Outcome |

|---|---|---|---|---|

| Objective | Provide a viable and equitable personal injury motor accident insurance scheme. | |||

Delivered cost reductions through process improvements. |

Premium bands and levies set within legislated time-frames |

100% | 100% | |

Premium bands are set at a level to ensure scheme viability. |

100% | 100% | ||

Highest filed CTP premium for Class 1 vehicles (sedans and wagons) as a percentage of average weekly earnings. |

<45% | <45% | ||

| Objective | Continually improve the performance of the Nominal Defendant. | |||

• Realised the benefits of the Nominal Defendant claims management system. |

The percentage of the Nominal Defendant claims finalised compared to the number outstanding at the start of the financial year. |

1 |

50% | 75.9% |

Percentage of Nominal Defendant claims settled within two years of compliance with the Motor Accident Insurance Act 1994. |

2 |

50% | 73.8% | |

Percentage of Nominal Defendant claims paid within 60 days of the settlement date. |

95% | 95.8% | ||

Investment strategies align with the anticipated claims runoff. |

100% | 100% | ||

| Objective | Provide a corporate governance model that facilitates MAIC's vision and meets the State's financial and performance requirements. | |||

• Completed internal restructuring to better align staff capabilities with service delivery requirements. |

Financial requirements outlined in the Financial Accountability |

100% | 100% | |

Planning and reporting requirements outlined in the Financial and Performance Management Standard 2009 are met. |

100% | 100% | ||

Staff capabilities align with strategic plan. |

100% | 100% | ||

1. Favourable variance is due to higher than anticipated number of claims being finalised.

2. Claims can take two to three years to settle, consequently it is difficult to estimate the number of claims that will be finalised in any given period.

Reducing the incidence of road trauma

MAIC works closely with the lead agencies for road safety in Queensland, the Department of Transport and Main Roads (DTMR) and Queensland Police Service (QPS), in identifying opportunities for collaboration and investment.

Reducing the incidence of road trauma means there will be fewer Queenslanders killed or injured on Queensland roads. This will reduce the social, economic and financial costs of road trauma which amongst the many benefits this will bring, leads to lower CTP scheme costs and a more affordable CTP scheme.

Aside from immediate investments in a range of road safety programs, MAIC will continue to strengthen its focus on a range of programs to help deliver improved road safety outcomes across Queensland, specifically involving young drivers and regional community groups.

Queensland Road Safety Strategy

MAIC supports research and education activities that aim to reduce the number of crashes on Queensland roads generally, along with activities that have a specific focus on reducing the number of claims to the Queensland CTP scheme.

MAIC champions a number of initiatives under the Queensland Road Safety Strategy.

In 2015-16, the funding MAIC provided CARRS-Q, DTMR and QPS has helped progress these initiatives and also contributed to other initiatives outlined in the action plan.

Learner Driver Mentor Programs

With funding provided by MAIC, CARRS-Q undertook research and consultation to develop a best practice toolkit for Learner Driver Mentor Programs to assist practitioners and stakeholders in implementing evidence based programs that are sustainable in the long term. These guidelines have been released publicly and endorsed by DTMR.

MAIC also engaged CARRS-Q to undertake an evaluation of the Braking the Cycle program run by QPS through PCYC.

Learner Driver Mentor Programs provide a valuable and effective way of improving young and novice driver safety by providing disadvantaged young people with the opportunity to obtain the 100 on-road hours necessary to obtain their licence and as a means of reducing unlicensed driving.

Road Trauma Mitigation Fund

In 2015-16, MAIC established the Road Trauma Mitigation Fund to support DTMR and QPS led initiatives aimed at reducing the incidences and effects of motor vehicle crashes.

This financial year $2.325 million was allocated primarily towards initiatives that are either pilot or proof of concept. These include evaluating the impact on road safety of additional enforcement by QPS during peak motoring periods and DTMR piloting the effectiveness of outdoor billboards highlighting the Fatal Five in targeted regional locations that have been historically overrepresented in crashes.

Taxi industry partnering

MAIC partnered with the Taxi Council of Queensland to identify opportunities to reduce the incidence of taxis in crashes.

