Introduction

Read our annual report to learn how we continued to improve Queensland’s CTP insurance scheme in the 2017-18 financial year.

See how we’ve met the annual report requirements for Queensland Government agencies and statutory bodies.

MAIC Annual Report 2017-18

( pdf 1.85 Mb )Accessibility and copyright

ISSN:1837-1450

The Queensland Government is committed to providing accessible services to Queenslanders from all culturally and linguistically diverse backgrounds. If you have difficulty in understanding the annual report, you can contact us on the enquiries line 1800 CTP QLD (1800 287 753) and we will arrange an interpreter to effectively communicate the report to you.

Motor Accident Insurance Commission

GPO Box 2203, Brisbane QLD 4001

Phone: 1800 CTP QLD (1800 287 753)

Email: maic@maic.qld.gov.au

Web: www.maic.qld.gov.au

Facebook: @MAICQld

Twitter: @MAICQld

Nominal Defendant

GPO Box 2203, Brisbane QLD 4001

Phone: 07 3035 6321

Email: nd@maic.qld.gov.au

Web: www.maic.qld.gov.au/nominal-defendant/

National Injury Insurance Scheme

GPO Box 1391, Brisbane QLD 4001

Phone: 1300 607 566

Email: enquiries@niis.qld.gov.au

Web: www.niis.qld.gov.au

Facebook: NIISQld

LinkedIn: NIISQ Agency

Visit www.maic.qld.gov.au to view this annual report. Copies of the report are also available in paper format. To request a copy, please contact us using the details above.

© Motor Accident Insurance Commission 2018

Licence: This annual report is licensed by the State of Queensland under a Creative Commons (CC BY) 4.0 International licence.

CC BY Licence Summary Statement: In essence, you are free to copy, communicate and adapt this annual report, as long as you attribute the work to the Motor Accident Insurance Commission. View this licence.

Attribution: Content from this annual report should be attributed as: The Motor Accident Insurance Commission Annual Report 2017-18.

Letter of compliance and certification of financial statements

5 September 2018

The Honourable Jackie Trad MP

Deputy Premier, Treasurer and Minister for Aboriginal and Torres Strait Islander Partnerships

GPO Box 611

BRISBANE QLD 4001

Dear Deputy Premier

I am pleased to submit for presentation to the Parliament the Annual Report 2017-18 and financial statements for the Motor Accident Insurance Commission and the Nominal Defendant.

I certify that this Annual Report complies with:

- the prescribed requirements of the Financial Accountability Act 2009, the Financial and Performance Management Standard 2009, the Motor Accident Insurance Act 1994 and the National Injury Insurance Scheme (Queensland) Act 2016, and

- the detailed requirements set out in the Annual report requirements for Queensland Government agencies.

A checklist outlining the annual reporting requirements can be accessed online.

Yours sincerely

Neil Singleton

Insurance Commissioner

About us

Queensland’s Compulsory Third Party insurance scheme

Queensland’s Compulsory Third Party (CTP) insurance scheme protects motor vehicle owners and drivers from being held financially responsible if they cause injury to someone else in a motor vehicle accident. It also enables an injured person to claim fair and timely compensation for their injuries and access prompt medical and rehabilitation treatment.

The Motor Accident Insurance Commission (MAIC) was established under the Motor Accident Insurance Act 1994 (MAI Act) to regulate Queensland’s CTP insurance scheme. This includes licensing and supervising the four private insurers who cover the risk of Queensland motor vehicle owners through the scheme.

Motor vehicle owners pay their CTP insurance premium when they pay their vehicle registration through the Department of Transport and Main Roads. This minimises administration costs, is convenient for motorists and reduces the incidence of uninsured vehicles.

The Nominal Defendant acts as a licensed insurer in the CTP insurance scheme for claims that involve motor vehicles that are unidentified or not covered by CTP insurance. It also meets the claims costs associated with licensed insurers that become insolvent.

The National Injury Insurance Scheme Queensland (NIISQ) provides necessary and reasonable lifetime treatment, care and support to people who sustain serious personal injury on Queensland roads, regardless of who was at fault. MAIC has been located in Brisbane since it commenced operations on 1 September 1994 and is located at 1 William Street.

