Introduction

Read our annual report to learn how we continued to improve Queensland’s CTP insurance scheme in the 2018-19 financial year.

See how we’ve met the annual report requirements for Queensland Government agencies and statutory bodies.

MAIC Annual Report 2018-19

( pdf 2.13 Mb )Accessibility and copyright

Print: ISSN:1837-1450

Online: ISSN: 1837-1469

The Queensland Government is committed to providing accessible services to Queenslanders from all culturally and linguistically diverse backgrounds. If you have difficulty in understanding the annual report, you can contact us on the enquiries line 1800 CTP QLD (1800 287 753) and we will arrange an interpreter to effectively communicate the report to you.

Motor Accident Insurance Commission

GPO Box 2203, Brisbane QLD 4001

Phone: 1800 CTP QLD (1800 287 753)

Email: maic@maic.qld.gov.au

Web: www.maic.qld.gov.au

Twitter: @MAICQld

Facebook: @MAICQld

Nominal Defendant

GPO Box 2203, Brisbane QLD 4001

Phone: 07 3035 6321

Email: nd@maic.qld.gov.au

Web: www.maic.qld.gov.au/nominal-defendant

Visit www.maic.qld.gov.au to view this annual report. Copies of the report are also available in paper format. To request a copy, please contact us using the details above.

© Motor Accident Insurance Commission 2019

Licence: This annual report is licensed by the State of Queensland under a Creative Commons (CC BY) 4.0 International licence.

CC BY Licence Summary Statement: In essence, you are free to copy, communicate and adapt this annual report, as long as you attribute the work to the Motor Accident Insurance Commission. To view a copy of this licence, visit: http://creativecommons.org/licenses/by/4.0/.

Attribution: Content from this annual report should be attributed as: The Motor Accident Insurance Commission Annual Report 2018-19.

Letter of compliance and certification of financial statements

30 August 2019

The Honourable Jackie Trad MP

Deputy Premier, Treasurer and Minister for Aboriginal and Torres Strait Islander Partnerships

GPO Box 611

BRISBANE QLD 4001

Dear Deputy Premier

I am pleased to submit for presentation to the Parliament the Annual Report 2018-19 and financial statements for the Motor Accident Insurance Commission and the Nominal Defendant.

I certify that this Annual Report complies with:

- the prescribed requirements of the Financial Accountability Act 2009, the Financial and Performance Management Standard 2009, the Motor Accident Insurance Act 1994 and the National Injury Insurance Scheme (Queensland) Act 2016, and

- the detailed requirements set out in the Annual report requirements for Queensland Government agencies.

A checklist outlining the annual reporting requirements can be accessed online.

Yours sincerely

Neil Singleton

Insurance Commissioner

About us

Queensland’s Compulsory Third Party insurance scheme

Queensland’s Compulsory Third Party (CTP) insurance scheme is governed by the Motor Accident Insurance Act 1994 (MAI Act).

The scheme protects motor vehicle owners, drivers and passengers from being held financially responsible if they injure someone in a motor vehicle accident. It also enables the injured person to claim fair and timely compensation for their injuries and access prompt and reasonable medical treatment and rehabilitation.

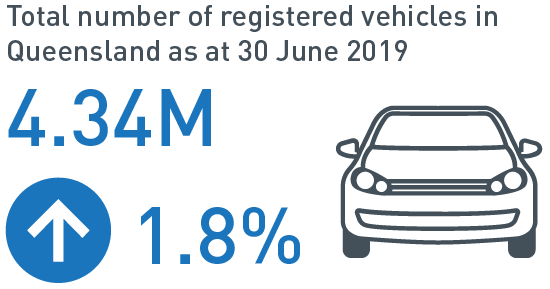

Motor vehicle owners pay their CTP insurance premium when they pay their vehicle registration through the Department of Transport and Main Roads (DTMR). DTMR remits the applicable premium to the licensed CTP insurer nominated by the motor vehicle owner. This minimises administration costs, is convenient for motorists and reduces the incidence of uninsured vehicles.

Motor Accident Insurance Commission

The Motor Accident Insurance Commission (MAIC) regulates Queensland’s CTP insurance scheme.

This involves a number of important functions:

- licensing and supervising CTP insurers and monitoring their compliance

- keeping the statutory insurance scheme under review and making recommendations for its amendment

- fixing the range within which each insurer must file their premium and recommending to government the levies payable

- contributing funds towards research and education to reduce the number of motor vehicle crashes and facilitate rehabilitation of injured people

- developing and maintaining a claims register and statistical database for the purpose of providing management information

- administering the Nominal Defendant.