The first project will pilot the effectiveness of combining the use of a smartphone app to monitor taxi driver performance with incentives for safe driving performance.

The second project involved a situational and data analysis of the taxi industry in Queensland to gain a greater understanding of the structure and operations of the industry and to identify potential opportunities for enhancement particularly in relation to safety.

Intelligent Transport System

Intelligent Transport Systems are transforming the way transport systems operate with an aim to:

• improve safety

• reduce traffic congestion

• reduce environmental impacts.

MAIC has partnered with DTMR to provide funding to two intelligent transport system pilots, the Cooperative Intelligent Transport System (C-ITS), and the Cooperative and Automated Vehicles (CAV) pilot.

The introduction of ITS and CAV to Queensland’s roads has the potential to provide significant economic, social, and environmental benefits, including massive reductions in the number of road crashes and a corresponding decrease in CTP claims.

MAIC is committed to providing $1 million in 2016-17 to the CAV pilot, which will include the testing of two highly automated vehicles in Queensland. MAIC has also given in-principle support to provide funding in future years, in conjunction with DTMR, to the C-ITS pilot project, which will run until 2020. The C-ITS pilot project will include development and trialling of interconnected safety

applications in passenger vehicles and road infrastructure.

CARRS-Q funding agreement

CARRS-Q was established twenty years ago with funding from MAIC and Queensland University of Technology (QUT). It is now recognised internationally for its excellence as a road safety research centre. After undertaking an evaluation of current performance which included independent external advice and considering the future funding submission, MAIC was proud to confirm a further three years of funding to CARRS-Q to ensure the Centre continues its significant research activity which contributes to the evidence base for road safety policy in Queensland and continues to attract researchers and research funding to Queensland.

Young driver research

MAIC has provided over $60,000 in funding to the Adolescent Risk and Research Unit of the University of the Sunshine Coast.

The funds will support a research program testing the effectiveness of introducing situational skills to novice drivers to reduce the incidence of road trauma involving young and inexperienced drivers.

Stay on Track Outback

Stay on Track Outback is a regionally focused initiative targeted at increasing awareness of road safety issues specific to regional areas.

In 2015-16, MAIC partnered with QPS to provide $80,000 towards this important initiative, allowing QPS to expand this initiative to additional regional areas. MAIC has committed to providing $80,000 per annum over 3 years. www.stayontrackoutback.qld.gov.au

Support seriously injured people

Each year MAIC invests in activities that prevent road traffic injuries, and improve health and vocational outcomes of people who have been injured on the road.

Transitional Rehabilitation Services investment

MAIC has committed an investment of approximately $14.7 million over five years to fund a Transitional Rehabilitation Service (TRS) for adults with Acquired Brain Injuries within the continuum of brain injury services of Metro South Hospital and Health Service. The TRS model is based on research findings over a number of years, extensive consultation and a benchmarking process.

This service aims to facilitate early community integration and improve health outcomes of adults with an acquired brain injury. An improved patient flow within the Brain Injury Rehabilitation Services is also expected which will deliver savings for Queensland Health.

Spinal injury support program

MAIC continues its support of the Spinal Education Awareness Team (SEAT) through Spinal Life Australia. The team provides education to Queensland school students about their life and the importance of not taking risks while on Queensland roads. MAIC and Spinal Life Australia are currently exploring opportunities to expand our partnerships.

Brain injury research program MAIC commenced a new partnership with the Queensland Brain Institute (QBI). MAIC has approved a $1.5 million funding boost to fund a Senior Research Fellowship in traumatic brain injury, which will focus on developing new methods for assessing damage and change overtime in traumatic injuries. The investment in QBI is building capabilities and fosters the delivery of world-class research within Queensland.

Paediatric rehabilitation focus

MAIC has partnered with Children’s Health Queensland Hospital and Health Service and the University of Queensland Child Health Research Centre to establish the Paul Hopkins Chair in Paediatric Rehabilitation. The investment by MAIC of $1 million over five years will support the Chair to build a high-standard research program focusing specifically on the area of paediatrics, particularly in relation to acquired brain injury and disability.

