2011-12 Motor Accident Insurance Commission Annual Report

The Motor Accident Insurance Commission reports to the State Parliament through the Treasurer and prepares an annual report, as required by the Motor Accident Insurance Act 1994 and the Financial Accountability Act 2009.

Compliance checklist

The compliance checklist outlines the governance, performance, reporting and other specific requirements for agency annual reports.

Viewing and printing PDF files

Adobe Reader is required to open and print Portable Document Format (PDF) files and is free to download from the Adobe website.

If you experience any difficulties with accessing PDF files on this website, please refer to our PDF help page.

Contact us

If you have any enquiries regarding the annual report, please email maic@maic.qld.gov.au.

Disclaimer

The electronic versions of the Motor Accident Insurance Commission Annual Report 2011-12 provided on this site are for information purposes only and are not recognised as the official or authorised version. The official copy of the Annual Report, as tabled in the Legislative Assembly of Queensland, can be accessed from the Queensland Parliament tabled papers website.

Annual Report 2011- 2012

( pdf 1.33 Mb )Letter of compliance

The Honourable Tim Nicholls MP

Treasurer of Queensland and Minister for Trade

GPO Box 611

Brisbane Qld 4000

Dear Treasurer

I am pleased to present the 2011-12 annual report and financial statements for the Motor Accident Insurance Commission and the Nominal Defendant.

I certify that this annual report complies with:

- the prescribed requirements of the Financial Accountability Act 2009, Financial and Performance Management Standard 2009 and the Motor Accident Insurance Act 1994, and

- the detailed requirements set out in the Annual Report requirements for Queensland Government agencies.

A checklist outlining the annual reporting requirements can be accessed at https://maic.qld.gov.au/annual-reports/annual-report-2011-12/

Yours sincerely

Neil Singleton

Insurance Commissioner

Accessibility and copyright

The Queensland Government is committed to providing accessible services to Queenslanders from all culturally and linguistically diverse backgrounds. If you have difficulty in understanding the annual report, you can contact us on the CTP helpline 1800 CTP QLD (1800 287 753) and we will arrange an interpreter to effectively communicate the report to you.

Visit https://maic.qld.gov.au/annual-reports/annual-report-2011-12/ for additional copies of this annual report and to view additional information which meets the disclosure of additional information requirements.

© Motor Accident Insurance Commission 2012

License:

This annual report is licensed by the Motor Accident Insurance Commission under a Creative Commons Attribution (CC BY) 3.0 Australia License.

CC BY License Summary Statement:

In essence, you are free to copy, communicate and adapt this annual report, as long as you attribute the work to the Motor Accident Insurance Commission.

To view a copy of this license, visit:

http://creativecommons.org/licenses/by/3.0/au/deed.en

Attribution:

Content from this annual report should be attributed as:

The Motor Accident Insurance Commission Annual Report 2011-12

Queensland's CTP scheme

Queensland’s Compulsory Third Party (CTP) scheme is a common law ‘fault’ based scheme and is currently underwritten by six licensed private insurers who accept applications for insurance and manage claims on behalf of their policyholders. The scheme has operated since 1936, overseeing the provision of insurance policies covering unlimited liability for personal injuries to motor vehicle owners, drivers, passengers and other persons injured in motor vehicle accidents to which the Motor Accident Insurance Act 1994 (the MAI Act) applies.

The Motor Accident Insurance Commission (MAIC) regulates insurance premium costs by setting floor and ceiling premium bands for each vehicle class within which CTP insurers must set premiums. An efficient system of premium collection, through the motor vehicle registry of the Department of Transport and Main Roads (DTMR), minimises administration costs within the scheme and provides motorists with a relatively convenient transaction.

The Nominal Defendant is a statutory body established under the MAI Act for the purpose of compensating people who are injured as a result of the negligent driving of unidentified and/or uninsured (no CTP insurance) motor vehicles. The Nominal Defendant has the extended role of meeting the claims costs of any licensed insurer which may become insolvent.