MAIC, NIISQ and the Nominal Defendant are positioned within the Risk and Intelligence Division of Queensland Treasury.

Motor Accident Insurance Commission

Vision

Ensuring financial protection that makes Queensland stronger, fairer and safer.

Purpose

Our role is to:

- support, regulate and improve Queensland’s CTP insurance scheme

- manage the Motor Accident Insurance Fund

- manage the Nominal Defendant Fund.

Objectives

We aspire to:

- provide a viable and equitable personal injury motor accident insurance scheme

- continually improve scheme performance with a focus on efficiency and affordability

- continually improve the performance of the Nominal Defendant in their indemnification of uninsured and unidentified motor vehicles

- implement the 19 recommendations made by the 2016 CTP insurance scheme review.

To support the Queensland Government’s goals for our community, we also:

- build safe, caring and connected communities by investing in road safety initiatives to reduce the frequency of motor vehicle accidents and minimise their impact on the community

- deliver quality frontline services by investing in targeted research and service delivery initiatives to improve health outcomes for people injured in motor vehicle crashes.

Strategic opportunities

We have the unique opportunity to:

- harness and support broader technological or innovative changes in road safety, trauma injury management and claims management systems and processes

- actively reduce the incidence and severity of road trauma through strategic partnerships with the Department of Transport and Main Roads and Queensland Police Service

- continually seek ways to improve the Motor Accident Insurance Commission.

Strategic challenges

We meet the challenges of:

- protecting the CTP insurance scheme against unexpected adverse developments

- maintaining prudential supervision of licensed insurers

- keeping CTP insurance premiums affordable for motorists.

Insurance Commissioner report

Queensland road users continue to enjoy a strong and sustainable CTP insurance scheme.

In terms of key scheme metrics, CTP insurance premiums remained stable, the incidence of claims fraud identified by insurers remained very low and market research surveys showed that motorists and claimants are satisfied with the scheme – overall, it is a positive story.

One key challenge that threatens the stability of the scheme is a scam called ‘claim farming’. Claim farmers obtain the personal details of people involved in a crash and use potentially fraudulent, unethical and/or high-pressure tactics to convince them to make a CTP insurance claim, then sell these details to law firms for a profit. This insidious practice not only affects the scheme, but results in Queenslanders being harassed by phone calls and having their privacy breached.

We have been directed by the Deputy Premier to develop a range of initiatives including legislative reforms to stop the claim farmers. This is our immediate priority.

We continue to invest in strengthening and supporting the scheme.

During the year, we proudly supported a number of new research programs and initiatives that will help reduce the incidence and effects of road trauma. These are outlined in more detail later in this annual report.

We also invested in additional resources to strengthen insurer supervision and data analytics. This was achieved at no additional cost to motorists and will directly focus on continuing to improve scheme performance for motorists and injured people.

Arising from the 2016 CTP insurance scheme review, we continue to tighten premium assumptions and ensure a fair balance between premiums paid by motorists and profits achieved by insurers.

We are also working with the Department of Transport and Main Roads and communicating with insurers on initiatives to ensure motor vehicle purchasers are selecting their preferred CTP insurer without influence by a motor dealer or other intermediary.

The Nominal Defendant continues to lead by example in its excellent management of CTP insurance claims that has enabled a further reduction in the Nominal Defendant levy for 2018-19.

In the coming year, our key priorities are to firmly address claim farming and continue to improve Queensland’s CTP insurance scheme to meet the needs of motorists, claimants and the community – ensuring Queensland benefits from the best CTP insurance scheme in Australia.

I thank the team from ‘the Nommo’ and MAIC, as well as our stakeholders, who continue to support the strength and integrity of the scheme.