Housing and community support programs for catastrophically injured people

In 2015-16, MAIC finalised an agreement with Griffith University to be a partner funder for an Australian Research Council Linkage Grant to develop a tool for people with significant disabilities, and other stakeholders, to assist with decision-making about housing design and supply.

This project involves detailed investigations to better understand the housing needs and preferences of consumers with disabilities. Understanding consumers’ preferences in this area is an important step towards the development of more suitable and sustainable housing for people with a disability.

Recover Injury Research Centre

The ongoing partnership between MAIC, University of Queensland and Griffith University in the Recover Research Centre provides access to world class researchers to inform policy and practice. During the year CONROD was rebranded as Recover Injury Research Centre and a new Director, world-renowned expert in the psychology of pain and disability Dr Michael Sullivan was appointed. This presents an opportunity to refresh the focus on research programs and funding.

National Injury Insurance Scheme Queensland

In 2015-16, MAIC worked closely with Treasury to draft the National Injury Insurance Scheme (Queensland) Act 2016, which was passed by Parliament on 26 May 2016.

The Act establishes the NIISQ, an important social reform that ensures all eligible people who sustain serious personal injuries in motor vehicle crashes receive necessary and reasonable care and support for their lifetime, regardless of fault. The reform will significantly and directly assist injured people and will also bring tremendous peace of mind to their family and carers.

From 1 July 2016, the scheme will be administered by the National Injury Insurance Agency Queensland. MAIC will work closely with the agency and will monitor the operation of the scheme, providing recommendations to the Treasurer about the scheme and the NIISQ levy.

For the 2016-17 financial year, MAIC will report on significant aspects of the operation of the scheme, and information on the cost of administering the scheme in its annual report.

Nominal Defendant

![]() The Nominal Defendant continues to deliver cost effective services to people who sustain an injury through the involvement of an unidentified or unregistered vehicle. By applying best practice processes the Nominal Defendant has tailored an approach to their claims management that has led to a reduction in legal costs and average claim duration. These improvements have seen better outcomes delivered to claimants and cost savings passed on to Queensland motorists through an affordable and sustainable Nominal Defendant levy.

The Nominal Defendant continues to deliver cost effective services to people who sustain an injury through the involvement of an unidentified or unregistered vehicle. By applying best practice processes the Nominal Defendant has tailored an approach to their claims management that has led to a reduction in legal costs and average claim duration. These improvements have seen better outcomes delivered to claimants and cost savings passed on to Queensland motorists through an affordable and sustainable Nominal Defendant levy.

Innovate and improve

To deliver a contemporary CTP scheme for Queensland, MAIC remains future focused and embraces technological innovations and business improvements.

MAIC has fostered strong relationships with industry leaders and academic experts to enable opportunities of knowledge sharing and research partnerships. Through these partnerships MAIC is able to ensure current business processes are adopted. MAIC has delivered savings for Queenslanders through innovation as seen in the implementation of the Nominal Defendant ‘best practice’.

MAIC continues its commitment to remain efficient and adaptable through its Data Management and Insight programs, and reviews in claims mining and the future effects of the digital economy on the CTP scheme.

CTP Scheme Insights Framework

MAIC has commissioned its consulting actuary, in conjunction with State Actuary Office and MAIC Business Intelligence Unit personnel, to develop a monitoring framework to provide deep analysis and insight into CTP scheme experience, and identify priority areas for investment and improvement.

The framework will inform and guide MAIC investment in research and pilot programs to help reduce the incidence and effects of road trauma, as well as develop a deeper understanding of scheme dynamics and performance. This may, for example, help inform MAIC about emerging cost pressures or changes in scheme experience relating to claims cost, emergence of vehicle safety features or changes due to various road safety programs, and also assist in quantifying the appropriate nature and level of any response.

Claim process mining

In 2015-16 MAIC partnered with information systems researchers from QUT to review impediments to CTP claim processing. With the involvement of the Nominal Defendant and one licensed insurer, QUT has completed two case studies and provided initial feedback and insight to the insurers.

Over the next 12 months QUT will continue to review target demographics of both insurers and design tools that can automatically extract impacts on CTP claims processing.