The Nominal Defendant (ND) acts as a licensed insurer in the CTP insurance scheme for claims that involve motor vehicles that are unidentified or uninsured. It also meets the claims costs associated with licensed insurers that become insolvent.

Queensland’s CTP insurance scheme is complemented by the National Injury Insurance Scheme Queensland (NIISQ) which was established on 1 July 2016. NIISQ provides necessary and reasonable lifetime treatment, care and support to people who sustain eligible serious personal injuries in motor vehicle accidents on Queensland roads, regardless of who was at fault. MAIC also has a legislative function pursuant to Chapter 5 of the National Injury Insurance Scheme (Queensland) Act 2016 (NIISQ Act) to monitor the efficiency and effectiveness of the National Injury Insurance Agency, Queensland which administers NIISQ.

MAIC has been located in Brisbane since it commenced operations on 1 September 1994 and is located at 1 William Street. MAIC and the Nominal Defendant are positioned within the Risk and Intelligence Division of Queensland Treasury.

Our aspiration

We aspire to ensure Queensland benefits from the best CTP insurance scheme in Australia by delivering:

- financial protection for motorists

- recovery for claimants

- opportunity for service providers

- economic growth and skills building in the community.

Our purpose

Our role is to:

- regulate and improve Queensland’s CTP insurance scheme

- monitor and make recommendations on the NIISQ

- manage the Motor Accident Insurance and Nominal Defendant funds for the benefit of the Queensland community.

Our objectives

We aim to:

- deliver a financially sound, contemporary CTP insurance scheme

- strengthen insurer supervision and compliance

- develop and promote best practice claims management

- turn scheme information and insights into actions and outcomes

- create a positive workplace environment where our people are engaged, committed and highly capable.

To support Our Future State: Advancing Queensland’s Priorities we also

- keep communities safe by investing in road safety initiatives to reduce the frequency of motor vehicle accidents and minimise their impact on the community

- keep Queenslanders healthy by investing in targeted research and service delivery initiatives to improve health outcomes for people injured in motor vehicle crashes.

Our strategic opportunities

We have the unique opportunity to:

- harness and support broader technological or innovative changes in road safety, trauma injury management and claims management systems and processes

- actively reduce the incidence and severity of road trauma through strategic partnerships with DTMR and the Queensland Police Service, along with investing in grants, sponsorships and research initiatives

- continually seek ways to improve MAIC

- continue to investigate regulatory changes required to introduce automated vehicles into the Australian market by 2020

- explore opportunities for MAIC and the CTP insurance scheme to manage future innovation and disruption

- strengthen supervision and regulation of insurers to mitigate potential fraud and car crash scamming (also known as claim farming).

Our strategic challenges

We meet the challenges of:

- emerging unethical practices

- insurer non-compliance

- maintaining premium affordability

- evolving community expectations

- emerging technological innovations.

Our success measures

We measure our success with:

- strong scheme performance and claimant benefits balanced against affordable premiums

- motorist and claimant awareness and satisfaction

- effective MAIC and ND operations and sound financial management

- a robust insurer supervision regime

- a capable and well-respected team.

Insurance Commissioner report

I am pleased to report that Queensland road users continue to benefit from what is arguably the fairest and most affordable CTP insurance scheme in Australia.

- Premiums remain affordable for motorists.

- Claims are being resolved faster; with low instances of litigation, fraud or complaints.

- More of the CTP insurance premium is going towards claimant benefits.

- Fewer people are being seriously injured on Queensland roads.

The priority for MAIC continues to be stamping out car crash scamming (also known as ‘claim farming’ in the insurance industry). Car crash scamming is a blight on the scheme and on the broader community. The Deputy Premier introduced the Motor Accident Insurance and Other Legislation Amendment Bill 2019 into Parliament on 14 June 2019 to combat these scammers. The reforms have received widespread support from industry stakeholders and positive feedback from the Queensland community.

During the year, we developed increased capability and sophistication in data analytics which will help to reduce the incidence and effects of road trauma. This capability will also be applied to scheme monitoring and ongoing fraud deterrence. This is critical in delivering an effective and affordable scheme for Queensland.