Neil Singleton

Insurance Commissioner

Year in review

Report card

| Highlights | Performance indicators | Notes | Target | Outcome |

|---|---|---|---|---|

| Objective | Provide a viable and equitable personal injury motor accident insurance scheme. | |||

|

Premium bands and levies set within legislated time-frames. |

100% | 100% | |

|

Premium bands are set at a level to ensure scheme viability. |

100% | 100% | |

|

Highest filed CTP premium for Class 1 vehicles (sedans and wagons) as a percentage of average weekly earnings. |

<45% | <45% | |

| Objective | Continually improve scheme performance with a focus on efficiency and affordability. | |||

|

Premium affordability and cost compared to other jurisdictions. |

Among the top 4 most affordable CTP insurance schemes in Australia | Achieved | |

| Objective | Continually improve the performance of the Nominal Defendant in the indemnification of uninsured and unidentified motor vehicles. | |||

|

Percentage of Nominal Defendant claims finalised compared to the number outstanding at the start of the financial year. (See note 1) |

50% | 68.2% | |

|

Percentage of Nominal Defendant claims settled within two years of compliance with the Motor Accident Insurance Act 1994. (See note 2) |

50% | 72.5% | |

|

Percentage of Nominal Defendant claims paid within 60 days of the settlement date. |

95% | 98.1% | |

|

Investment strategies aligned with anticipated claims payments. |

100% | 100% | |

| Objective | Implement the 19 recommendations made by the 2016 CTP insurance scheme review. | |||

|

Deputy Premier and Treasurer briefed. |

Achieved | Achieved | |

|

Percentage of recommendations that have been implemented (of those recommendations that could be progressed immediately). |

100% | 100% | |

|

Planning underway for the recommendations that require longer-term analysis and change. |

Achieved | Achieved | |

1 Favourable variance is due to higher than anticipated number of claims being finalised.

2 Claims can take 2 to 3 years to settle; consequently, it is difficult to estimate the number of claims that will be finalised in any given period.

Combating claim farming

In 2017-18, we developed a three-pronged strategy to eliminate ‘claim farming’ from Queensland’s CTP insurance scheme.

Claim farming is when people receive unexpected phone calls or messages about involvement in a car accident. Claim farmers encourage people to make or exaggerate a CTP insurance claim to gain access to personal details, which they sell to third parties. They often use high-pressure tactics and target vulnerable people, including children and the elderly.

We devised a multifaceted approach to combat this insidious practice:

- A public awareness campaign to educate and protect Queenslanders from being targeted by claim farmers.

- Consultation with key stakeholders on measures to minimise claim farming and fraud within the CTP insurance scheme.

- Amendments to the Motor Accident Insurance Act 1994 in 2019 to prohibit claim farming within the scheme.

As we implement this strategy in the coming year, we aim to ensure that our scheme remains affordable to motorists and supportive of genuinely injured claimants.

Help us to eliminate claim farming. If a claim farmer contacts you, hang up and report it.

Improving our CTP insurance scheme for Queenslanders

An external review of our CTP insurance scheme in 2016-17 showed that stakeholders consider it to be effective, affordable and stable. The review recommended that we maintain the core strengths of the scheme and continue to build on its success.

Since then, we have implemented improvements to scheme affordability and efficiency, consumer awareness, scheme monitoring and prudential supervision.

To implement the review’s recommendations, we:

Addressed high profitability of insurers and improved premium affordability

Since premium affordability is an important consideration for motorists, we reviewed the factors used to set insurance premiums to achieve an appropriate balance between affordability and the maintenance of a viable and efficient scheme. Between 1 April and 30 June 2018, the highest Class 1 premium for the majority of vehicles was $355. This was approximately $40 less than what it would have been had the review not been undertaken and no change to premium setting assumptions occurred.

Conducted market research

We commissioned market research into Queensland motor vehicle owners and CTP insurance claimants. Our research into motor vehicle owners offered insight into their awareness and understanding of CTP insurance, experience with claim farming, and key priorities for the scheme. Our research into CTP insurance claimants provided vital feedback on their satisfaction with the claims process. Read the insights.

Educated consumers about their choice of CTP insurer

The scheme review recommended that we improve consumer awareness of choice of CTP insurer both during renewal and when purchasing a vehicle. Market research supported this, indicating that most motorists do not take up the option to change CTP insurer. To combat this, we reached 253,000 people with a communication campaign titled ‘CTP what?’ and launched an insurer comparison tool to improve motorist awareness of their ability to change insurer and the benefits of doing so.