CTP premium levels for ordinary private vehicles have remained stable in 2011‑12 and are the second cheapest in Australia amongst all states and territories. Queensland continues to offer common law access for injured people with no threshold entry level for claims

but with limits on certain heads of damage.

About us

MAIC is responsible for regulating Queensland’s CTP insurance scheme and managing the Nominal Defendant Fund.

Established under the MAI Act, MAIC has been located in Brisbane since it commenced operations on 1 September 1994.

Our vision

Ensuring financial protection that makes Queensland stronger, fairer and safer, through:

- overseeing an affordable and efficient CTP scheme, and

- sound research funding, service delivery, policy development and strategic advice.

Our purpose

MAIC is responsible for ensuring a fair, efficient, affordable and effective motor accident insurance scheme. It achieves this by regulating private sector insurers so premiums charged to insured vehicle owners are reasonable and sustainable, and so treatment and payments to the injured are accessible and consistent.

Our responsibilities

MAIC is responsible for:

- ensuring people injured in road accidents receive fair compensation;

- compensating people who are injured as a result of the negligent driving of unidentified and/or uninsured motor vehicles through the Nominal Defendant;

- ensuring Queensland motorists receive affordable premiums;

- the regulation of insurers’ activity and compliance; and

- meeting any claim costs of insolvent insurers.

Functions

MAIC’s key functions involve:

- the licensing and supervision of CTP insurers;

- monitoring the operation of the scheme;

- fixing the range within which each insurer’s premium must fall and recommending to Government the levies payable;

- promoting research, education and the infrastructure to facilitate the rehabilitation of the injured person;

- developing and maintaining a claims register and statistical database for the purpose of providing management information; and

- administering the Nominal Defendant Fund.

How we contribute to the Queensland Government objectives for the community:

MAIC contributes to growing a four pillar economy by maintaining prudent investment strategies for the Motor Accident Insurance and Nominal Defendant funds.

MAIC contributes to lowering the cost of living for families by monitoring CTP scheme affordability and advising the Queensland Government on appropriate action.

MAIC contributes to revitalising front line services by investing in targeted research and service delivery initiatives which benefit motorists and improve health outcomes for people injured in motor vehicle crashes.

Insurance Commissioner's Report

The Queensland CTP Scheme (the scheme) continues to serve Queensland well, providing affordable premiums for motorists as well as fair and timely compensation for injured claimants.

CTP premiums currently average around 25 per cent of average weekly earnings compared to levels above 40 per cent a decade ago. The average duration of claims has also reduced indicating that injured claimants are generally receiving appropriate rehabilitation and fair compensation faster. These are positive outcomes and testament to the overall stability and performance of the scheme.

While scheme experience remains sound, broader economic uncertainty has led to a slight increase in CTP premiums during the year. MAIC is continuing to monitor this aspect to ensure the scheme remains fully-funded while also maintaining an appropriate balance when setting premium bands.

Premium based competition has reduced with licensed insurers currently setting their premiums at the highest permissible level for most vehicle classes. While this may disappoint those who would like to see evidence of price competition, it is important to recognise that insurers are delivering a CTP policy that provides unlimited liability protection at a cost that represents good value for money.

During 2011-12, MAIC implemented a range of initiatives to seek to continually improve the performance of the scheme. Included amongst these initiatives was the development of the Scheme Performance Report (SPR). The SPR measures the proportion of premium that goes to the benefit of injured claimants compared to the proportion that goes to scheme and insurer delivery costs. Over time the SPR will provide greater transparency and understanding of scheme performance.

I thank all staff at MAIC for their ongoing commitment and support during 2011-12 and for their clear passion and enthusiasm in helping position MAIC as a professional, contemporary scheme regulator.