We are proud to be the inaugural sponsor of the Associate Professor Clifford Pollard AM Trauma Fellowship which will be established within the Royal Brisbane and Women’s Hospital Trauma Service. The fellowship recognises Cliff’s significant contribution to road safety and trauma management in Queensland over many years. We hope that the fellowship will enable gifted clinicians to further sustain and grow Cliff’s tremendous legacy.

We are also pleased to support initiatives aimed at reducing the incidence and effects of road trauma in Queensland. This includes supporting Queensland Road Safety Week and delivering the ‘Be a Mate, Don’t Tailgate’ campaign, and a partnership with RACQ motoring club to deter distracted driving. These campaigns offer practical solutions to motorists to improve their own safety and the safety of others on the roads. Full details of the range of initiatives being supported are detailed within the report.

The Nominal Defendant continues to lead by example in excellent claims management. A sustained focus on continuous improvement enabled the Nominal Defendant levy to be reduced again in 2019-20. MAIC has also been able to deliver increased services at no additional cost to motorists.

In the year ahead, our focus will remain on the implementation of the car crash scammer reforms. We will also explore opportunities for innovation in the scheme to better meet the needs of Queenslanders injured in motor vehicle crashes and keeping premiums affordable to motorists.

I thank the staff at MAIC and the Nominal Defendant for their tireless work, and thank our stakeholders for their ongoing support. Together we are well-placed to ensure that Queensland benefits from the best CTP insurance scheme in Australia.

Neil Singleton

Insurance Commissioner

Year in review

Report card

| Highlights | Performance indicators | Notes | Target | Outcome |

|---|---|---|---|---|

| Objective | 1. Deliver a financially sound, contemporary CTP insurance scheme | |||

Maintain an affordable and efficient scheme for Queenslanders |

Highest filed CTP premium for Class 1 vehicles (cars and station wagons) as a percentage of average weekly earnings |

<45% | 22% | |

Premium bands and levies set within legislative timeframes |

100% | 100% | ||

Premium bands set at a level to ensure scheme viability |

100% | 100% | ||

| Objective | 2. Strengthen insurer supervision and compliance | |||

Embed a dynamic insurer supervision regime |

Development and implementation of an agile supervision regime |

Achieved | Achieved | |

Insurer supervision capability established and communication channels developed |

Achieved | Achieved | ||

Structured audit processes in place and continued building of audit capability |

Achieved | Achieved | ||

| Objective | 3. Develop and promote best practice claims management | |||

Focus on the prevention of the unethical practices, including car crash scamming and fraud |

Public awareness campaign delivered to encourage Queenslanders to hang up on car crash scammers and report them to MAIC |

Achieved | Achieved | |

Legislation responding to car crash scamming reform introduced into parliament |

Achieved | Achieved | ||

Percentage of Nominal Defendant managed claims finalised compared to the number outstanding at the start of the financial year. (See note 1) |

50% | 87% | ||

Nominal Defendant to lead by example |

Percentage of Nominal Defendant claims settled within two years of compliance date. (See note 2) |

50% | 69% | |

Percentage of Nominal Defendant claims with General Damages paid within 60 days of the settlement date |

95% | 96% | ||

| Objective | 4. Turn scheme information and insights into actions and outcomes | |||

Improve data analytics capability |

Analytics resources and capabilities enhanced |

Achieved | Achieved | |

Increased decision-making informed by data insights |

Achieved | Achieved | ||

| Objective | 5. Create a positive workplace environment where our people are engaged, committed and highly capable | |||

Ensure our people have the tools and skills required to fulfil their roles competently |

Percentage of staff who reported that they were able to access relevant training opportunities |

70% | 73% | |

Focus on quality, innovation and improvement |

MAIC mentoring program completed by the first cohort of emerging leaders |

Achieved | Achieved | |

Increased staff engagement via an online engagement tool |

Achieved | Achieved | ||

Nominal Defendant claims management system changes successfully implemented to specifications |

Achieved | Achieved | ||

1 Favourable variance is due to higher than anticipated number of claims being finalised.

2 Claims can take two to three years to settle; consequently, it is difficult to estimate the number of claims that will be finalised in any given period.

Levies and administration fee

Queensland’s CTP insurance premium contains levies and an administration fee to help cover the costs involved in delivering different components of the CTP insurance scheme. These levies and administration fee are calculated annually and include the statutory insurance scheme levy, the Nominal Defendant levy, the hospital and emergency services levy, the National Injury Insurance Scheme, Queensland levy and an administration fee. In setting these levies, advice is sought from the receiving agencies, and the State Actuary’s Office.