Improved performance analysis and communication

We launched an online scheme knowledge centre to more openly communicate about our scheme’s performance in terms of affordability, efficiency, and motorist and claimant satisfaction. We also increased resourcing in MAIC to support our performance and reporting activities.

Progressed a legal fee reporting model

To promote transparency about legal costs, we are consulting with stakeholders regarding a proposed legal cost reporting framework.

Investigated risk rating and its effects

We consulted insurers and sought expert actuarial advice to investigate opportunities to improve price competition and affordability.

These efforts have improved our key scheme metrics, with CTP insurance premiums remaining stable, the incidence of claims fraud identified by insurers remaining low, and market research showing that stakeholders are satisfied with our scheme. We will continue to progress the longer-term recommendations of the CTP insurance scheme review for the benefit of motorists, injured claimants and the community.

Nominal Defendant continues on its positive trajectory

The Nominal Defendant continues to deliver important protection for Queensland road users while remaining affordable, as shown by continued reductions in the Nominal Defendant levy for 2017-18 and 2018-19. An external review of our CTP insurance scheme also found that most stakeholders were satisfied by its performance and would like to retain its current structure and functions. The review committee agreed that the Nominal Defendant provides the Queensland Government with valuable insight into the CTP insurance scheme that helps improve understanding of the operating challenges of licensed insurers in the scheme. We look forward to continuing to deliver an affordable and efficient Nominal Defendant scheme to Queenslanders.

Improving lives through NIISQ

NIISQ is now providing necessary and reasonable lifetime treatment, care and support to 139 people who were seriously injured in car crashes in Queensland. The scheme predominately supports people with traumatic brain injuries, spinal cord injuries and amputations.

Relationships with stakeholders and service providers remain strong and play an important role in ensuring that the National Injury Insurance Agency Queensland (NIIAQ) meets the needs of these injured people. Each of these relationships is critical to the effectiveness of the scheme and we are sincerely grateful for their support and cooperation. NIISQ continued to raise awareness of its scheme through a photographic exhibition called ‘NIISQ on Tour’. Held initially in 1 William Street, Brisbane, the exhibition was subsequently displayed in the Townsville Hospital and the Royal Brisbane and Women’s Hospital. Thank you to the teams in each hospital who helped enable and promote the displays.

NIIAQ is now an employing entity which allows its staff to truly identify as being part of NIISQ. The first external NIIAQ Board was also appointed and has been integral in developing the strategic direction for the NIISQ. Over the coming year, NIIAQ will reach a stage where it will be able to operate more independently from the Insurance Commission. We look forward to continuing to support NIIAQ and its role in making lives better for Queenslanders.

The cost of administering the NIISQ during 2017-18 was $449.91 million including a provision for future participants’ lifetime treatment care and support expenses of $428.35 million. To learn more, view the NIIAQ annual report.

Investing in grants, sponsorships and research initiatives

| Pre-crash | Crash scene | Hospitalisation | Rehabilitation |

|---|---|---|---|

| CARRS-Q, Queensland University of Technology (QUT) - Funding to sustain operations of this road safety research centre based at QUT. | Pre-Hospital Retrieval Pathways, QUT - Supporting research into patient care and transport to hospital to identify areas for improvement. | Jamieson Trauma Institute, Metro North Hospital and Health Service - Supporting the institute to advance trauma prevention, research, trauma systems and clinical management to deliver the best possible care for people who suffer traumatic injuries. | Spinal Cord Therapy, Griffith University - Supporting the spinal cord therapy project which aims to repair permanent spinal cord damage. |

| SAFER, University of the Sunshine Coast - Funding of young driver situational awareness pilot project which specifically targets pre-learner drivers. | Analysis of fatal and serious injury crashes by region, CARRS-Q - Supporting the analysis of crashes by region to aim to reduce the impact of fatalities and serious injuries. | Trauma Data Fellowship, QUT - Exploring data linkages to better target road safety policies and injury management research. | RECOVER Centre, University of Queensland - Funding towards enhancing physical, psychological and vocational outcomes for injured people. |