Strategic review – CTP in a digital world

The potential of digital technologies to enable competitiveness, entrepreneurship and innovation has led to a rapidly developing digital economy worldwide. MAIC is aware that this growing economy stands to reshape Queensland’s CTP insurance scheme over the next decade and has collaborated with the QUT PwC Chair in Digital Economy to explore a range of scenarios likely to develop.

The QUT PwC Chair in Digital Economy’s report ‘The future of Compulsory Third Party insurance in the Digital Economy’ was released on 17 July 2016 and highlights many of the issues facing Queensland’s CTP scheme as a consequence of digital disruption and digital transformation in the next 20 years. The impact of trends such as motor vehicle technology, digital technologies, driver behaviour, motor vehicle ownership trends, and medical advances and costs are likely to fuel significant adjustments to the CTP scheme.

MAIC will use this report to deliver an innovative CTP scheme for Queensland ensuring it remains contemporary and delivers improved outcomes for motorists and people injured in motor vehicles crashes.

Prudential supervision and scheme health

During the 2015-16 financial year, MAIC remained focused on delivering an affordable and viable scheme for all Queenslanders. To maintain the integrity of the scheme MAIC promotes principle-based supervision of licensed insurers, and undertakes a regulatory program including benchmarking, compliance and performance monitoring.

Communication strategies

During 2015-16, MAIC focused on strengthening its communication strategies to ensure it was better able to advise stakeholders of any changes. MAIC and the Nominal Defendant developed new corporate identities and their website was redeveloped with a focus on increasing accessibility of information for claimants, insurers and service providers.

MAIC is currently developing a social media strategy and will continue to investigate ways new technology can be used to stay in touch with motorists and other stakeholders.

Fraud deterrence program

MAIC is committed to identifying and combatting fraud in motor vehicle crash claims. Where insurers refer matters to MAIC, these are thoroughly assessed and, where appropriate, MAIC pursues prosecutions and looks to courts to impose penalties upon those who commit offences under the Motor Accident Insurance Act 1994.

Prudential supervision

MAIC undertakes a range of prudential supervision activities in accordance with its powers and responsibilities under the MAIA. The risk of insurer failure is one of the most significant aspects MAIC monitors – given the financial risk to the State as well as the disruptive impact and implications for insured motorists and claimants.

In undertaking its supervision role MAIC has regard to the role of the Australian Prudential Regulatory Authority (APRA). MAIC has a Memorandum of Understanding (MoU) with APRA. The MoU covers a range of prudential supervision and information sharing protocols, and is intended to ensure an efficient supervisory regime that protects the interests of the State while avoiding excessive regulatory burden on licensed insurers. MAIC meets with APRA on a bi-annual basis to discuss matters related to the prudential supervision of Queensland licensed CTP insurers.

On at least an annual basis MAIC meets with senior executives from each of the licensed insurers to analyse key reports and discuss performance and trends. This process has been generally well received by licensed insurers although opportunities to strengthen and clarify aspects of the MAIC prudential supervision regime appear warranted and will be explored in 2016-17.

Targeted licensed insurer compliance programs

MAIC continues to closely supervise licensed insurer performance through its targeted compliance programs, and monitors claims data on a regular basis. MAIC meets with each CTP insurer claims manager on a bi-annual basis to discuss a range of claims performance and compliance issues. Performance is monitored against benchmarks as well as changes compared to the results of previous reviews.

MAIC also monitors the claims compliance and performance of insurers through sophisticated data and ad-hoc analysis, and monitoring industry trends, court decisions and levels of customer complaints.

Our people

MAIC works in partnership with Queensland Treasury (Treasury) to invest in our people to create the right workplace with the right skills, culture and behaviour. As part of this partnership, MAIC has adopted Treasury’s frameworks for capability development, workforce planning, employee performance management, leadership, and industrial and employee relations. Treasury provides MAIC with strategic advice and support on issues such as recruitment, attraction, retention, induction, performance management, talent management, knowledge transfer and recognition.

In addition to providing MAIC with human resource support services, Treasury’s Human Resources branch also assists MAIC with meeting its obligations under the Public Sector Ethics Act 1994. MAIC staff access Treasury’s suite of online training modules specific to public sector ethics and the Queensland Government Code of Conduct. The online training package is rolled out to all new MAIC staff and all staff are required to complete the training annually.

