Introduction

The Motor Accident Insurance Commission reports to the State Parliament through the Treasurer and prepares an annual report, as required by the Motor Accident Insurance Act 1994 and the Financial Accountability Act 2009.

Compliance checklist

The compliance checklist outlines the governance, performance, reporting and other specific requirements for agency annual reports.

Complete Annual Report

Complete 2013-14 Annual Report (PDF 2,105 K)

Viewing and printing PDF files

Adobe Reader is required to open and print Portable Document Format (PDF) files and is free to download from the Adobe website.

If you experience any difficulties with accessing PDF files on this website, please refer to our PDF help page.

Contact us

If you have any enquiries regarding the annual report, please email maic@maic.qld.gov.au.

Disclaimer

The electronic versions of the Motor Accident Insurance Commission Annual Report 2013-14 provided on this site are for information purposes only and are not recognised as the official or authorised version. The official copy of the Annual Report, as tabled in the Legislative Assembly of Queensland, can be accessed from the Queensland Parliament tabled papers website.

MAIC-annual-report-13-14-FINAL

( pdf 2.05 Mb )Accessibility and copyright

The Queensland Government is committed to providing accessible services to Queenslanders from all culturally and linguistically diverse backgrounds. If you have difficulty in understanding the annual report, you can contact us on the CTP enquiries line 1800 CTP QLD (1800 287 753) and we will arrange an interpreter to effectively communicate the report to you.

Visit https://maic.qld.gov.au/ to view this annual report.

© Motor Accident Insurance Commission 2014

Licence: This annual report is licensed by the Motor Accident Insurance Commission under a Creative Commons Attribution (CC BY) 3.0 Australia Licence.

CC BY Licence Summary Statement: In essence, you are free to copy, communicate and adapt this annual report, as long as you attribute the work to the Motor Accident Insurance Commission.

To view a copy of this licence, visit:

http://creativecommons.org/licenses/by/3.0/au/deed.en

Attribution: Content from this annual report should be attributed as:

The Motor Accident Insurance Commission Annual Report 2013-14

ISSN: 1837-1450

Letter of compliance

The Honourable Tim Nicholls MP

Treasurer of Queensland and Minister for Trade

GPO Box 611

Brisbane Qld 4001

Dear Treasurer

I am pleased to present the annual report 2013-14 and financial statements for the Motor Accident Insurance Commission and the Nominal Defendant.

I certify that this Annual Report complies with:

- the prescribed requirements of the Financial Accountability Act 2009, Financial and Performance Management Standard 2009 and the Motor Accident Insurance Act 1994, and

- the detailed requirements set out in the Annual Report requirements for Queensland Government agencies.

A checklist outlining the annual reporting requirements can be accessed at https://maic.qld.gov.au/

Yours sincerely

Neil Singleton

Insurance Commissioner

About MAIC

MAIC is responsible for regulating Queensland’s CTP insurance scheme and managing the Nominal Defendant.

Established under the MAI Act, MAIC has been located in Brisbane since it commenced operations on 1 September 1994.

Organisationally, MAIC and the Nominal Defendant are positioned within the Corporate Group of Queensland Treasury and Trade.

Vision

Ensuring financial protection that makes Queensland stronger, fairer and safer, through:

- overseeing an affordable and efficient CTP scheme, and

- sound research funding, service delivery, policy development and strategic advice.

Values

Role

MAIC is responsible for ensuring a fair, efficient, affordable and effective motor accident insurance scheme.

Responsibilities

MAIC is responsible for:

- ensuring people injured in road accidents receive fair compensation;

- ensuring Queensland motorists receive affordable premiums;

- the regulation of insurers’ activity and compliance;

- compensating people who are injured as a result of the negligent driving of an unidentified or uninsured motor vehicle through the Nominal Defendant; and

- meeting any claim costs of insolvent insurers.

Functions

MAIC’s key functions involve:

- the licensing and supervision of CTP insurers;

- monitoring the operation of the scheme;

- fixing the range within which each insurer’s premium must fall and recommending to Government the levies payable;

- promoting research, education and the infrastructure to reduce the number of motor vehicle crashes and facilitate rehabilitation of injured people;

- developing and maintaining a claims register and statistical database for the purpose of providing management information; and

- administering the Nominal Defendant Fund.