Statutory insurance scheme levy

The statutory insurance scheme levy covers the estimated operating costs of administering the MAI Act and also provides funding for research into accident prevention and injury mitigation. From 1 July 2018, the levy remained unchanged at $1.50 per policy and the levy collected $6.5 million in 2018-19. From 1 July 2019, the levy remains unchanged.

Nominal Defendant levy

The Nominal Defendant levy, which varies by vehicle class, covers the estimated costs of the Nominal Defendant scheme which provides funds to pay for claims relating to uninsured or unidentified vehicles. The levy is set having regard to an actuarial assessment of claim trends. From 1 July 2018, the levy for Class 1 vehicles was $9.00 with $38.7 million collected in 2018-19. From 1 July 2019, the Nominal Defendant levy will be reduced to $8.50 for a Class 1 vehicle.

Hospital and emergency services levy

The hospital and emergency services levy is designed to cover a reasonable proportion of the estimated cost of providing public hospital and public emergency services to people who are injured in motor vehicle crashes, who use such services and who are claimants or potential claimants under the CTP insurance scheme. The levy amount calculated varies by vehicle class. From 1 July 2018 the hospital and emergency services levy remained at $18.00 for a Class 1 vehicle. Proceeds from this levy are then apportioned to Queensland Health and the Department of Community Safety. Collecting the levy in this way removes the need for hospitals and emergency services to issue invoices to CTP insurers for each treatment provided to victims of road crashes. This saves significant administration burden for service providers and licensed CTP insurers. In the year 2018-19, $77.3 million was collected. From 1 July 2019, the levy will increase marginally to $18.30 for Class 1 vehicles.

National Injury Insurance Scheme, Queensland levy

The National Injury Insurance Scheme, Queensland levy (NIISQ levy), which varies by vehicle class, covers the estimated costs of the NIISQ which provides necessary and reasonable lifetime treatment, care and support for anyone who sustains a serious personal injury in a motor vehicle accident in Queensland. The NIISQ levy was $88.20 for a Class 1 vehicle in 2018 -19 and collected $403.5 million. From 1 July 2019, the NIISQ levy will rise to $90.50 for a Class 1 vehicle.

Administration fee

The administration fee is the fee payable to DTMR for delivering administrative support for the CTP insurance scheme. The administration fee was $7.50 for a Class 1 vehicle in 2018-19, and $36.2 million was collected. From 1 July 2019, the fee will increase to $8.40 per policy after two years of no increase.

Achievements

Combating car crash scammers

An estimated 1.5 million Queenslanders have been contacted by a car crash scammer.

Car crash scammers contact unsuspecting people via phone or social media and pressure them into making a CTP insurance claim.

These scammers pretend that they represent MAIC or another organisation to obtain personal information, which they sell on to law firms for a profit.

They have been known to use aggressive tactics and target vulnerable people such as children and older Queenslanders.

As directed by the Deputy Premier, we took firm action to address this insidious practice. Our efforts have included:

Public awareness campaign

- Showed millions of Queenslanders how to protect themselves from car crash scammers

- Doubled the number of scammers reported to us during the eight-week campaign

Stakeholder consultation

- Developed solutions with stakeholders to eliminate car crash scamming and fraud from operating in our scheme

Legislative reform

- Developed changes to the Motor Accident Insurance Act 1994 that will prohibit car crash scamming in our scheme

- Introduced legislative changes into Queensland Parliament in June 2019

These efforts will protect Queenslanders from car crash scammers, keep our CTP insurance scheme affordable, and continue to support people who have genuinely been injured in a motor vehicle crash through no fault of their own. Find out more at maic.qld.gov.au/hangup.

Nominal Defendant continues its positive trajectory

The Nominal Defendant continues to deliver important protection for Queensland road users who may be injured by an unidentified or uninsured vehicle. Nominal Defendant claims require a particularly stringent approach to claim management, especially where the involvement of an unidentified vehicle is alleged. A recent external review by Finity Consultants highlighted the significant improvements made to the Nominal Defendant – especially with respect to claims management practices. As the Nominal Defendant receives its funding for the payment of claims from a levy paid by Queensland motorists, this work is vital in ensuring that the Nominal Defendant is well placed to be able to continue delivering this important service. Over the past decade, the Nominal Defendant levy has remained stable or decreased.