I would like to make particular mention of the significant contribution of two members of the MAIC Advisory Committee whose terms of appointment concluded on 30 June 2012. Henry Smerdon and Shauna Tomkins have been members of the Advisory Committee since 1999 and 2001 respectively and during this time they have played critical roles in providing insight and advice across a range of issues that are fundamental to the ongoing strength and stability of the Scheme. I thank Henry and Shauna for their support to me personally over the last year and to the support given more broadly to MAIC over many years.

I also acknowledge the contribution of so many stakeholders to the scheme during the year whether through the provision of research, through service delivery to motorists or injured people or in supporting initiatives to improve scheme performance.

MAIC is well positioned to continue working with all stakeholders to ensure Queensland enjoys a stable, fair and affordable CTP scheme into the future.

Our year in review

In 2011-12, MAIC continued to work hard to support, monitor and regulate Queensland’s CTP scheme through activities in premium setting, auditing insurer compliance, investing in research and service delivery initiatives while compensating those injured by unidentified or uninsured motor vehicles through the Nominal Defendant.

At 30 June 2012, the CTP scheme covered 3.68 million registered vehicles in Queensland. In the last financial year there were close to 6,500 claims notified to CTP insurers, with $810 million paid in claim benefits and costs*.

Throughout the past 12 months, MAIC has examined the adequacy of resources for claimants wishing to self-manage their claims. In the year ahead, MAIC will build on this work with the aim of improving support and resources to ensure all claimants, whether legally or self-represented, have the information available to make informed decisions about compensation, treatment and rehabilitation.

MAIC has also commenced a review of information collected by the Personal Injuries Register. This comprehensive database of claims statistics and information is a key tool used by MAIC to monitor the scheme and ensure insurer compliance with the MAI Act. Improvements to this tool over the forthcoming year will ensure MAIC has access to the most relevant data to enable the most effective monitoring of the scheme.

These ongoing improvements in data and information collection and service delivery, as well as internal reviews of research investment and systems integration, promise to further enhance MAIC’s ability to ensure the scheme remains efficient, stable and equitable while maintaining affordability for Queensland drivers.

In 2012-13, MAIC will focus on expanding these ongoing improvements while exploring new opportunities to improve the performance and efficiency of the scheme. Key to this goal will be strengthening strategic relationships with agencies such as DTMR, Queensland Health and the Queensland Police Service. These relationships enable MAIC to maximise the benefit from investments in road safety, injury mitigation and management and service delivery.

* The CTP scheme by nature is long-tail, with payments made during the 2011‑12 financial year, representing compensation for claims lodged in the years up to 2011-12.

Our report card

| Highlights | Performance indicators | Notes | Target | Outcome |

|---|---|---|---|---|

| Objective | Provide a viable and equitable personal injury motor accident insurance scheme. | |||

|

Setting of premium bands within legislated timeframes. |

100% | 100% | |

|

Recommendation to the Treasurer of annual CTP levies by legislated timeframes. |

100% | 100% | |

Funds expended on grants per registered vehicle. |

$0.48 | $0.36* | ||

| Objective | Improve the performance of the operation of the Nominal Defendant. | |||

|

Number of Nominal Defendant claims finalised as a percentage of total outstanding claims. |

50% | 52% | |

|

Percentage of Nominal Defendant claims settled within two years of compliance. |

50% | 51% | |

|

Percentage of Nominal Defendant claims with General Damages paid within 60 days of the settlement date. |

95% | 95% | |

| Objective | Provide a corporate governance model that facilitates the Commission's vision and meets the State's financial and performance standards. | |||

|

Financial requirements outlined in the Financial Accountability Act 2009 are met. |

100% | 100% | |

|

Planning and reporting requirements outlined in the Financial and Performance Management Standard 2009 are met. |

100% | 100% | |

Staff capabilities align with strategic plan. |

100% | 100% | ||

* The decrease in funds expended on grants per registered vehicle is primarily due to an increase in MAIC’s operating expenses as a result of additional positions approved in August 2011 following a review of operational requirements. However, other funding sources are available to fully fund grant commitments as grants are funded from Statutory Insurance Scheme Levy, penalties revenue and Queensland Investment Corporation investments.