In 2015-16, MAIC continued to develop and improve its complementary framework to Treasury’s Great People Capability Development System. The framework has allowed MAIC to reinvigorate its current workforce ensuring MAIC staff demonstrate behaviours and grow capabilities that add value to the organisation. MAIC will continue to review the framework and ensure it remains flexible and relevant to the needs of the business.

In 2016, MAIC underwent a staged reshaping to ensure the organisation’s structure aligned with service delivery needs. The revitalised structure allowed MAIC to realise a number of efficiencies and to build the necessary capabilities to provide interim support for NIISQ.

Staff also benefited from Treasury’s workplace health and wellbeing policy and services including annual flu vaccinations, the employee assistance program, access to first aid officers, corporate health insurance rates and the opportunity to attend health workshops.

With a planned move to 1 William Street (1WS) in late 2016, MAIC continues to ensure staff remain supported through the transition. MAIC staff have remained engaged and informed of transition activities and the leadership team have worked with staff on ways the organisation can utilise 1WS’s contemporary fitout to enhance productivity. MAIC will move to a more contemporary and dynamic way of working making the most of available collaborative spaces of 1WS and further promoting the usage of suburban satellite offices. These changes will further improve staff satisfaction and optimise employee work life balance in 2016-17.

MAIC’s full-time equivalent staff establishment, employee expenses and key executive management personnel and remuneration information can be found in the Financial information section (pages 33-56 for MAIC and pages 57-88 for the Nominal Defendant). Additional information on Treasury’s workforce strategies and frameworks, along with workforce statistics that include MAIC, can be located in Treasury’s annual report.

Leading the Motor Accident Insurance Commission

Reporting to the State Parliament through the Treasurer, Minister for Aboriginal and Torres Strait Islander Partnerships and Minister for Sport, the Insurance Commissioner sets the direction for MAIC and the Nominal Defendant.The MAIC leadership team includes the Insurance Commissioner, Director Finance and Procurement, Director Business Solutions, Director Strategic Planning and Business Performance, and Director CTP Scheme Claims.

The leadership team’s role is to lead and empower employees and to drive performance, ensuring the organisation meets the objectives and major activities set out in the strategic plan. The leadership team is also responsible for determining operational policy and strategies to identify and manage key areas of risk.

As at 30 June 2016, membership of the leadership team included:

B.Business (Insurance), MBA

Appointed as Insurance Commissioner in December 2010. Prior to this appointment Neil acquired over 30 years’ insurance experience across a broad range of management and executive positions. Neil’s responsibilities include providing strong strategic leadership to ensure

a viable, affordable and equitable CTP scheme in Queensland.

B.Commerce, CA

Appointed to MAIC in 2006, Lina’s responsibilities include financial and procurement management and ensuring MAIC meets statutory and government reporting obligations. Lina has an accountancy and auditing background covering the chartered profession, commerce, industry, and more recently the public sector.

GAICD

Appointed to MAIC in June 2014, Sarah’s responsibilities include providing strategic and operational direction for the Systems and Development, Business Intelligence and Continuous Improvement areas. Prior to this, Sarah worked for Queensland Treasury for 14 years responsible for a

range of services including information technology, data management and urban development research.

MBA, B.Business (Communication)

Appointed to MAIC in 2006, Vicki’s responsibilities include strategic and business planning, organisational reporting, policy, communication,

capability development and business support. Prior to working for MAIC, Vicki worked in marketing and communication roles across government, university and private sector organisations.

Appointed to MAIC in 2012, Kylie has held leadership positions in personal injury insurance across the public and private sectors for more than 15 years. Kylie is responsible for leading the Nominal Defendant, supervising licensed insurer claims management compliance and performance, and managing claims related legislated functions.

B.Physiotherapy, MBA, M.Commerce, AFCHSM, CPA

Appointed to the Commission in 2006, Fanny’s responsibilities include CTP premium setting, policy administration and acquisition matters, licensing and prudential supervision. Fanny also provides operational advice, and contributes to policy development and implementation to

support whole-of-government initiatives. Fanny has a physiotherapy background and ten years’ experience in health finance and administration with Queensland Health prior to her appointment to the Commission.