How MAIC contributes to the Queensland Government objectives for the community

MAIC contributes to lowering the cost of living for families through monitoring CTP scheme affordability and advising the Queensland Government on appropriate action.

MAIC is actively revitalising front line services by investing in targeted research and service delivery initiatives which benefit motorists and improves health outcomes for people injured in motor vehicle crashes.

Strategic opportunities

MAIC has the opportunity to:

- deliver direct and tangible benefits to the insurance industry by reducing red tape in the Queensland CTP scheme; and

- transform the way MAIC and the Nominal Defendant deliver services through innovation, process improvements, strategic partnerships and ongoing renewal initiatives.

Strategic risks and challenges

Ongoing risks and challenges MAIC and the Nominal Defendant face include:

- Environmental factors such as claims trends, delivery costs and broader economic volatility can impact significantly on CTP premium rates. As a result, MAIC must continue to keep Queensland’s CTP scheme under review.

- Legislative provisions relating to insurer insolvency and the protection afforded to injured parties through the Nominal Defendant.

- Keeping CTP affordable while managing a competitive insurer premium filing model.

Queensland's CTP scheme

Queensland’s Compulsory Third Party (CTP) scheme is a common law fault based scheme currently underwritten by four licensed private insurers who accept applications for insurance and manage claims on behalf of their policyholders. The scheme has operated since 1936, overseeing the provision of insurance policies covering unlimited liability for personal injuries to motor vehicle owners, drivers, passengers and other persons injured in motor vehicle crashes to which the Motor Accident Insurance Act 1994 (the MAI Act) applies.

The Motor Accident Insurance Commission (MAIC) and the Nominal Defendant are statutory bodies established under the MAI Act to regulate and support the CTP scheme. MAIC regulates insurance premium costs by setting floor and ceiling premium bands for each vehicle class within which CTP insurers must set premiums. The Nominal Defendant compensates people who are injured as a result of the negligent driving of an unidentified or uninsured (no CTP insurance) motor vehicle. The Nominal Defendant has the extended role of meeting any claims costs of a licensed insurer who becomes insolvent.

An efficient system of CTP premium collection, through the motor vehicle registry of the Department of Transport and Main Roads (DTMR), minimised administration costs within the scheme.

Insurance Commissioner's Report

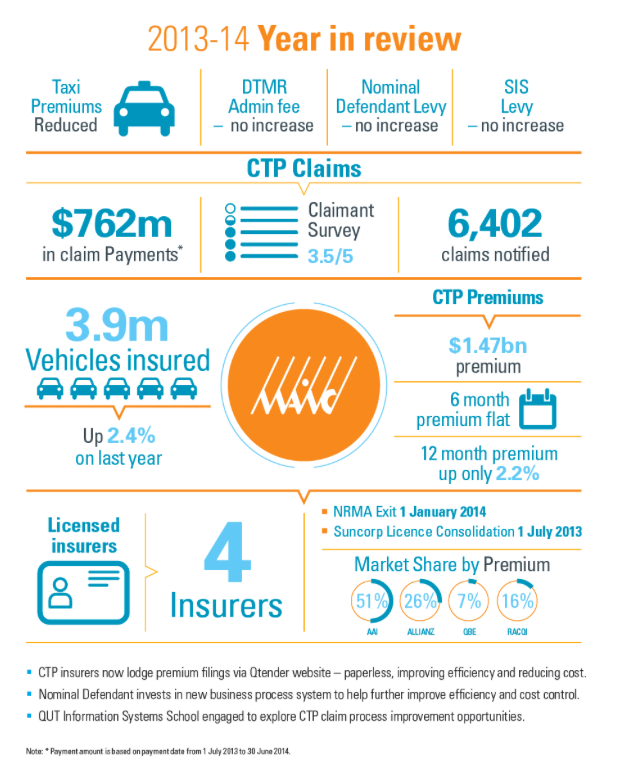

The Queensland CTP scheme continues to perform in a stable and equitable manner

- Annual Class 1 vehicle premiums rose to $334.60 or $336.60 depending on the choice of insurer (up 2.2 per cent and 2.7 per cent)

- No increase in the Nominal Defendant levy, DTMR administration fee and MAIC (SIS) levy

- Taxi premiums fell by 1.3 per cent due to improved claims experience

- Injured claimant survey reported overall satisfaction with the claims process

- Less than 1 per cent of claims progressed to Court Hearings with the majority resolving through early resolution processes

- Scheme profitability for insurers remains sound

MAIC remains focused on continually improving the scheme

- Focus on scheme performance

- The frequency of new claims is falling – albeit not fast enough.