The grants program is developed to meet legislative requirements to fund activities including research that contributes to a reduction in the frequency and severity of road traffic crashes as well as improves outcomes for injured parties through enhanced injury management and rehabilitation practices.

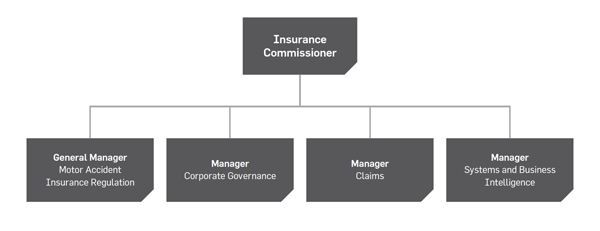

Our structure

Management and organisational structure

Our leadership team

The below roles comprised our leadership team, as at 30 June 2012.

B. Business (Insurance), MBA, ANZIIF (Fellow), CIP, GAICD

Appointed as Insurance Commissioner in December 2010. Prior to this appointment Neil acquired over 30 years insurance experience across a broad range of management and executive positions.

Neil’s responsibilities include providing strong strategic leadership to ensure a viable, affordable and equitable CTP scheme in Queensland.

B.HSc. RN

Appointed to MAIC in 2001, Kim’s responsibilities include providing high-level strategic advice to the Insurance Commissioner and leading the development and implementation of strategies and policies for regulating the CTP Insurance Scheme in Queensland. Her roles within the Commission have encompassed management and policy advice on CTP insurance issues, injury management and claims. Kim has a nursing background covering all areas of clinical care and management and a further six-years experience with the insurance industry working with CTP claims prior to her appointment to MAIC.

B.Com, CA

Appointed to MAIC in 2006, Lina’s responsibilities include strategic and business planning, financial management, office management, records management, workforce planning and ensuring MAIC meets statutory and government reporting obligations. Lina has an accountancy and auditing background covering the chartered profession, commerce, industry, and more recently the public sector.

Appointed to MAIC in 2010, Mike’s responsibilities include the efficient and effective day to day management of the claims function of the Nominal Defendant. His roles within the Commission have encompassed the provision of strategic advice and the development and implementation of claims management initiatives. Mike has extensive operational insurance experience and prior to his appointment to MAIC held a number of management positions within the personal injury claims environment.

Appointed as Manager Systems and Business Intelligence in October 2011. Prior to this appointment Gavin has acquired 20 years of experience working in the Information Technology and Business Intelligence domains across a number of sectors including insurance, rail and media. Gavin’s responsibilities include providing strategic and operational direction of the Information Technology and Business Intelligence assets for MAIC.

Managing our workforce

MAIC works in partnership with Queensland Treasury and Trade to ensure our workforce has the skills and capabilities to progress our strategic objectives. As part of this partnership, MAIC has adopted Treasury and Trade’s frameworks for workforce planning, performance management and leadership development. Treasury and Trade’s Human Resources branch provides MAIC with strategic advice on issues such as recruitment, induction, performance development, talent management, retention, workplace health and safety and industrial relations.

Training and education

MAIC’s workforce is encouraged to participate in Treasury and Trade’s internal education programs including the Professional Excellence Program, from which two MAIC staff graduated in 2011-12. MAIC maintains its own legislation-based, training modules, which all new claims staff must complete. In 2011-12, MAIC staff participated in external training in areas such as Queensland Parliamentary processes, statistical and business process management software, selection panels, settlement and negotiation skills, independent medical examinations and risk management. Staff were also supported to maintain currency on first aid training.