| Braking the Cycle, PCYC - Supporting a learner driver mentor program across 14 PCYC branches to help young people to obtain the 100 hours required to sit their driving test. | QBI Fellowship in Traumatic Brain Injury, University of Queensland - Supporting research to identify methods to assess the seriousness of a traumatic brain injury. | The Hopkins Centre, Griffith University and Metro South Hospital and Health Service - Fostering research into improving disability and rehabilitation practices for people with lifelong disabilities. | |

| Motorcycle Protective Clothing - Partnering with Transport New South Wales to develop a testing regime and safety rating system for motorcycle protective clothing. | Transitional Rehabilitation Service, Metro South Hospital and Health Service - Community-based rehabilitation for people with a traumatic brain injury, including NIISQ participants. | ||

| PEERS Project, University of Queensland - Funding to pilot a social skills training program for adolescents with acquired brain injury and cerebral palsy. | |||

| Whiplash Online Assessment Package, University of Sydney - Developing a website to provide whiplash information for physiotherapists and their patients. |

Our people

Our dedicated and focused team is the backbone of MAIC and the Nominal Defendant. They are committed to ensuring that Queensland’s CTP insurance scheme supports motorists and people who are injured in motor vehicle accidents, both now and into the future.

We acknowledge that our people are our primary resource, that they work in a challenging context and need to be highly skilled and well supported. We support our staff through active recruitment and selection strategies, strengthened employee performance management and development programs, regular staff check-ins through the Working for Queensland survey and other pulse surveys, and workplace health and safety strategies.

We rely heavily on the judgement and experience of our staff to achieve sound outcomes in Queensland’s CTP insurance scheme. In 2017-18, to counter risks such as claim farming, fraud and issues relating to insurer monitoring, we increased our focus on regulation by increasing our regulatory staff. We continue to focus on maintaining a highly-skilled workforce that comprises a strong blend of supervisory and industry expertise. We recruit predominantly from the insurance and legal profession to ensure capable staff.

In partnership with Treasury, we introduced a new performance and planning system called iPerform, which facilitates informal and formal feedback meetings between managers and staff. The new system outlines employee objectives and development needs and is used to document regular discussions. Conversations involving the new system have led to development programs focused on resilience, fraud mitigation, governance, customer research, machine learning, behavioural economics and policy and parliamentary education, to name a few.

In 2017-18, 91 per cent of staff participated in the Working for Queensland Survey*. Staff engagement measures from the Working for Queensland Survey show increased levels of safety, health and wellness. The health and wellbeing of our staff is essential, so we emphasise the importance of an appropriate work-life balance.

In 2017-18, we placed an increased focus on staff resilience and vicarious trauma. Insurance Commission staff investigated workplace health and safety programs such as mental health first aid and resilience training. Our staff also benefited from Treasury’s workplace health and safety policy and procedures, such as the employee assistance program, annual flu vaccinations, access to first aid officers, corporate health insurance rates and the opportunity to attend health workshops.

In early 2018, our staff were also given the opportunity to participate in strategic planning. They provided valuable input into the initiatives that will help deliver the 2018—22 strategic plan. We meet our obligations under the Public Service Ethics Act 1994 by ensuring that MAIC and Nominal Defendant staff complete Treasury’s suite of online training modules, including modules related to the Code of Conduct. The online training package is delivered to all new staff.

In 2017-18, MAIC continued to provide operational support to the National Injury Insurance Agency Queensland through a service level agreement. Targeted activities aimed at building staff engagement are delivered through the Office Vitality team. Our staff expenses and key executive management personnel and remuneration information can be found in our Finances section (on page 35 for MAIC and page 58 for the Nominal Defendant). To see MAIC’s workforce profile, including full-time equivalent (FTE) staff and permanent separation rate, view the annual report of Queensland Treasury.

*results indicative of broader Insurance Commission experience.