Preparing for automated vehicles

Connected and highly automated vehicles are now being trialled for use on Queensland roads. As this technology evolves, we need to ensure that the Queensland CTP insurance scheme adapts to meet the needs of our community.

This includes Queenslanders who plan to own or use an automated vehicle and those who are unfortunately injured by one. We meet regularly with other regulators and managers of CTP insurance schemes in Australia, guided by the key principles that no one should be worse off if they are injured by an automated vehicle than if they were injured by a non-automated vehicle – either in terms of the compensation they receive or the process of making a CTP claim. We remain committed to keeping Queensland CTP insurance premiums affordable for all motorists.

In December 2018, MAIC made a submission in response to the National Transport Commission’s (NTC’s) Motor Accident Injury Insurance and Automated Vehicles discussion paper. In developing this response, MAIC consulted widely with Queensland Government agencies.

MAIC continues to work alongside the CTP insurance working group and the NTC to facilitate the introduction of automated vehicles. MAIC also attends regular intragovernmental discussions and contributes to submissions to the NTC by other Queensland Government agencies regarding highly automated vehicles.

NIISQ is making lives better

The National Injury Insurance Agency, Queensland (NIISQ Agency) coordinates and funds necessary and reasonable lifetime treatment, care and support for people who sustain an eligible serious personal injury in a motor accident in Queensland, on or after 1 July 2016.

The NIISQ Agency administers the National Injury Insurance Scheme, Queensland (NIISQ) and performs other key functions as listed in the National Injury Insurance Scheme (Queensland) Act 2016. The Insurance Commissioner guided the establishment of the NIISQ Agency from its inception on 1 July 2016 until the end of 2018.

The cost of administering NIISQ during 2018-19 was $812.357 million including a provision for future participants’ lifetime treatment, care and support services expenses of $779.541 million. To learn more, view the NIISQ Agency’s annual report at niis.qld.gov.au.

During the 2018-19 period, the NIISQ Agency Board appointed Chief Executive Officer, Sally Noonan to continue the efficient and effective administration and operation of the NIISQ Agency independent of the Motor Accident Insurance Commission.

During the 2018-19 period, NIISQ accepted its first lifetime participant. The significant health benefits of early treatment, care and support have meant that some interim participants have exited NIISQ. As at 30 June 2019, NIISQ is funding treatment, care and support to 186 interim and lifetime participants, predominately people living with traumatic brain injuries, spinal cord injuries and amputations.

We look forward to the NIISQ Agency evolving and delivering on its vision of making lives better. Further information can be found in the NIISQ Agency Annual Report at niis.qld.gov.au.

Investing in road safety and rehabilitation

We support research and education activities that contribute to an effective CTP insurance scheme. This investment ranges from initiatives focused on decreasing the number of road crashes that occur, through to providing appropriate rehabilitation and disability support. Learn more about the initiatives we support below.

For a complete list of the initiatives that we support, view the Appendices.

Governance

Our people

We strive to create a positive workplace environment where our people are engaged, committed and highly capable. Our dedicated and focused team is committed to ensuring that Queensland’s CTP insurance scheme protects motorists and supports people who are injured in motor vehicle crashes.

We rely on the commitment and capabilities of our staff to achieve sound scheme outcomes. In 2018- 19, to counter risks such as car crash scamming, fraud, and issues relating to insurer monitoring, we invested in staff development focused on:

- building resilience in Nominal Defendant staff whose work involves complex claims where decisions affect the day-to-day lives of people

- developing legislative responses to mitigate risk

- effective leadership of programs and support of staff

- embracing innovation and change.

We further support our staff through active recruitment and selection strategies, strong employee performance management and development programs, regular staff check-ins through the Working for Queensland survey and other pulse surveys, and workplace health and safety strategies.

During the year, staff participated in the Working for Queensland survey. Staff engagement measures from the survey showed increased levels of safety, health and wellness. The health and wellbeing of our staff is essential, so we emphasise the importance of an appropriate work-life balance.

We meet our obligations under the Public Service Ethics Act 1994 by ensuring that MAIC and ND staff complete Treasury’s suite of online training modules, including modules related to the Code of Conduct. The online training package is rolled out to all new staff. This year the induction manual was reviewed and improved.

MAIC staff expenses and key executive management personnel and remuneration information can be found in the Financial Information (page 38 for MAIC, and page 63 for the Nominal Defendant). To see MAIC’s workforce profile, including full-time equivalent (FTE) staff and permanent separation rate, view the annual report of Queensland Treasury.