Voluntary Separation Program

In 2011-12, MAIC participated in the Queensland Government’s voluntary separation program. The Voluntary Separation Program (VSP) was introduced by the State Government as part of the Mid-Year Fiscal and Economic Review in January 2011. This program was one of a number of measures designed to deliver additional savings and reprioritise spending. The program was targeted primarily at non-frontline areas, as a service reprioritisation strategy to ensure continued growth in frontline areas. MAIC sought expressions of interest from all permanent staff across MAIC. Offers were made to eligible employees based on criteria outlined in the relevant Australian Taxation Office ruling. In 2011-12, nine employees accepted offers of voluntary separation packages at a cost of $0.81 million.

Code of Conduct

Following the adoption of the Code of Conduct for the Queensland Public Service in 2011, MAIC worked with Treasury and Trade to ensure the Code was implemented effectively. Firstly, all staff were provided with access to a copy of the Code; this continues today with all new staff receiving a copy of the Code as part of their induction. Secondly, all staff completed an online training package about the Code and ethical decision making. The online training package is rolled out to all new staff and all staff will be required to complete the training annually.

More information on Treasury and Trade’s Workforce Strategy, along with workforce statistics that include MAIC, can be located in Treasury and Trade’s annual report.

Ensuring accountability and managing risk

Ensuring accountability

Our governance framework incorporates both internal and external accountability measures.

Treasury and Trade provides internal audit services to MAIC and the Nominal Defendant through Treasury’s Audit Committee, of which the Insurance Commissioner is a member. Supporting the Audit Committee is Treasury and Trade’s Internal Audit Unit, which regularly evaluates financial and operating systems. The results of internal audits are reported to the Under Treasurer and include recommendations regarding the adequacy and effectiveness of financial, operational, administrative and computer controls.

In 2011-12, Internal Audit carried out an audit of MAIC’s vendor controls and grants payment processes. The result of this audit was reported to the Under Treasurer and recommendations will be implemented during the 2012-13 financial year.

Externally, MAIC and the Nominal Defendant are audited by the Queensland Audit Office in accordance with the Financial Accountability Act 2009. MAIC and the Nominal Defendant have achieved unqualified audits since the Commission commenced operations in 1994.

Information on the Treasury and Trade Audit Committee and Internal Audit, can be located in Treasury and Trade’s annual report.

Recognising and managing risk

MAIC is committed to establishing an organisational culture that ensures risk management is an integral part of all activities and a core management capability. Our risk management philosophy is aided by Treasury and Trade, who provides us with a framework for regularly reviewing the importance, probability and treatment of risks.

As part of MAIC’s annual planning and reporting processes, the leadership team identifies risks and opportunities which could impact on MAIC achieving its objectives. Risk mitigating strategies are identified and implemented. Risks are recorded in MAIC’s risk register and reviewed on a six-monthly basis. The risk register is also reviewed annually by external auditors.

MAIC is also committed to business continuity management as an integral component of risk management, to ensure continuity of key business services which are essential for or contribute to achievement of MAIC’s goals.

In addition to managing operational risks, as part of our project management methodology, we identify risks associated with projects and develop solutions to mitigate and manage them. Project reporting includes continual assessment of risks, their impact and the need for intervention.

Levies and Administration Fee

Queensland’s CTP insurance premium contains levies and an administration fee to help cover the costs involved in delivering different components of the CTP scheme. These levies and administration fee are calculated annually and include the Statutory Insurance Scheme Levy, the Nominal Defendant Levy, the Hospital and Emergency Services Levy and an Administration Fee (payable to the DTMR).

The Statutory Insurance Scheme Levy

The Statutory Insurance Scheme Levy covers the estimated operating costs of administering the MAI Act and also provides funding for research into accident prevention and injury mitigation. From 1 July 2011, the Levy increased by 5 cents to $1.85 per policy and the Levy collected income of $6.90 million.