Governance

Our corporate governance framework ensures we:

• meet out statutory responsibilities under the MAI Act and other legislation

• integrate risk management into organisational activity

• assess and enhance corporate governance processes, including our systems of internal control.

MAIC is committed to effective risk management and has adopted Treasury’s framework for proactively identifying, assessing and managing risks. MAIC has continued to work within Treasury’s policy framework which is aimed at enhancing risk management capabilities

MAIC’s leadership team is accountable for risks. As part of MAIC’s ongoing planning and reporting processes, the leadership team identifies and monitors risks that may affect our ability to achieve our strategic objectives. MAIC maintains a risk register which the leadership team reviews on a quarterly basis. Risks are monitored with risk controls and treatment strategies assigned to each risk, this helps MAIC mitigate negative impacts to its core business. Treasury’s Board of Management reviews the MAIC risk register from a consolidated Treasury perspective, and MAIC has external auditors review the register annually. MAIC’s commitment to business continuity management ensures continuity of key business services which are essential for or contribute to the achievement of MAIC’s objectives.

In addition to managing operational risks, as part of our portfolio, program, project and contract management methodology, we identify risks associated with initiatives and develop solutions to mitigate and manage them. Initiative reporting includes continual assessment of risks, their impact and the need for intervention.

MAIC participates in Treasury wide risk and accountability management through representation on the Audit and Risk Management Committee (ARMC). MAIC also has an active Internal Audit program in place provided by the Treasury Internal Audit function.

Audit and Risk Management Committee

Insurance Commissioner Neil Singleton is a representative on Treasury’s ARMC where he accesses advice and assurance on the performance or discharge of functions and duties prescribed in the Financial Accountability Act 2009, the Financial and Performance Management Standard Act 2009, and other relevant legislation and prescribed requirements.

The committee’s key responsibilities include:

• considering audit and audit-related findings

• assessing and enhancing our corporate governance processes including our systems of internal control and the internal audit function

• evaluating and facilitating the practical discharge of the internal audit function, particularly in planning, monitoring and reporting

• overseeing and appraising our financial and operational reporting processes through the internal audit function

• reviewing risk management, control and compliance framework and strategies

• considering our external accountability responsibilities and integrity framework.

The committee met five times during the year and had oversight of various matters including (but not limited to):

• the delivery of the 2015-16 Internal Audit plan

• review of the 2014-15 financial statements for Treasury, MAIC and the Nominal Defendant

• fraud and misconduct investigations

• Queensland Audit Office (QAO) activity including reports to Parliament where they related to Treasury.

Internal and external accountability

MAIC’s governance framework includes both internal and external accountability measures.

Treasury provides internal audit services to MAIC through an outsourced arrangement with PwC. In 2015-16, Internal Audit provided an independent and objective assurance service operating in accordance with our Internal Audit Charter, which incorporates key internal audit and ethical standards. This function is independent of the QAO, however, it does liaise with the QAO regularly to ensure appropriate assurance services are provided.

In 2015-16, Internal Audit conducted a review of the Road Trauma Mitigation Fund to ensure allocation of funds were occurring efficiently and effectively.

Externally, MAIC and the Nominal Defendant are audited by the QAO in accordance with the Financial Accountability Act 2009. MAIC and the Nominal Defendant have achieved unqualified audits since the Commission commenced operations in 1994.

More information on Treasury’s Audit and Risk Management framework including information about the committee can be located in Treasury’s annual report.

Information systems and recordkeeping

In 2015-16, MAIC continued its commitment to prudent information systems and recordkeeping. Effective record keeping is fundamental to good business and ensures transparency and accountability in MAIC decision-making. MAIC’s records are managed until they have completed their lifecycle where they are archived and disposed of in accordance with the Queensland State Archives Retention and Disposal Schedule.

MAIC’s recordkeeping framework aligns with Treasury’s Information Management framework. The framework aims to ensure our record management practices are consistent with other offices within the Treasury portfolio and are compliant with current legislation and best practice record keeping standards. These include Public Records Act 2002, Information Privacy Act 2009 and the Right to Information Act 2009 (RTA) and Information Standard 18 : Information Security, Information Standard 31 : Retention and Disposal of Government Information, Information Standard 34 : Metadata, Information Standard 38 : Use of ICT Facilities and Devices and Information Standard 40: Recordkeeping.