Our values

Our leadership team

The Insurance Commissioner sets the direction for MAIC and the Nominal Defendant and reports to the State Parliament through the Deputy Premier, Treasurer and Minister for Aboriginal and Torres Strait Islander Partnerships. Our leadership team includes the Insurance Commissioner; General Manager Motor Accident Insurance Commission; Director Finance, Procurement and Systems; Director Policy, Performance and Improvement; and Director Analytics. Our leadership team is responsible for setting the strategic direction of MAIC and the Nominal Defendant, overseeing operational performance, determining operation policy and project management. The leadership team supports the Insurance Commissioner, as the accountable officer, to meet legislative requirements and accountabilities and the identification and management of key areas of risk. This year saw the inclusion of a Director Analytics strengthening our ability to make decisions informed by data analysis insights; and the departure of Kylie Horton, General Manager of the Motor Accident Insurance Commission. Kylie was appointed to MAIC in 2012 and was a valued member of the leadership team.

As at 30 June 2019, membership of the leadership team included:

Neil Singleton

Insurance Commissioner

B. Business (Insurance), MBA

Neil was appointed as Insurance Commissioner in December 2010. Neil has over 30 years of insurance experience across a broad range of management and executive positions. Neil’s responsibilities include providing strong strategic leadership to ensure a viable, affordable and equitable CTP insurance scheme in Queensland.

David Vincent

Acting General Manager

Motor Accident Insurance Commission

David has over 25 years’ insurance experience including roles in personal injury claims management and underwriting, along with positions involving insurance regulation and government policy development. David worked in MAIC from 2002 to 2008 and recently returned as the Acting General Manager. David is responsible for leading the strategic management of the Nominal Defendant claims unit, the supervision of licensed insurer claims management compliance and performance and managing claims related legislative functions.

Lina Lee

Director Finance, Procurement and Systems

B. Commerce, CA

Appointed to MAIC in 2006, Lina oversees the financial management and procurement of MAIC and oversight of the IT system roadmap for the organisation. Lina has an accounting and auditing background covering the chartered profession, commerce, industry and the Queensland public sector.

Vicki Vanderent

Director Policy, Performance and Improvement

B. Business, MBA

Appointed to MAIC in 2006, Vicki is responsible for strategic and business planning, organisational reporting, policy, business improvement, communication, capability development and business support. Prior to working for MAIC, Vicki held various marketing and communication roles across Government, university and the private sector.

Youyou Luo

Director Analytics

B. Actuarial Studies, PhD (Finance)

Appointed to MAIC in 2018, Youyou is responsible for leading Insurance Commission’s data analytics, premiums and levies advice, business intelligence and scheme reporting functions. Youyou has a research background and over 10 years of public sector experience in data analytics and business intelligence across several government organisations.

Risk management

We are committed to effective risk management and have adopted Treasury’s framework for proactively identifying, assessing and managing risks. Our risk management approach ensures:

- we meet our statutory responsibilities under the MAI Act, the NIISQ Act and other legislation

- risk management is integrated into organisational activity

- corporate governance processes, including systems of internal control, are assessed and enhanced.

Everyone in Treasury is responsible for managing risk. A robust risk management framework is integrated into all Treasury business activities and systems; and our leadership team is accountable for risks that may affect our ability to achieve our strategic objectives. Risks are managed through our corporate governance framework providing the foundation for effective decision-making, sound management and clear accountability.

A risk register is maintained and reviewed by the leadership team on a quarterly basis. Risks are monitored with risk controls and treatment strategies assigned to each risk. Treasury’s Executive Leadership Team reviews the MAIC risk register from a consolidated Treasury perspective and MAIC has external auditors review the register annually. Our commitment to business continuity management ensures continuity of key business services which are essential for or contribute to the achievement of our objectives.

We participate in Treasury-wide risk and accountability management through representation on the Audit and Risk Management Committee. We also have an active Internal Audit program in place provided by the Treasury Internal Audit function.

Audit and Risk Management Committee

Our Insurance Commissioner, Neil Singleton, is a representative on Treasury’s Audit and Risk Management Committee.