Our values

We align our behaviour and operations with the five Queensland public service values:

Customers first

- Know your customers

- Deliver what matters

- Make decisions with empathy

Ideas into action

- Challenge the norm and suggest solutions

- Encourage and embrace new ideas

- Work across boundaries

Unleash potential

- Expect greatness

- Lead and set clear expectations

- Seek, provide and act on feedback

Be courageous

- Own your actions, successes and mistakes

- Take calculated risks

- Act with transparency

Empower people

- Lead, empower and trust

- Play to everyone’s strengths

- Develop yourself and those around you

Our leadership team

Front row: Kylie Horton, Neil Singleton, Vicki Vanderent. Back row: Sarah Sawyer, Lina Lee.

The Insurance Commissioner sets the direction for MAIC and the Nominal Defendant and reports to the State Parliament through the Deputy Premier, Treasurer and Minister for Aboriginal and Torres Strait Islander Partnerships. Our leadership team is responsible for our strategic direction, operational policy, project management and operational performance. The team supports the Insurance Commissioner, as the accountable officer, to meet our legislative requirements and accountabilities. This includes identifying and managing key areas of risk.

On 30 June 2018, membership of the leadership team included:

Neil Singleton

Insurance Commissioner

B. Business (Insurance), MBA

Neil was appointed as Insurance Commissioner in December 2010. Neil has over 30 years of insurance experience across a broad range of management and executive positions. Neil’s responsibilities include providing strong strategic leadership to ensure a viable, affordable and equitable CTP insurance scheme in Queensland.

Lina Lee

Director, Finance and Procurement

B. Commerce, CA

Appointed to MAIC in 2006, Lina oversees financial and procurement management and ensures that MAIC meets its statutory and Government reporting obligations. Lina has an accounting and auditing background covering the chartered profession, commerce, industry and the Queensland public sector.

Sarah Sawyer

Director, Business Solutions

Sarah was appointed to MAIC in June 2014. Overall, Sarah has acquired 18 years of experience working within Queensland Treasury. She has been responsible for a range of services including information technology, data management, urban development research and office management. Sarah’s recent responsibilities include providing strategic and operational direction for the Business Systems and Development, Continuous Improvement and Road Safety Research branches of the Insurance Commission.

Vicki Vanderent

Director, Strategic Planning and Business Performance

B. Business, MBA

Appointed to MAIC in 2006, Vicki is responsible for strategic and business planning, organisational reporting, policy, communication, capability development and business support. Prior to working for MAIC, Vicki held various marketing and communication roles across Government, university and the private sector.

Kylie Horton

General Manager, Motor Accident Insurance Commission

Appointed to MAIC in 2012, Kylie has held leadership positions in personal injury insurance across the public and private sectors for over 17 years. Kylie is responsible for leading the strategic management of the Nominal Defendant claims unit, the supervision of licenced insurer claims management compliance and performance and managing claims related legislative functions.

Risk management

Our corporate governance framework provides the foundation for effective decision making, sound management and clear accountability. It ensures that:

- we meet statutory responsibilities under the MAI Act, the NIISQ Act and other legislation

- risk management is integrated into organisational activity

- corporate governance processes, including systems of internal control, are assessed and enhanced.

We are committed to effective risk management and have adopted Treasury’s framework for proactively identifying, assessing and managing risks. We continue to work within Treasury’s policy framework which is aimed at enhancing risk management capabilities.

Our leadership team is accountable for risks. As part of our ongoing planning and reporting, our leadership team identifies and monitors risks that may affect our ability to achieve our strategic objectives. We maintain a risk register which the leadership team reviews on a quarterly basis. Risks are monitored with risk controls and treatment strategies assigned to each risk. This helps us to mitigate negative impacts to its core business. Treasury’s Executive Leadership Team reviews the MAIC risk register from a consolidated Treasury perspective and MAIC has external auditors review the register annually. Our commitment to business continuity management ensures continuity of key business services which are essential for or contribute to the achievement of MAIC’s objectives.

We participate in Treasury-wide risk and accountability management through representation on the Audit and Risk Management Committee. We also have an active Internal Audit program in place provided by the Treasury Internal Audit function.