- The duration of claims is reducing.

- Focus on innovating and improving

- Supporting programs and initiatives that improve road safety.

- Targeting 30 per cent reduction in road trauma by 2020

- Sponsored QLD Central Region Road Safety promoting road safety messages from the Sunshine Coast to Bowen

- Funded QUT Pilot – During the year, MAIC funded a pilot study by a team from QUT Information Systems School led by Professor Michael Rosemann and Professor Arthur ter Hofstede to identify whether there are opportunities to improve the CTP claims process. The results of the study were positive and it is pleasing to note that a more detailed and extensive study has recently received funding approval. MAIC will work with licensed insurers in supporting the QUT team as they progress this work over the coming two years.

- MAIC funding for research through CONROD and CARRS-Q continues, with the CONROD funding agreement renewed this year. The new funding agreement introduces contestability principles as part of a focus on continually improving performance and ensuring best value for money outcomes are achieved through investments in research activity.

- Supporting programs and initiatives that improve road safety.

- Focus on our people and resources

- Advisory Committee – Chair Bernard Rowley and Committee member Rowan Ward were both reappointed during the year. Their extensive CTP experience is highly regarded and I value their advice during each quarterly premium determination process.

- Management changes – A number of key management personnel left MAIC or changed roles during the year. I thank Kim Birch, Gavin Charlton, Mike Jarrett and Bronwyn Jenner for their contributions to MAIC and the Queensland CTP Scheme. I welcome Bill Dwyer and Sarah Sawyer into key management roles with the Commission.

- Continuing to invest in business intelligence tools to help improve analysis of Scheme Performance.

A key outcome for the year was the Nominal Defendant launching its new claims management system called Connect. A dedicated project team including MAIC and Queensland Treasury and Trade Corporate Services personnel deserve high praise for their expertise and commitment in delivering Connect. The new system enables claims to be managed in a more efficient, paperless environment and supports the ongoing focus of our Claims Manager Kylie Horton and her team in delivering superior service and cost outcomes. All Connect costs were met by the Nominal Defendant and a payback on the investment will be achieved through a range of performance improvements and efficiency gains.

I thank all stakeholders to the scheme for their continued professionalism and support in helping deliver great outcomes for Queensland.

Year in review

Report card

| Highlights | Performance indicators | Notes | Target | Outcome |

|---|---|---|---|---|

| Objective | Provide a viable and equitable personal injury motor accident insurance scheme. | |||

|

Premium bands and levies set within legislated timeframes. |

100% | 100% | |

|

MAIC funds expended on motor vehicle injury prevention and rehabilitation grants per registered vehicle. |

1. |

$1.56 | $1.26 |

|

Highest filed CTP premium for Class 1 vehicles(sedans and wagons) as a percentage of average weekly earnings. |

45% | 45% | |

| Objective | Continually improve the performance of the operation of the Nominal Defendant. | |||

|

The percentage of Nominal Defendant claims finalised compared to the number outstanding at the start of the financial year. |

2. |

50% | 58% |

|

Percentage of Nominal Defendant claims settled within two years of compliance with the MAI Act. |

3. |

50% | 61.5% |

|

Percentage of Nominal Defendant claims paid within 60 days of the settlement date. |

95% | 95.3% | |

|

Investment strategies align with the anticipated claims runoff. |

100% | 100% | |

| Objective | Provide a corporate governance model that facilitates the Commission’s vision and meets the State’s financial and performance standards. | |||

|

Financial requirements outlined in the Financial Accountability Act 2009 are met. |

100% | 100% | |

|

Planning and reporting requirements outlined in the Financial and Performance Management Standard 2009 are met. |

100% | 100% | |

|

Staff capabilities align with strategic plan. |

100% | 100% | |

- Actual grant funding to date is lower than anticipated primarily due to a timing difference in the payment of grants.

- Favourable variance is due to higher than anticipated number of claims being finalised.

- Claims can take two to three years to settle; consequently it is difficult to estimate the number of claims that will be finalised in any given period.