MAIC supports the Queensland Government Open Data Initiative. In 2015-16, MAIC released 15 datasets including CTP scheme statistical data and annual report data. MAIC’s open data sets are available at the following website: data.qld.gov.au/dataset/compulsory-third-party-ctp-statistics

Levies and administration fee

Queensland’s CTP insurance premium contains levies and an administration fee to help cover the costs involved in delivering different components of the CTP scheme. These levies and administration fee are calculated annually and include the Statutory Insurance Scheme levy, the Nominal Defendant levy, the Hospital and Emergency Services levy and an Administration Fee (payable to the DTMR).

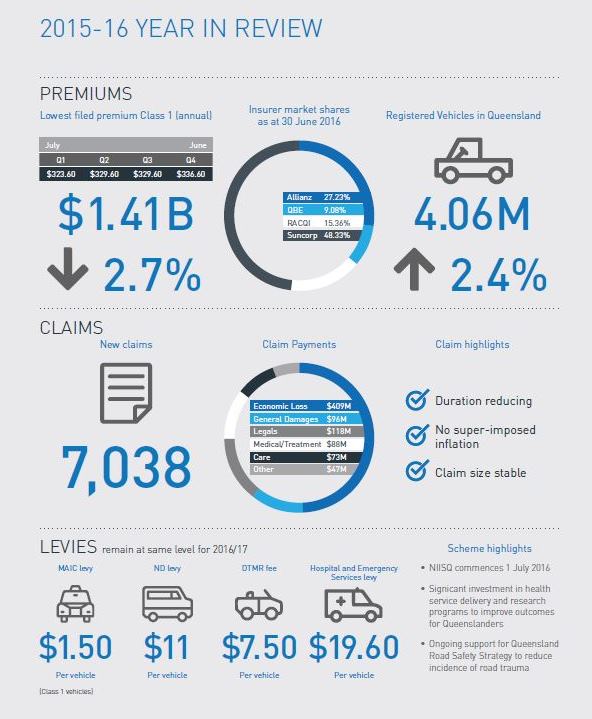

The Statutory Insurance Scheme levy

The Statutory Insurance Scheme levy covers the estimated operating costs of administering the MAI Act and also provides funding for research into crash prevention and injury mitigation. From 1 July 2015, the levy was $1.50 per policy and the levy collected income of $6.109 million in 2015-16.

The Nominal Defendant levy

The Nominal Defendant levy, which varies by vehicle class, covers the estimated costs of the Nominal Defendant scheme which provides funds to pay for claims relating to uninsured or unidentified vehicles. The levy is set having regard to an actuarial assessment of claim trends. From 1 July 2015, the levy for Class 1 vehicles was $11.00, with $43.973 million collected in 2015-16.

The Hospital and Emergency Services levy

The Hospital and Emergency Services levy is designed to cover a reasonable proportion of the estimated cost of providing public hospital and public emergency services to people who are injured in motor vehicle crashes, who use such services and are claimants or potential claimants under the CTP scheme. The levy amount calculated varies by vehicle class. From 1 July 2015, the levy was $19.60 for Class 1 vehicles, proceeds from this levy are then apportioned to Queensland Health and the Department of Community Safety. In 2015-16, $78.347 million was collected in levy income.

The Administration fee

The Administration fee is the fee payable to DTMR for delivering administrative support for the CTP scheme. There was no change to this fee in 2015-16.

Statistical information

The below statistical report covers all aspects of the CTP scheme required by the Motor Accident Insurance Act 1994, including:

- Vehicle registrations and CTP premiums collected

- Scheme delivery components and affordability

- Average Class 1 filed premiums and market share by insurer

- Accidents by region

- Claims by gender and severity

- Rates of legal representation and litigation

- Claim duration

- Claim payments by heads of damage and injury severity

MAIC Annual Report 2015-16 Statistical Information

( pdf 176.17 Kb )Financial information

These financial statements are an electronic presentation of the audited statements for the Motor Accident Insurance Commission and the Nominal Defendant.