Audit and Risk Management Committee

Our Insurance Commissioner, Neil Singleton, is a representative on Treasury’s Audit and Risk Management Committee. Through this forum, Neil accesses advice and assurance on the performance or discharge of functions and duties prescribed in the Financial Accountability Act 2009, the Financial and Performance Management Standard 2009, and other relevant legislation and prescribed requirements. The committee’s key responsibilities include:

- reviewing the appropriateness of our accounting policies and financial performance

- annually reviewing our risk management framework, including processes for identifying, monitoring and managing significant business risks

- integrity and preventing misconduct – quarterly reporting of misconduct issues and trends, prevention strategies and areas for improvement

- reviewing, with the assistance of internal and external audit functions, the adequacy of our internal controls, including IT security

- internal and external audit:

– reviewing and approving our Internal Audit Plan

– consulting with External Audit on our proposed audit strategy

– considering audit findings and recommendations to ensure key risks are considered and mitigated.

The committee met five times during the year and fulfilled its responsibilities in accordance with its charter and an approved work plan, which included:

- reviewing the 2016–17 financial statements for Queensland Treasury, Motor Accident Insurance Commission, NIISQ and Nominal Defendant

- reviewing the outcomes of 2017–18 Internal Audit activity and endorsement of 2018–19 Internal Audit Plan

- considering issues raised by the Queensland Audit Office (QAO), including recommendations from performance audits

- considering Treasury-related QAO reports to Parliament.

Internal and external accountability

Our governance framework includes both internal and external accountability measures.

Treasury provides internal audit services to MAIC through an outsourced arrangement with PwC. In 2017-18, Internal Audit provided an independent and objective assurance service operating in accordance with Treasury’s Internal Audit Charter, which incorporates key internal audit and ethical standards. This function is independent of the QAO; however, it does liaise with the QAO regularly to ensure appropriate assurance services are provided.

Externally, MAIC and the Nominal Defendant are audited by the QAO in accordance with the Financial Accountability Act 2009. MAIC and the Nominal Defendant have achieved unqualified audits since the Commission commenced operations in 1994.

More information on Treasury’s audit and risk management framework including information about the Audit and Risk Management Committee are detailed in Treasury’s annual report.

Information systems and recordkeeping

In 2017-18, we continued our commitment to prudent information systems and recordkeeping. Effective recordkeeping is fundamental to good business and ensures transparency and accountability in our decision-making. Our records are efficiently managed throughout their lifecycle and archived and disposed of in accordance with the General Retention and Disposal schedule and/or Treasury’s Retention and Disposal schedule (implementation version).

We continue to record all documents that come into the office by scanning them and saving them as soft copy files and then referring to materials electronically. All hard copies are filed and depending on the nature of the document, are either stored securely at 1 William Street, or sent to secure off-site storage able to be retrieved at any time.

Our recordkeeping framework aligns with Treasury’s Information Management Framework. The framework aims to ensure our record management practices are consistent with other offices within the Treasury portfolio and are compliant with current legislation and best practice record keeping standards. These include Public Records Act 2002, Information Privacy Act 2009, Right to Information Act 2009, Information Standard 18: Information Security, Information Standard 31: Retention and Disposal of Government Information, Information Standard 34: Metadata, Information Standard 38: Use of ICT Facilities and Devices and Information Standard 40: Recordkeeping.

We support the Queensland Government Open Data Initiative. In 2017-18, MAIC released 15 datasets including CTP insurance scheme statistical data and annual report data. View them online.