CTP claimant survey outcomes

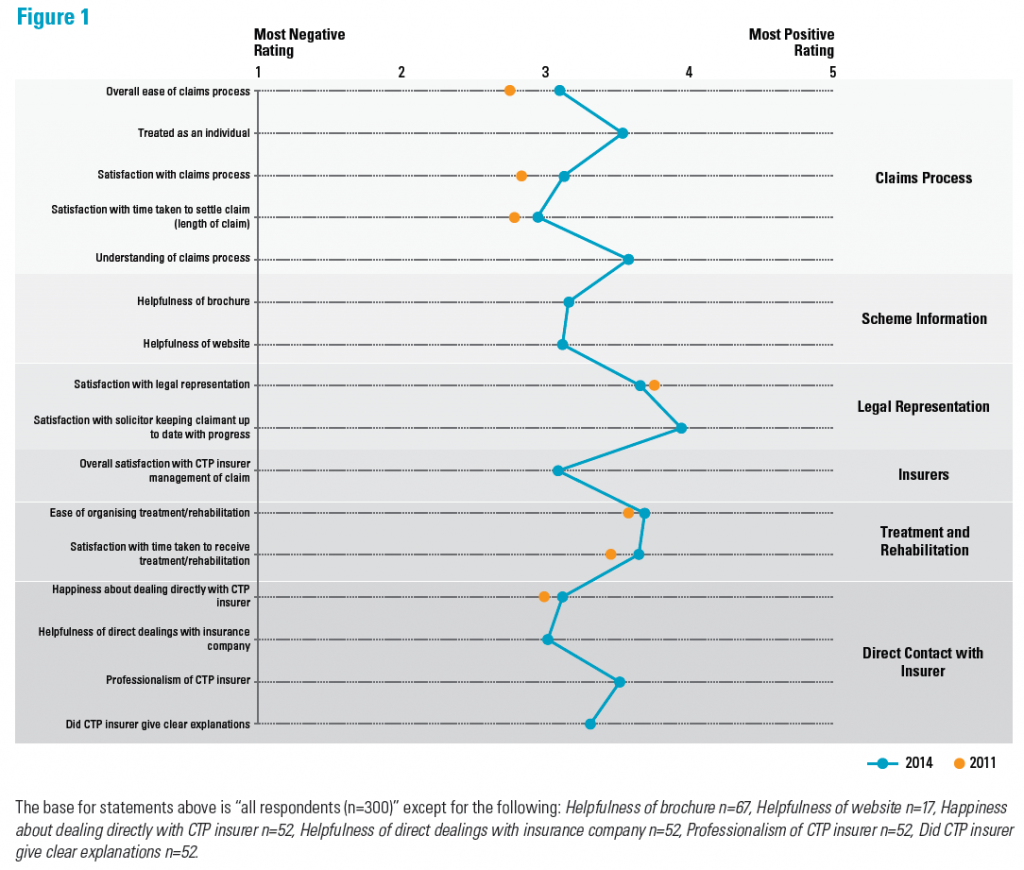

In 2014, MAIC commissioned research to better understand the CTP claims experience and delivery of compensation benefits. Researchers interviewed 300 legally represented claimants with recently finalised claims, on various aspects of their experience of the CTP claims process.

The research has provided MAIC with valuable insight into the views and perspectives of CTP claimants.

Although claimants viewed the CTP claims process as complex and lengthy, they were generally satisfied with most aspects surveyed.

Results were consistent with or were slightly more positive than results obtained in a previous MAIC commissioned claimant survey (reported in 2011) (Fig 1).

MAIC is also reviewing what actions need to be taken regarding two specific points of feedback – that some claimants advised they did not know the name of the CTP insurer, and some claimants advised they weren’t aware they could claim for medical treatment prior to resolving their claim.

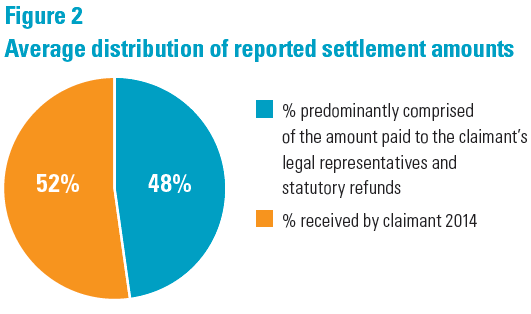

Settlement amounts

A specific area surveyed was around settlement amounts (Fig 2). Results indicated that on average claimants reported receiving 52 per cent of the recalled total settlement amount.

MAIC is undertaking analysis of these results to further

understand the breakdown of claimant benefits and the impact on scheme efficiency.

