Introduction

The Motor Accident Insurance Commission reports to the State Parliament through the Treasurer and prepares an annual report, as required by the Motor Accident Insurance Act 1994 , National Injury Insurance Scheme (Queensland) Act 2016 and the Financial Accountability Act 2009.

Compliance checklist

The compliance checklist outlines the governance, performance, reporting and other specific requirements for agency annual reports.

Complete Annual Report

Complete 2016-17 Annual Report (PDF 4MB)

Viewing and printing PDF files

Adobe Reader is required to open and print Portable Document Format (PDF) files and is free to download from the Adobe website.

If you experience any difficulties with accessing PDF files on this website, please refer to our PDF help page.

Contact us

If you have any enquiries regarding the annual report, please email maic@maic.qld.gov.au.

Disclaimer

The electronic versions of the Motor Accident Insurance Commission Annual Report 2016-17 provided on this site are for information purposes only and are not recognised as the official or authorised version. The official copy of the Annual Report, as tabled in the Legislative Assembly of Queensland, can be accessed from the Queensland Parliament tabled papers website.

MAIC Annual Report 2016-17

( pdf 4.01 Mb )Accessibility and copyright

ISSN:1837-1450

The Queensland Government is committed to providing accessible services to Queenslanders from all culturally and linguistically diverse backgrounds. If you have difficulty in understanding the annual report, you can contact us on the CTP enquiries line 1800 CTP QLD (1800 287 753) and we will arrange an interpreter to effectively communicate the report to you.

Motor Accident Insurance Commission

GPO Box 2203, Brisbane Qld 4001

Phone: 1800 CTP QLD (1800 287 753)

Email: maic@maic.qld.gov.au

Nominal Defendant

GPO Box 2203, Brisbane Qld 4001

Phone: 07 3035 6321

Email: nd@maic.qld.gov.au

National Injury Insurance Scheme

GPO Box 2203, Brisbane Qld 4001

Phone: 1300 607 566

Email: enquiries@niis.qld.gov.au

Visit https://maic.qld.gov.au/ to view this annual report.

© Motor Accident Insurance Commission 2017

Licence: This annual report is licensed by the State of Queensland under a Creative Commons (CC BY) 4.0 international licence.

CC BY License Summary Statement: In essence, you are free to copy, communicate and adapt this annual report, as long as you attribute the work to the Motor Accident Insurance Commission. To view a copy of this license, visit: http://creativecommons.org/licenses/by/4.0/.

Attribution: Content from this annual report should be attributed as: The Motor Accident Insurance Commission Annual Report 2016-17.

Letter of compliance and certification of financial statements

The Honourable Curtis Pitt MP

Treasurer and Minister for Trade and Investment

GPO Box 611

BRISBANE QLD 4001

Dear Treasurer

I am pleased to submit for presentation to the Parliament the Annual Report 2016-17 and financial statements for the Motor Accident Insurance Commission and the

Nominal Defendant.

I certify that this Annual Report complies with:

- the prescribed requirements of the Financial Accountability Act 2009, the Financial and Performance Management Standard 2009, the Motor Accident Insurance Act 1994 and the National Injury Insurance Scheme (Queensland) Act 2016; and

- the detailed requirements set out in the Annual report requirements for Queensland Government agencies.

A checklist outlining the annual reporting requirements can be accessed at www.maic.qld.gov.au.

Yours sincerely

Neil Singleton

Insurance Commissioner

About the CTP Scheme

Queensland’s Compulsory Third Party Scheme

Queensland’s Compulsory Third Party (CTP) scheme is a common law, fault-based scheme currently underwritten by four licensed private insurers who accept applications for insurance and manage claims on behalf of their policyholders. The scheme has operated since 1936 and provides motor vehicle owners, drivers and other insured people with an insurance policy that covers their unlimited liability for personal injury caused by, through or in connection with the use of the insured motor vehicle in incidents to which the Motor Accident Insurance Act 1994 (MAI Act) applies. Compensation is paid to accident victims from the respective insurer’s premium pool. The scheme focuses on the rehabilitation of injured people by placing certain obligations

on insurers and claimants.