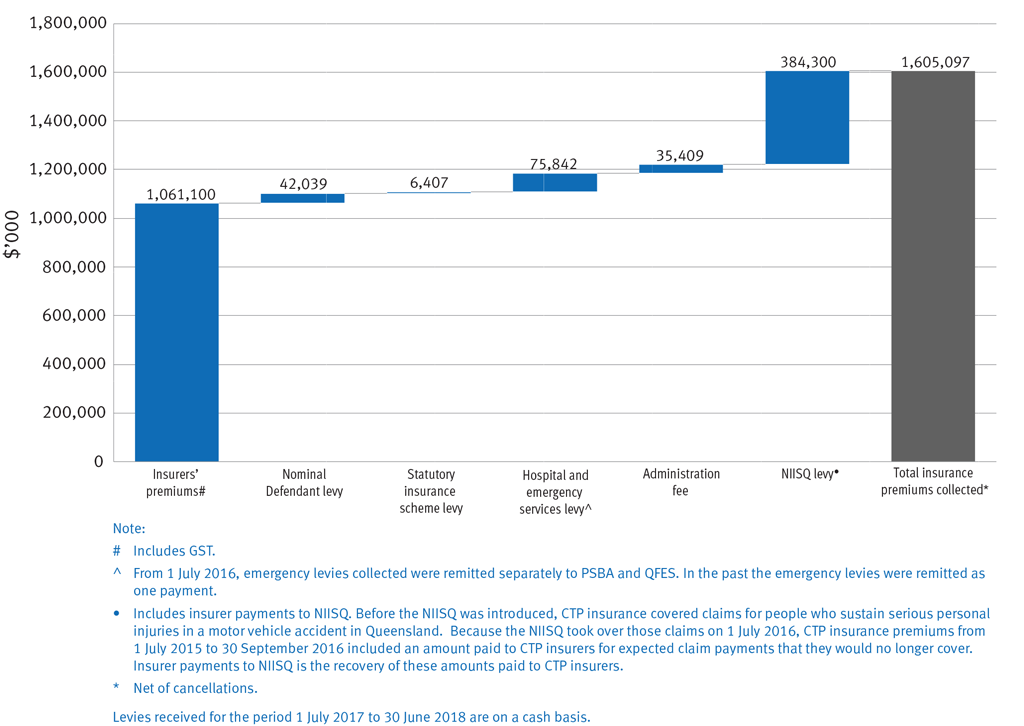

Levies and administration fee

Queensland’s CTP insurance premium contains levies and an administration fee to help cover the costs involved in delivering different components of the CTP insurance scheme. The levies and administration fee are calculated annually and include the statutory insurance scheme levy, Nominal Defendant levy, hospital and emergency services levy, National Injury Insurance Scheme Queensland levy and an administration fee.

Statutory insurance scheme levy

The statutory insurance scheme levy covers the estimated operating costs of administering the MAI Act and also provides funding for research into accident prevention and injury mitigation. From 1 July 2017, the levy remained unchanged at $1.50 per policy and the levy collected $6.4 million in 2017-18. From 1 July 2018, the levy remains unchanged.

Nominal Defendant levy

The Nominal Defendant levy, which varies by vehicle class, covers the estimated costs of the Nominal Defendant scheme which provides funds to pay for claims relating to uninsured or unidentified vehicles. The levy is set having regard to an actuarial assessment of claim trends. From 1 July 2017, the levy for Class 1 vehicles was $10.00 with $42 million collected in 2017-18. The Nominal Defendant levy will be reduced to $9.00 for a Class 1 vehicle in the 2018-19 period.

Hospital and emergency services levy

The hospital and emergency services levy is designed to cover a reasonable proportion of the estimated cost of providing public hospital and public emergency services to people who are injured in motor vehicle crashes, who use such services and who are claimants or potential claimants under the CTP insurance scheme. The levy amount calculated varies by vehicle class. The hospital and emergency services levy was reduced in 2017-18 to $18.00 for Class 1 vehicles. Proceeds from this levy are then apportioned to Queensland Health, Queensland Fire and Emergency Services, and the Public Safety Business Agency. In the year 2017-18, $75.8 million was collected.

National Injury Insurance Scheme levy

The National Injury Insurance Scheme levy, which varies by vehicle class, covers the estimated costs of the NIISQ which provides necessary and reasonable lifetime treatment, care and support for anyone who sustains a serious personal injury in a motor vehicle accident in Queensland. The National Injury Insurance Scheme levy remained unchanged at $85.00 for a Class 1 vehicle in 2017-18 and collected $384.3 million. From 1 July 2018, the NIISQ Levy will rise to $88.20 for a Class 1 vehicle.

Administration fee

The administration fee is paid to the Department of Transport and Main Roads for delivering administrative support to the CTP insurance scheme. From 1 July 2017, the fee remained unchanged at $7.50 per policy. In the year 2017-18, $35.4 million was collected. From 1 July 2018, the fee will remain unchanged at $7.50 per policy.