MAIC conducted this research under its functions of reviewing the scheme and monitoring its efficiency.

Leading the Motor Accident Insurance Commission

Reporting to the State Parliament through the Treasurer and Minister for Trade, Insurance Commissioner Neil Singleton sets the direction for MAIC and the Nominal Defendant. The Insurance Commissioner is supported by Director Corporate Governance Lina Lee, Director Business Solutions Sarah Sawyer, Director Claims Bill Dwyer and Manager Claims CTP Kylie Horton – collectively they are the leadership team.

The leadership team’s role is to drive MAIC and the Nominal Defendant’s performance, ensuring the organisation meets the objectives and major activities set out in the strategic plan. The Leadership Team is also responsible for determining operational policy and strategies to identify and manage key areas of risk.

The below roles comprised our leadership team, as at 30 June 2014.

B. Bus (Insurance), MBA, ANZIIF (Fellow), CIP, GAICD

Appointed as Insurance Commissioner in December 2010. Prior to this appointment Neil acquired over 30 years insurance experience across a broad range of management and executive positions.

Neil’s responsibilities include providing strong strategic leadership to ensure a viable, affordable and equitable CTP scheme in Queensland.

B.Com, CA

Appointed to MAIC in 2006, Lina’s responsibilities include strategic and business planning, financial management, office management, organisational reporting, business support and ensuring MAIC meets statutory and government reporting obligations. Lina has an accountancy and auditing background covering the chartered profession, commerce, industry, and more recently the public sector.

GAICD

Appointed to MAIC in June 2014. Prior to this appointment Sarah has acquired 14 years of experience working within QTT, responsible for a range of services including information technology, data, urban development research and office management. Sarah’s responsibilities include providing strategic and operational direction for the systems and development, business intelligence and continuous improvement areas of MAIC.

Appointed to MAIC in April 2014, Bill’s responsibilities include the efficient and effective management of the claims activities of the Nominal Defendant. Bill has a legal background as well as a further 12 years in the insurance industry working for a national claims management service provider.

Appointed to MAIC in 2012, Kylie’s responsibilities include the efficient and effective day-to-day management of the claims function of the Nominal Defendant. In fulfilling her role, Kylie has developed and implemented a number of claims management initiatives. Prior to Kylie’s appointment to MAIC she had held a number of management positions within the personal injury claims environment.

Our people

MAIC works in partnership with Queensland Treasury and Trade (QTT) to create the right workplace with the right skills, culture and behaviour. As part of this partnership, MAIC has adopted QTT’s frameworks for capability development, workforce planning, employee performance management, leadership and industrial and employee relations. QTT provides MAIC with strategic advice and support on issues such as recruitment, attraction, retention, induction, performance management, talent management and recognition.

In addition to providing MAIC with human resource support services, QTT’s Human Resources branch also assists MAIC with meeting its obligations under the Public Sector Ethics Act 1994. MAIC staff access QTT’s suite of online training modules specific to public sector ethics and the Queensland Government Code of Conduct. The online training package is rolled out to all new MAIC staff and all staff are required to complete the training annually.

In May 2014, QTT introduced the Great People capability system. Great People underpins our people management framework, ensuring MAIC has talented people within the Commission who are equipped and ready to lead others to deliver outcomes. Great People provide staff with clear, consistent and meaningful capabilities, allowing them to actively manage their career and performance, confident in the knowledge that they will be supported to achieve their full potential.

During the year, MAIC’s workforce accessed QTT’s flexible work arrangements and policies including part-time work arrangements and telecommuting. Staff also benefited from QTT’s workplace health and wellbeing policy and services including annual flu vaccinations, the employee assistance program, access to first aid officers, corporate health insurance rates and the opportunity to attend health workshops.

MAIC’s full-time equivalent staff establishment, employee expenses and key executive management personnel and remuneration information can be found in the Financial Information(pages 22-48 for MAIC and pages 49-83 for the Nominal Defendant). Additional information on QTT’s workforce strategies and frameworks, along with workforce statistics that include MAIC, can be located in Treasury and Trade’s annual report.

People

MAIC works in partnership with Queensland Treasury and Trade (QTT) to ensure its workforce has the skills and capabilities to progress its strategic objectives. As part of this partnership, MAIC has adopted QTT’s frameworks for workforce planning, employee performance management, leadership development and industrial and employee relations. QTT provides MAIC with strategic advice and support on issues such as recruitment, attraction, retention, induction, performance management, talent management and recognition.