The Nominal Defendant Levy

The Nominal Defendant Levy, which varies by vehicle class, covers the estimated costs of the Nominal Defendant scheme which provides funds to pay for claims relating to uninsured or unidentified vehicles. The Levy is set having regard to an actuarial assessment of claim trends. From 1 July 2011, the Levy for Class 1 vehicles was $12.35, a decrease of 85 cents from 2010-11, with $45.27 million collected in 2011-12.

The Hospital and Emergency Services Levy

The Hospital and Emergency Services Levy is designed to cover a reasonable proportion of the estimated cost of providing public hospital and public emergency services to people who are injured in motor vehicle accidents, who use such services and who are claimants or potential claimants under the CTP scheme. The Levy amount calculated varies by vehicle class. From 1 July 2011, the Hospital and Emergency Services Levy increased by $1.70 to $16.10 for Class 1 vehicles. Proceeds from this levy are then apportioned to Queensland Health and the Department of Community Safety.

The Administration Fee

The Administration Fee is the fee payable to the DTMR for delivering administrative support for the CTP scheme. From 1 July 2011, the Fee increased by 10 cents to $7.70 per policy to meet increasing staff and transaction costs. In the 2011-12 year, $31.06 million was collected.

CTP scheme statistics

The statistical report (PDF 460 K) covers all aspects of the CTP scheme required by the Motor Accident Insurance Act 1994, including:

- Vehicle registrations and CTP premiums collected

- Scheme delivery components and affordability

- Average Class 1 filed premiums and market share by insurer

- Accidents by region

- Claims by gender and severity

- Rates of legal representation and litigation

- Claim duration

- Claim payments by heads of damage and injury severity

Our financial information

These financial statements are an electronic presentation of the audited statements for the Motor Accident Insurance Commission and the Nominal Defendant.

Our financial information (PDF 720 K)

Appendices

This section of the Motor Accident Insurance Commission Annual Report 2011-12 includes information on:

Additional Information

Information Systems and Record Keeping

Effective record keeping is fundamental to good business as records are evidence of business activities, transactions and decisions. In addition to managing records as a dependable resource, MAIC’s staff aim to create and capture complete and accurate records in both paper and electronic form. MAIC records are managed until they have completed their lifecycle where they are archived and disposed of in accordance with the Queensland State Archives Retention and Disposal schedule.

In 2012, the Nominal Defendant commenced a project to replace its claims management system. This project will result in a leading edge claims management system which will facilitate best practice claims management and support sound record keeping practices. The project is expected to be completed in 2014.

MAIC’s recordkeeping framework aligns with Queensland Treasury’s Information Management Framework. The framework aims to ensure our records management practices are consistent with other offices within the Treasury portfolio and are compliant with current legislation and best practice record keeping standards. These include Public Records Act 2002, Information Privacy Act 2009 and the Right to Information Act 2009(RTA) and Information Standard 18 : Information Security, Information Standard 31 : Retention and Disposal of Government Information, Information Standard 34 : Metadata, Information Standard 38 : Use of ICT Facilities and Devices and Information Standard 40: Recordkeeping.

Consultancies and overseas travel

Motor Accident Insurance Commission Consultancies

Motor Accident Insurance Commission Consultancies

Actual expenditure – end of financial year Professional and technical $502,368

Nominal Defendant Consultancies

Actual expenditure – end of financial yearProfessional and technical $60,886

Overseas Travel

Nil to report.

Carers (Recognition) Act 2008

AIC values and supports the carers in our workforce in achieving work-life balance. We are guided by Treasury and Trade’s policies with respect to staff entitlements under this Act and ensure that our staff has access to flexible leave and work practices and a range of information and services to help them as carers.

MAIC staff are encouraged to participate in Treasury and Trade initiatives which are broadcast via e-messaging and also through the intranet. Staff also have access to Treasury and Trade’s carer’s room which provides a comfortable, well-equipped environment with full network and internet access so that staff can care for their dependants at work should the need arise.