The Audit and Risk Management Committee helps Under Treasurer Frankie Carroll to meet his responsibilities under the Financial Accountability Act 2009, the Financial and Performance Management Standard 2009 and other prescribed requirements. It does this by carrying out a range of activities to maintain oversight of key financial, risk and performance management activities for our organisation, including:

- financial statements – reviewing the appropriateness of Treasury’s accounting policies and financial performance

- risk management – reviewing the effectiveness of our risk management framework, including processes for identifying, monitoring and managing significant business risks

- integrity oversight and misconduct prevention – monitoring any misconduct trends and prevention approaches and highlighting any issues or areas for improvement with management

- internal control – reviewing, with the assistance of internal and external audit functions, the adequacy of internal controls, including IT security

- internal and external audit – reviewing and approving Treasury’s Internal Audit Plan; consulting with External Audit on the proposed audit strategy; and considering audit findings and recommendations to ensure key risks are considered and mitigated.

The committee also performs oversight functions for select related entities who sit within Treasury’s broader portfolio but prepare independent financial statements. In 2018–19, these entities were the Motor Accident Insurance Commission and the Nominal Defendant. Through participation in this forum, the Insurance Commissioner accesses advice and assurance on the performance or discharge of functions and duties prescribed in the Financial Accountability Act 2009, the Financial and Performance Management Standard 2009, and other prescribed requirements.

2018–19 Audit and Risk Management Committee membership (as of June 2019)

Chair:

Executive General Manager, Risk and Intelligence

Members:

Deputy Under Treasurer, Economics and Fiscal Coordination

Insurance Commissioner

Commissioner, Office of State Revenue

Don Licastro – independent member

Standing invitations:

Under Treasurer

Chief Finance Officer

Queensland Audit Office (QAO)

Internal Audit

Achievements in 2018–19

In 2018–19, the committee met five times and fulfilled its responsibilities in accordance with its charter and an approved work plan, which included:

- reviewing the 2017–18 Financial Statements for Queensland Treasury, Motor Accident Insurance Commission and Nominal Defendant

- reviewing outcomes of the 2018–19 Internal Audit activity and endorsement of 2019–20 Internal Audit Plan

- considering issues raised by QAO including recommendations from performance audits

- considering Treasury-related QAO reports to Parliament

- monitoring progress of the implementation of internal audit recommendations.

Internal and external accountability

Our governance framework includes both internal and external accountability measures.

Treasury provides internal audit services to MAIC through an outsourced arrangement with PricewaterhouseCoopers (PwC). PwC provides an independent and objective internal audit service in accordance with our Internal Audit Charter and ethical standards. Although independent, Internal Audit regularly liaises with QAO to ensure appropriate assurance services are provided to Treasury. In 2018–19, Internal Audit delivered a program of work for Treasury’s three-year Internal Audit Plan (approved by the Audit and Risk Management Committee). This plan is aligned to our key risk areas, operations, and strategic objectives and draws on additional specialist expertise as needed.

Externally, MAIC and the Nominal Defendant are audited by QAO in accordance with the Financial Accountability Act 2009. MAIC and the Nominal Defendant have achieved unqualified audits since the Commission commenced operations in 1994.

More information on Treasury’s Audit and Risk Management framework including information about the committee are detailed in Queensland Treasury’s annual report.

Information systems and recordkeeping

In 2018-19, our commitment to prudent information systems and recordkeeping continued. We undertook an internal review to improve and increase business process efficiencies in records management. Our records are managed throughout their lifecycle and archiving and disposal is done in accordance with the General Retention and Disposal schedule and/or Treasury’s Retention and Disposal schedule (implementation version).

We continue to record the documents that come into the office by scanning them and saving them as soft copy files and then referring to materials electronically. All hard copies are filed and depending on the nature of the document, are either stored securely at 1 William Street, or sent to secure off-site storage able to be retrieved at any time.

Our recordkeeping framework aligns with Treasury’s Information Management Framework. The framework aims to ensure our record management practices are consistent with other offices within the Treasury portfolio and are compliant with current legislation and best practice record keeping standards. These include Public Records Act 2002, Information Privacy Act 2009, Right to Information Act 2009, Information Standard 18: Information Security, Information Standard 31: Retention and Disposal of Government Information, Information Standard 34: Metadata, Information Standard 38: Use of ICT Facilities and Devices and Information Standard 40: Recordkeeping.

We support the Queensland Government Open Data Initiative. In 2018-19, we released 15 datasets including CTP insurance scheme statistical data and annual report data. Our Open Data sets are available at data.qld.gov.au/dataset/compulsory- third-party-ctp-statistics