In addition to providing MAIC with human resource support services, QTT’s Human Resources branch also assists MAIC with meeting its obligations under the Public Sector Ethics Act 1994. MAIC staff access QTT’s suite of online training modules specific to public sector ethics and the Queensland Government Code of Conduct. The online training package is rolled out to all new MAIC staff and all staff are required to complete the training annually.

In October 2012, MAIC piloted QTT’s new online Achievement and Development Plan (ADP) performance management system. Since the new system was introduced, staff participation in performance planning has improved and MAIC’s leadership team now have greater visibility of staff performance plans.

During the year, MAIC’s workforce accessed QTT’s flexible work arrangements and policies including part-time work arrangements and telecommuting / working from home. Staff also benefited from QTT’s workplace health and wellbeing policy and services including annual flu vaccinations, the employee assistance program, access to first aid officers, corporate health insurance rates and the opportunity to attend health workshops.

MAIC’s full-time equivalent staff establishment, employee expenses and key executive management personnel and remuneration information can be found in the Financial Information (pages 23-49 for MAIC and pages 51-85 for the Nominal Defendant). Additional information on QTT’s workforce strategies and frameworks, along with workforce statistics that include MAIC, can be located in Treasury and Trade’s annual report.

Governance

Our corporate governance framework ensures we:

- meet our statutory responsibilities under the MAI Act and other legislation;

- integrate risk management into organisational activity; and

- assess and enhance corporate governance processes, including our systems of internal control.

Managing risks

MAIC is committed to effective risk management and has adopted QTT’s framework for proactively identifying, assessing and managing risks. In 2013-14, QTT released an updated policy and framework aimed at enhancing risk management capability, which MAIC has incorporated into its processes.

MAIC’s leadership team is accountable for risks. As part of MAIC’s ongoing planning and reporting processes, the leadership team identifies and monitors risks that may affect our ability to achieve our strategic objectives. Risk controls and treatment strategies are implemented and maintained. Risks are recorded in the Insurance Commission’s risk register and reviewed on a quarterly basis. The updated risk register is forwarded to QTT’s Board of Management where it is reviewed from a consolidated QTT perspective. The risk register is also reviewed annually by external auditors.

As an integral component of risk assessment MAIC is committed to business continuity management. This ensures continuity of key business services which are essential for or contribute to achievement of MAIC’s objectives.

In addition to managing operational risks, as part of our portfolio, program and project management methodology, we identify risks associated with initiatives and develop solutions to mitigate and manage them. Initiative reporting includes continual assessment of risks, their impact and the need for intervention.

MAIC participates in QTT risk and accountability management through representation on the Audit and Risk Management Committee.

Audit and Risk Management Committee

Insurance Commissioner Neil Singleton represents MAIC on QTT’s Audit and Risk Management Committee, where he accesses advice and assurance on the performance or discharge of functions and duties prescribed in the Financial Accountability Act 2009, the Financial and Performance Management Standard 2009, and other relevant legislation and prescribed requirements.

The committee’s key responsibilities include:

- considering audit and audit-related findings;

- assessing and enhancing our corporate governance processes including our systems of internal control and the internal audit function;

- evaluating and facilitating the practical discharge of the internal audit function, particularly in planning, monitoring and reporting;

- overseeing and appraising our financial and operational reporting processes through the internal audit function;

- reviewing risk management and mitigation strategies; and

- reviewing the effectiveness of our risk management framework and process for identifying, monitoring and managing significant business risks, including fraud.

In 2013-14, the committee met five times and considered a range of matters including reviewing the 2012-13 financial statements for MAIC and the Nominal Defendant.

Internal and external accountability

MAIC’s governance framework includes both internal and external accountability measures.

QTT provide internal audit services to MAIC through an outsourced arrangement with PricewaterhouseCoopers (PwC). In 2013-14, Internal Audit provided an independent and objective assurance service operating in accordance with our Internal Audit Charter which incorporates key internal audit and ethical standards. This function is independent of the Queensland Audit Office (QAO), however, it does liaise with the QAO regularly to ensure appropriate assurance services are provided.