The Motor Accident Insurance Commission (MAIC) is established under the MAI Act to regulate and support the CTP scheme. MAIC is the regulator of the CTP scheme and is responsible for licensing private insurers to operate within the scheme, monitoring their claims management and setting insurance premium costs by fixing the range for each vehicle class within which CTP insurers must set premiums. MAIC also monitors the performance of the Nominal Defendant; a statutory body who operates as a licensed insurer within the scheme for claims involving an unidentified or uninsured (no CTP insurance) motor vehicle. The Nominal Defendant has the additional role of meeting any claim costs of a licensed insurer who becomes insolvent.

An efficient system of CTP premium collection, through the motor vehicle registry of the Department of Transport and Main Roads (DTMR), minimises administration costs within the scheme.

The National Injury Insurance Scheme Queensland (NIISQ) commenced operation in 2016-17 to provide necessary and reasonable treatment, care and support for individuals who sustain serious personal injury on Queensland roads regardless of fault. This significant social reform transferred some risk from the Queensland CTP scheme for people who sustain personal injuries including traumatic brain injury, permanent legal blindness, multiple or high-level limb amputations, severe burns or permanent spinal

cord injuries.

About the Motor Accident Insurance Commission

The Motor Accident Insurance Commission

MAIC is responsible for regulating Queensland’s CTP insurance scheme, licencing and supervising CTP insurers (including the Nominal Defendant) as well as monitoring overall scheme trends to ensure appropriate premium limits are set. MAIC is established under the MAI Act.

MAIC has been located in Brisbane since it commenced operations on 1 September 1994 and is located at 1 William Street.

Organisationally, MAIC, the Nominal Defendant and the NIISQ are positioned within the Risk and Intelligence Division of Queensland Treasury.

Vision

Ensuring financial protection that makes Queensland stronger, fairer and safer, through:

- overseeing an affordable and efficient CTP scheme; and

- actively engaging and consulting with stakeholders on scheme performance and improvement opportunities.

Purpose

MAIC is responsible for regulating and improving Queensland’s Compulsory Third Party (CTP) insurance scheme and managing the Motor Accident Insurance and Nominal Defendant funds.

Responsibilities

MAIC is responsible for:

- ensuring people injured in road accidents receive fair compensation;

- ensuring Queensland motorists receive affordable premiums; and

- the regulation of insurers’ activity and compliance.

The Nominal Defendant is responsible for:

- compensating people who are injured as a result of the negligent driving of an unidentified or uninsured motor vehicle; and

- meeting any claim costs of an insolvent insurer.

Functions

MAIC’s key functions involve:

- the licensing and supervision of CTP insurers;

- monitoring the operation of the scheme;

- setting the range within which each insurer’s premium must fall and recommending to Government the levies payable;

- promoting research, education and the infrastructure to reduce the number of motor vehicle crashes and facilitate rehabilitation of injured people;

- developing and maintaining a claims register and statistical database for the purpose of providing management information; and administering the Nominal Defendant Fund.

How MAIC contributes to the Queensland Government objectives for the community

MAIC contributes to building safe, caring and connected communities by investing in road safety initiatives to reduce the frequency of motor vehicle accidents and minimise their impact on the community. MAIC also supports quality front line services by investing in targeted research and service delivery initiatives to improve health outcomes for people injured in motor vehicle crashes.

Strategic opportunities

MAIC has the opportunity to:

- support broader technological or innovative changes in road safety, trauma injury management and claims management system processes;

- reduce the incidence and severity of road trauma;

- identify ways to improve MAIC and Nominal Defendant service delivery; and

- deliver on the recommendations of the 2016 CTP Scheme Review.

Strategic risks and challenges

Ongoing risks and challenges faced by MAIC and the Nominal Defendant:

- keeping the CTP scheme under review to guard against unexpected adverse developments;

- maintaining prudential supervision of licensed insurers;

- keeping CTP affordable while managing a competitive insurer premium filing model;

- maintaining cost effective claims management of Nominal Defendant claims; and

- managing the transition of the National Injury Insurance Scheme Queensland (NIISQ) to the National Injury Insurance Agency Queensland.

Insurance Commissioner's Report

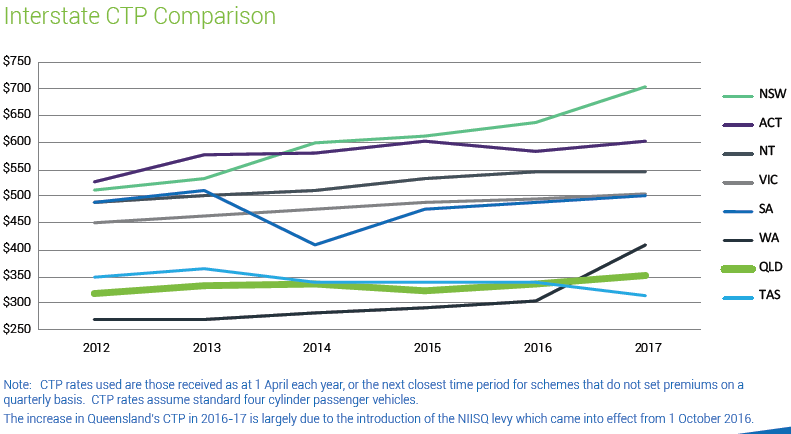

Queensland continues to be well served by a fair and affordable CTP scheme. The introduction of the National Injury Insurance Scheme Queensland from 1 July 2016 has been achieved in a manner that sees Queensland remain one of the most affordable CTP schemes in Australia.

The past year has been one of many highlights.

The CTP scheme review led by Mr Henry Smerdon AM along with Ms Jo Blades and Mr Rowan Ward highlighted the strength and stability of the existing scheme, while also identifying opportunities for improvement. The Palaszczuk Government directed MAIC to implement the 19 recommendations from the review. The priority recommendation was to address persistent high insurer profits bringing better balance to the scheme in terms of premium affordability for motorists. Savings have already been delivered and MAIC continues to focus on premium affordability as well as progressing the remaining review recommendations.

MAIC has also worked closely with the Department of Transport and Main Roads and the Personalised Transport Taskforce to address the CTP insurance related aspects of the personalised transport reforms. As a result, a new Vehicle Classification (Class 26) was created in June for booked hire vehicles and limousines, with the new class due to commence 1 October 2017.

During the year, MAIC entered into a number of exciting research programs and initiatives aimed at reducing the incidence and effects of road trauma. These are outlined in more detail in the Report. These initiatives are outlined in more detail on pages 11 and 12 of this Report. Our ongoing sponsorship of research excellence will benefit all Queensland road users.

While there were many positives, we also saw the disturbing rise of claim farming. With increasing numbers of Queensland residents reporting being cold called and harassed by claim farmers, MAIC is resolute in seeking ways to deter this insidious practice. Not only can it lead to people being misled into making false claims, but left unchecked it could create a cost burden for all motorists through higher CTP premiums.

MAIC is strengthening the focus on detecting and deterring fraudulent and unmeritorious claims across the scheme. This includes working closely with licensed insurers and through increased monitoring, analysis and information sharing.

Looking forward, MAIC is exploring the CTP insurance implications of autonomous vehicles, preparing for the next phase of the National Heavy Vehicle legislation related reforms and further strengthening our insight and reporting of scheme performance.

I thank the dedicated staff at MAIC for their support and contribution during the year. I also thank the many stakeholders who made submissions to the scheme review and have engaged with MAIC to maintain the longstanding stability and balance of our scheme.

The staff of the Nominal Defendant led by Kylie Horton and Luke Major have not only preserved the integrity of the ‘Nommo’ but their excellent claims management has led to the third reduction of the levy in five years. Truly great work team.

I look forward to progressing the scheme review recommendations and continuing to further strengthen and preserve the affordability, fairness and efficiency of the Queensland CTP scheme.

Neil Singleton

Insurance Commissioner

Year in review

Report Card

| Highlights | Performance indicators | Notes | Target | Outcome |

|---|---|---|---|---|

| Objective | Provide a viable and equitable personal injury motor accident insurance scheme. | |||

|

Premium bands and levies set within legislated timeframes. |

100% | 100% | |

|

Premium bands are set at a level to ensure scheme viability. |

100% | 100% | |

|

Highest filed CTP premium for Class 1 vehicles (sedans and wagons) as a percentage of average weekly earnings. |

<45% | <45% | |

| Objective | Continually improve the performance and operation of the Nominal Defendant. | |||

|

The percentage of the Nominal Defendant claims finalised compared to the number outstanding at the start of the financial year. |

50% | 62.3% | |

|

Percentage of Nominal Defendant claims settled within two years of compliance with the Motor Accident Insurance Act 1994. |

Claims can take up to three years to settle. Consequently, it is difficult to estimate the number of claims that will be finalised in any given period. |

50% | 73.2% |

|

Percentage of Nominal Defendant claims paid within 60 days of the settlement date. |

This is a percentage of claims with a general damages payment within 60 days of the settlement date. |

95% | 96.4% |

|

Investment strategies align with the anticipated claims runoff. |

100% | 100% | |

Interstate CTP Comparison

Our Achievements 2016-17

CTP Scheme Review

Following the introduction of the NIISQ in May 2016, MAIC engaged an external committee to undertake a review of Queensland’s Compulsory Third Party (CTP) insurance scheme. A discussion paper inviting public submissions was issued in August 2016 and received 54 submissions from stakeholder groups and members of the public.

In preparing their report, the committee, chaired by Henry Smerdon AM who worked alongside Jo Blades and Rowan Ward, held meetings with key stakeholders in relation to their submissions. The review was undertaken using existing MAIC resources at no additional cost to Queenslanders. The report, discussion paper and terms of reference, can be accessed at https://maic.qld.gov.au/2016-ctp-scheme-review/.

The committee made 19 recommendations to retain and improve scheme performance which have been accepted by the Queensland Government and MAIC has been instructed to now implement these. Seven recommendations require immediate action, others require more detailed analysis or preserve existing scheme strengths.

Implement Now

| Recommendation | Progress to Date |

|---|---|

| Recommendation 5: As a matter of priority, MAIC take action to address the issue of high insurer profits in the scheme. | Premium factors tightened. Ongoing review of insurer profit outcomes compared to 8% allowance in pricing. |

| Recommendation 8: Action be taken to improve consumer awareness of choice of CTP insurer both at renewal and when purchasing a vehicle. | Redesign of MAIC website and communication material underway. |

| Recommendation 11: Appropriate benchmarks be developed to enable enhanced assessment of scheme performance particularly around issues of affordability, efficiency, and motorist and claimant satisfaction. | Benchmarks under development and will be implemented during 2017 calendar year. |

| Recommendation 12: MAIC implement a legal fee reporting model to allow for greater transparency of scheme efficiency. | Market researcher engaged to survey claimants regarding entire claiming process including details of their legal costs. This will inform more specific details that could be included in a voluntary legal cost disclosure framework. |

| Recommendation 13: Areas of overlap and lack of clarity in the current prudential supervision arrangements be eliminated. | Options analysis completed and engagement with the Australian Prudential Regulation Authority commenced to identify a framework that aligns supervision regimes rather than overlapping regimes. Exploring options for better ways to define MAIC’s supervisory role in the MAI Act. |

| Recommendation 14: The MAI Act be amended to establish an appropriate hierarchy of regulatory responses to licence compliance breaches. | Proposed hierarchy developed. |

| Recommendation 15: Insurer performance monitoring, benchmarking and reporting be strengthened. | Increased MAIC focus and resourcing on insurer performance monitoring including data quality, claims management performance and focus on specific claims management initiatives. Benchmarks and reporting to be explored during 2017-18. |

Responding to Claims Fraud

Licensed insurers raised concerns during the year that, as claims fraud in the NSW CTP scheme was being addressed, it would start to appear in Queensland. MAIC engaged specialist firms to complete scheme-wide data analysis to determine the existence of any networks of potentially fraudulent activity. It was reassuring to receive feedback that there was no evidence of systemic fraud in the Queensland CTP scheme although some aspects that warrant greater analysis were identified and are currently being further explored.

During 2016-17, MAIC received 10 referrals from Queensland CTP insurers of matters that were potentially fraudulent claims. Of the 10 referrals, two matters were viewed as appropriate to prosecute. As part of ensuring there is an appropriate regime of claims fraud detection and deterrence MAIC arranged a presentation to all of Queensland’s CTP insurers by a specialist criminal law firm outlining the evidential requirements for fraud prosecution and tips on identifying a fraudulent claim. MAIC remains committed to proactively responding to reports of fraud and taking the necessary action where appropriate.

Halting the Insidious Practice of Claim Farming

Claim farming is the process by which a third-party cold-calls an individual (repeatedly on some occasions) to encourage them to make a compensation claim and then ‘on sells’ the person’s personal details to law firms. To combat this practice, MAIC has engaged with the Department of Justice and Attorney General to explore options which include penalties and legislative reform. This follows the engagement of Mr. Richard Douglas QC to identify claim farming reform options and consult extensively with insurers and legal bodies.

MAIC has commenced a public awareness campaign, through its website and social media channels, to educate the public about claim farming with a message to ‘hang up’ on cold-calls made by claim farmers. This has elicited regular reporting to MAIC by the public of the details of companies and legal firms allegedly engaging in this practice. The legal profession, through the publication of an article by MAIC in Proctor, have also been made aware of claim farming and have made reports of this activity to MAIC for investigation.

Performance of the Nominal Defendant

The Nominal Defendant has increased its focus on claims officer mentorship and training in 2016-17. This focus has successfully halved the amount the Nominal Defendant’s spends on the engagement of external legal services since 2010-11. Additionally, the capability of claims officers has grown and the proportion of claims that are managed wholly in-house has increased. As claims managed without external representatives tend to resolve more quickly, the Nominal Defendant is consistently exceeding its objective of having 50 per cent of claims resolved within two years of compliance. However, it is recognised that external assistance provided by legal and investigatory services remain important to achieve claims best practice. Motorists have benefitted from the improved performance of the Nominal Defendant by enjoying three reductions in the Nominal Defendant levy in the past five years. The levy is set to reduce further to $10.00 for a Class 1 vehicle in 2017-18.

Motorist Market Research

In early 2017, MAIC commissioned Market and Communications Research to undertake market research of motor vehicle owners. The research aims to capture the knowledge and perceptions of CTP insurance from two groups: general motorists and new car buyers. MAIC have commissioned similar studies in 1999, 2007, 2011, 2013 and 2016.

97 per cent of motorists are aware of CTP but there is still some areas of confusion with almost half incorrectly believing CTP covers property damage. MAIC has engaged a marketing firm to produce videos and content explaining CTP coverage and also increase awareness of how to switch CTP insurer.

CTP premium affordability was the most important issue for motorists. Keeping things simple with CTP tied into the registration process was also strongly preferred.

While more than half of all motorists like receiving a CTP flyer with their registration renewal there is growing interest in having details sent by email with nearly two-thirds of motorists interested in this option. MAIC is working with the DTMR to enhance the quality of information motorists receive by email and direct more renewals online.

Over half of all motorists are with their current CTP insurer as they receive some discount or benefit or find this convenient. While most motorists know they can switch insurer if they choose to do so, not many take up this option – either because it’s not a priority or there is no perceived reason or benefit to do so. To increase awareness of discounts and benefits, MAIC is producing a comparison tool in the CTP premium calculator on the MAIC website which will list current insurer incentives. MAIC will continue monitoring discounts and benefits offered by insurers.

The 2017 study was conducted in two stages; a preliminary qualitative stage (two focus groups) to explore key issues and help inform questionnaire design for stage two (a state-wide quantitative online survey). This comprised 315 surveys with registered motor vehicle owners and 210 surveys with people who had purchased a new car between May 2016 and May 2017.

The National Injury Insurance Scheme Queensland (NIISQ)

The NIISQ is an important social reform that provides lifetime care and support for people who suffer a serious personal injury on Queensland roads regardless of fault. Eligible injuries include permanent spinal cord injuries, traumatic brain injuries, brachial plexus injuries, amputations, permanent blindness and severe burns. Prior to implementation, around half of the people who suffered a serious personal injury in motor vehicle accidents every year did not receive compensation through the CTP scheme. These Queenslanders had to rely on the support of family and friends, the public health and welfare systems as well as not-for-profit organisations.

MAIC has been integral in building the foundation upon which the NIISQ operates and continues to play a key role. This includes the creation of the National Injury Insurance Agency Queensland and supporting with the initial operational aspects of the NIISQ scheme. The Insurance Commissioner, Mr Neil Singleton, acted in a transitional role overseeing the establishment of the National Injury Insurance Agency. Through consultation with the licenced CTP insurers, MAIC initiated a clawback of unearned insurance premiums which kept the NIISQ Levy at $69.00 for a Class 1 vehicle in 2016-17.

MAIC have obligations under section 103 of the NIISQ Act to monitor the operation of the scheme, including monitoring the efficiency and effectiveness of the administration of the NIISQ scheme, the compliance with the NIISQ Act and interactions between the NIISQ scheme and the Queensland CTP scheme.

NIISQ Participants 2016-17

| Applications | Accepted | Rejected | Total |

|---|---|---|---|

| Received | 63 (includes 1 applicant who was accepted after internal review) | 8 | 71 |

Our People

MAIC works in partnership with Queensland Treasury to invest in our people to create a workplace with the right skills, culture and behaviour. As part of this partnership, MAIC has adopted Treasury’s

frameworks for capability development, workforce planning, employee performance management, leadership and industrial and employee relations. Queensland Treasury (Treasury) provides MAIC with strategic advice and support on issues such as recruitment, attraction, retention, induction, performance management, talent management, knowledge transfer and recognition.

In addition to providing MAIC with human resource support services, Treasury’s Human Resources branch also assists MAIC with meeting its obligations under the Public Sector Ethics Act 1994. MAIC staff access Treasury’s suite of online training modules specific to public sector ethics and the Queensland Government Code of Conduct. The online training package is rolled out to all new MAIC staff and all staff are required to complete the training annually.

As a flow on from structural changes in 2015-16, we have seen continued growth in MAIC’s communication capability including a regularly updated website and a growing social media presence on Facebook and Twitter.

In 2016-17, MAIC provided operational support to the National Injury Insurance Agency Queensland (the Agency) through a service level agreement established between MAIC and the Agency.

Staff also benefited from Treasury’s workplace health

and wellbeing policy and services including annual flu vaccinations, the employee assistance program, access to first aid officers, corporate health insurance rates and the opportunity to attend health workshops.

MAIC’s staff expenses and key executive management personnel and remuneration information can be found in the Financial Information (pages 49-50 for MAIC and page 67 for the Nominal Defendant). Additional information on Treasury’s workforce strategies and frameworks, along with workforce statistics that include MAIC, are detailed in Treasury’s annual report.

Leading the Motor Accident Insurance Commission

Reporting to the State Parliament through the Treasurer and Minister for Trade and Investment, the Insurance Commissioner sets the direction for MAIC and the Nominal Defendant. The MAIC leadership team includes the Insurance Commissioner, Director Finance and Procurement, Director Business Solutions, Director Strategic Planning and Business Performance and Director CTP Scheme Claims.

The MAIC leadership team is responsible for setting the strategic direction of the Insurance Commission, overseeing operational performance, determining operation policy and project management. The leadership team supports the Insurance Commissioner, as the accountable officer, in meeting legislative requirements and accountabilities and the identification and management of key areas of risk.

As at 30 June 2017, membership of the leadership team included:

Neil Singleton – Insurance Commissioner

B. Business (Insurance), MBA

Neil was appointed as Insurance Commissioner in December 2010. Neil has over 30 years insurance experience across a broad range of management and executive positions. Neil’s responsibilities include providing strong strategic leadership to ensure a viable, affordable and equitable CTP scheme in Queensland.

Lina Lee – Director Finance and Procurement

B. Commerce, CA

Appointed to MAIC in 2006, Lina’s responsibilities include financial and procurement management and ensuring MAIC meets statutory and Government reporting obligations. Lina has an accounting and auditing background covering the chartered profession, commerce, industry and the Queensland public sector.

Sarah Sawyer – Director Business Solutions

Sarah was appointed to MAIC in June 2014. Overall, Sarah has acquired 17 years of experience working within Queensland Treasury, responsible for a range of services including information technology, data management, urban development research and office management. Sarah’s current responsibilities include providing strategic and operational direction for the Business Systems and Development, Continuous Improvement and Road Safety Research branches of the Insurance Commission.

Vicki Vanderent – Director Strategic Planning and Business Performance

B. Business, MBA

Appointed to MAIC in 2006, Vicki’s responsibilities include strategic and business planning, organisational reporting, policy, communication, capability development and business support. Prior to working for MAIC, Vicki worked in various marketing and communication roles across Government, university and the private sector.

Kylie Horton – Director CTP Scheme Claims

Appointed to MAIC in 2012, Kylie has held leadership positions in personal injury insurance across the public and private sectors for over 15 years. Kylie is responsible for leading the Nominal Defendant, supervising licensed insurer claims management compliance and performance and managing claims-related legislative functions.

Governance

MAIC’s corporate governance framework ensures that:

-

statutory responsibilities under the MAI Act and other legislation are met;

-

risk management is integrated into organisational activity; and

-

corporate governance processes, including systems of internal control, are assessed and enhanced.

MAIC is committed to effective risk management and has adopted Treasury’s framework for proactively identifying, assessing and managing risks. MAIC has continued to work within Treasury’s policy framework which is aimed at enhancing risk management capabilities.

MAIC’s leadership team is accountable for risks. As part of MAIC’s ongoing planning and reporting processes, the leadership team identifies and monitors risks that may affect our ability to achieve our strategic objectives. MAIC maintains a risk register which the leadership team reviews on a quarterly basis. Risks are monitored with risk controls and treatment strategies assigned to each risk. This helps MAIC mitigate negative impacts to its core business. Treasury’s Executive Leadership Team reviews the MAIC risk register from a consolidated Treasury perspective and MAIC has external auditors review the register annually. MAIC’s commitment to business continuity management ensures continuity of key business services which are essential for or contribute to the achievement of MAIC’s objectives.

MAIC participates in Treasury-wide risk and accountability management through representation on the Audit and Risk Management Committee (ARMC). MAIC also has an active Internal Audit program in place provided by the Treasury Internal Audit function.

Audit and Risk Management Committee

Insurance Commissioner Neil Singleton is a representative on Treasury’s ARMC where he accesses advice and assurance on the performance or discharge of functions and duties prescribed in the Financial Accountability Act 2009, the Financial and Performance Management Standard 2009, and other relevant legislation and prescribed requirements.

The committee’s key responsibilities include:

- considering audit and audit-related findings;

- assessing and enhancing our corporate governance processes including our systems of internal control and the internal audit function;

- evaluating and facilitating the practical discharge of the internal audit function, particularly in planning, monitoring and reporting;

- overseeing and appraising our financial and operational reporting processes through the internal audit function;

- reviewing risk management, control and compliance framework and strategies; and

- considering our external accountability responsibilities and integrity framework.

The committee met five times during the year and had oversight of various matters including (but not limited to):

- the delivery of the 2016-17 Internal Audit Plan;

- Review of the 2016-17 financial statements for Treasury, MAIC, the Nominal Defendant and the NIISQ;

- Fraud and misconduct investigations; and

- Queensland Audit Office (QAO) activity including reports to Parliament as they relate to Treasury.

The ARMC meetings were held on the following dates:

- 15 July 2016;

- 26 August 2016;

- 17 November 2016;

- 6 March 2017; and

- 10 May 2017.

Internal and External Accountability

MAIC’s governance framework includes both internal and external accountability measures.

Treasury provide internal audit services to MAIC through an outsourced arrangement with PwC. In 2016-17, Internal Audit provided an independent and objective assurance service operating in accordance with Treasury’s Internal Audit Charter, which incorporates key internal audit and ethical standards. This function is independent of the Queensland Audit Office (QAO), however, it does liaise with the QAO regularly to ensure appropriate assurance services are provided.

Externally, MAIC and the Nominal Defendant are audited by the Queensland Audit Office in accordance with the Financial Accountability Act 2009. MAIC and the Nominal Defendant have achieved unqualified audits since the Commission commenced operations in 1994.

In 2016-17, MAIC engaged an external committee to review Queensland’s CTP scheme. Complete details of the review including the report, discussion paper and terms of reference can be found at: www.maic.qld.gov.au/2016-ctp-scheme-review.

More information on Treasury’s Audit and Risk Management framework including information about the committee are detailed in Treasury’s annual report.

Information Systems and Recordkeeping

In 2016-17, MAIC continued its commitment to prudent information systems and recordkeeping. Effective record keeping is fundamental to good business and ensures transparency and accountability in MAIC decision-making. MAIC’s records are managed until they have completed their lifecycle where they are archived and disposed of in accordance with the Queensland State Archives Retention and Disposal schedule.

The Insurance Commission has effectively gone paperless in its recordkeeping. In the lead-up to the move to 1 William Street in October 2016, the Commission managed to remove approximately 200 archive boxes of paperwork into secure storage.

The Commission continues to record all documents that come into the office by scanning them and placing them into soft copy files and then referring to materials electronically. All hard copies are filed and depending on the nature of the document, are either stored securely at 1 William Street or sent to secure off-site storage able to be retrieved at any time.

MAIC’s recordkeeping framework aligns with Treasury’s Information Management Framework. The framework aims to ensure our record management practices are consistent with other offices within the Treasury portfolio and are compliant with current legislation and best practice record keeping standards. These include Public Records Act 2002, Information Privacy Act 2009 and the Right to Information Act 2009 (RTA) and Information Standard 18 : Information Security, Information Standard 31 : Retention and Disposal of Government Information, Information Standard 34 : Metadata, Information Standard 38 : Use of ICT Facilities and Devices and Information Standard 40: Recordkeeping.

MAIC supports the Queensland Government Open Data Initiative. In 2016-17, MAIC released 15 datasets including CTP scheme statistical data and annual report data. MAIC’s Open Data sets are available at the following website: https://data.qld.gov.au/dataset/compulsory-third-party-ctp-statistics.

Levies and Administration Fee

Queensland’s CTP insurance premium contains levies and an administration fee to help cover the costs involved in delivering different components of the CTP scheme. These levies and administration

fee are calculated annually and include the Statutory Insurance Scheme Levy, the Nominal Defendant Levy, the Hospital and Emergency Services Levy, the National Injury Insurance Scheme Queensland Levy and an Administration Fee.

The Statutory Insurance Scheme Levy

The Statutory Insurance Scheme Levy covers the estimated operating costs of administering the MAI Act and also provides funding for research into accident prevention and injury mitigation. From 1 July 2016, the Levy remained unchanged at $1.50 per policy and the Levy collected income of $6.24 million in 2016-17. From 1 July 2017, the levy remains unchanged.

The Nominal Defendant Levy

The Nominal Defendant Levy, which varies by vehicle class, covers the estimated costs of the Nominal Defendant scheme which provides funds to pay for claims relating to uninsured or unidentified

vehicles. The Levy is set having regard to an actuarial assessment of claim trends. From 1 July 2016, the Levy for Class 1 vehicles was $11.00 with $44.93 million collected in 2016-17. The Nominal Defendant Levy will be reduced to $10.00 for the 2017-18 period.

The Hospital and Emergency Services Levy

The Hospital and Emergency Services Levy is designed to cover a reasonable proportion of the estimated cost of providing public hospital and public emergency services to people who are injured in motor vehicle

crashes, who use such services and who are claimants or potential claimants under the CTP scheme. The Levy amount calculated varies by vehicle class. The Hospital and Emergency Services Levy remains unchanged from

2015-16 at $19.60 for Class 1 vehicle. Proceeds from this levy are then apportioned to Queensland Health and the Department of Community Safety. In the year 2016-17, $80.17 million was collected.

The National Injury Insurance Scheme Levy

The National Injury Insurance Scheme Levy, which varies by vehicle class, covers the estimated costs of the NIISQ which provides necessary and reasonable lifetime treatment, care and support for anyone who sustains a serious personal injury in a motor vehicle accident in Queensland. From 1 July 2016, the Levy for Class 1 vehicles was $69.00 with $299.24 million collected in 2016-17. The cost of implementing the NIISQ was offset by $16.00 due to the clawback of insurer premiums for liabilities that would be assumed by the NIISQ. The insurer clawback finished on 30 June 2017 meaning the levy will rise to $85.00 for Class 1 vehicles in 2017-18.

The Administration Fee

The Administration Fee is the fee payable to DTMR for delivering administrative support for the CTP scheme. From 1 July 2016, the Fee remained unchanged at $7.50 per policy. In the year 2016-17, $34.46 million was collected.

Statistical Information 2016-17

The below statistical report covers all aspects of the CTP scheme required by the Motor Accident Insurance Act 1994, including:

- Vehicle registrations and CTP premiums collected

- Scheme delivery components and affordability

- Average Class 1 filed premiums and market share by insurer

- Accidents by region

- Claims by gender and severity

- Rates of legal representation and litigation

- Claim duration

- Claim payments by heads of damage and injury severity

Statistical Information

( pdf 409.19 Kb )Financial Information

These financial statements are an electronic presentation of the audited statements for the Motor Accident Insurance Commission and the Nominal Defendant.