In 2013-14, Internal Audit delivered a program of work pursuant to the QTT three year Internal Audit plan, which was approved by the Audit and Risk Management Committee in July 2013. This plan is aligned to QTT and MAIC’s key risk areas. Over the year, Internal Audit reviewed several key risk areas, drawing upon specialists as needed.

Externally, MAIC and the Nominal Defendant are audited by the Queensland Audit Office in accordance with the Financial Accountability Act 2009. MAIC and the Nominal Defendant have achieved unqualified audits since the Commission commenced operations in 1994.

More information on QTT’s Audit and Risk Management framework including information about the committee can be located in QTT’s annual report.

Information systems and recordkeeping

Effective record keeping is fundamental to good business as records are evidence of business activities, transactions and decisions. MAIC’s strategic approach is to capture records in electronic formats where possible, and where necessary in paper form. MAIC’s records are managed until they have completed their lifecycle where they are archived and disposed of in accordance with the Queensland State Archives Retention and Disposal schedule.

During this financial year we embarked on a significant project to reduce our use of paper and move to electronic record keeping. In May we also introduced a new claims management system which greatly reduces the need for paper as the majority of documents are stored on the system.

MAIC’s recordkeeping framework aligns with QTT’s Information Management Framework. The framework aims to ensure our record management practices are consistent with other offices within the QTT portfolio and are compliant with current legislation and best practice record keeping standards. These include Public Records Act 2002, Information Privacy Act 2009 and the Right to Information Act 2009(RTA) and Information Standard 18: Information Security, Information Standard 31: Retention and Disposal of Government Information, Information Standard 34: Metadata, Information Standard 38: Use of ICT Facilities and Devices and Information Standard 40: Recordkeeping.

MAIC supports the Queensland Government Open Data Initiative. In 2013-14, MAIC released 14 datasets including CTP scheme statistical data and annual report data. MAIC’s Open Data sets are available at the following website: https://data.qld.gov.au/dataset/compulsory-third-party-ctp-statistics

Levies and Administration Fee

Queensland’s CTP insurance premium contains levies and an administration fee to help cover the costs involved in delivering different components of the CTP scheme. These levies and administration fee are calculated annually and include the Statutory Insurance Scheme (SIS) Levy, the Nominal Defendant Levy, the Hospital and Emergency Services Levy and an Administration Free (payable to the Department of Transport and Main Roads(DTMR)).

The SIS Levy

The SIS Levy covers the estimated operating costs of administering the MAI Act and also provides funding for research into accident prevention and injury mitigation. From 1 July 2013, the Levy remained unchanged at $1.85 per policy and the Levy collected income of $7.488 million in 2013-14.

The Nominal Defendant Levy

The Nominal Defendant Levy, which varies by vehicle class, covers the estimated costs of the Nominal Defendant scheme which provides funds to pay for claims relating to uninsured or unidentified vehicles. The Levy is set having regard to an actuarial assessment of claim trends. From 1 July 2013, the Levy for Class 1 vehicles was $11.50, a reduction of $0.85 from 2012-13, with $45.657 million collected in 2013-14.

The Hospital and Emergency Services Levy

The Hospital and Emergency Services Levy is designed to cover a reasonable proportion of the estimated cost of providing public hospital and public emergency services to people who are injured in motor vehicle crashes, who use such services and who are claimants or potential claimants under the CTP scheme. The Levy amount calculated varies by vehicle class. From 1 July 2013, the Hospital and Emergency Services Levy increased by $1.65 to $18.55 for Class 1 vehicles. Proceeds from this levy are then apportioned to Queensland Health and the Department of Community Safety.

The Administration Fee

The Administration Fee is the fee payable to the DTMR for delivering administrative support for the CTP scheme. From 1 July 2013, the Fee remains unchanged at $7.70 per policy. In the year 2013-14, $33.888 million was collected.

CTP scheme statistics

The statistical report (PDF 2,130 K) covers all aspects of the CTP scheme required by the Motor Accident Insurance Act 1994, including:

- Vehicle registrations and CTP premiums collected

- Scheme delivery components and affordability

- Average Class 1 filed premiums and market share by insurer

- Accidents by region

- Claims by gender and severity

- Rates of legal representation and litigation

- Claim duration

- Claim payments by heads of damage and injury severity

Financial information

These financial statements are an electronic presentation of the audited statements for the Motor Accident Insurance Commission and the Nominal Defendant.

Appendices

This section of the Motor Accident Insurance Commission Annual Report 2013-14 includes information on: