Introduction

Read our annual report to learn how we continued to improve Queensland’s CTP insurance scheme in the 2021-22 financial year.

See how we’ve met the annual report requirements for Queensland Government agencies and statutory bodies.

MAIC Annual Report 2021-22

( pdf 2.18 Mb )Accessibility and copyright

Print: ISSN:1837-1450

Online: ISSN: 1837-1469

The Queensland Government is committed to providing accessible services to Queenslanders from all culturally and linguistically diverse backgrounds. If you have difficulty in understanding the annual report, you can contact us on the enquiries line 1800 CTP QLD (1800 287 753) and we will arrange an interpreter to effectively communicate the report to you.

Motor Accident Insurance Commission

GPO Box 2203, Brisbane QLD 4001

Phone: 1800 CTP QLD (1800 287 753)

Email: maic@maic.qld.gov.au

Web: www.maic.qld.gov.au

Nominal Defendant

GPO Box 2203, Brisbane QLD 4001

Phone: 07 3035 6321

Email: nd@maic.qld.gov.au

Web: www.maic.qld.gov.au/nominal-defendant

Visit www.maic.qld.gov.au to view this annual report. Copies of the report are also available in paper format. To request a copy, please contact us using the details above.

© Motor Accident Insurance Commission 2022

Licence: This annual report is licensed by the State of Queensland under a Creative Commons (CC BY) 4.0 International licence.

CC BY Licence Summary Statement: In essence, you are free to copy, communicate and adapt this annual report, as long as you attribute the work to the Motor Accident Insurance Commission. To view a copy of this licence, visit: http://creativecommons.org/licenses/by/4.0/.

Attribution: Content from this annual report should be attributed as: The Motor Accident Insurance Commission Annual Report 2021-22.

Letter of compliance and certification of financial statements

2 September 2022

The Honourable Cameron Dick MP

Treasurer and Minister for Trade and Investment GPO Box 611

BRISBANE QLD 4001

Dear Treasurer

I am pleased to submit for presentation to the Parliament the Annual Report 2021–22 and financial statements for the Motor Accident Insurance Commission and the Nominal Defendant.

I certify that this Annual Report complies with:

- the prescribed requirements of the Financial Accountability Act 2009, the Financial and Performance Management Standard 2019, the Motor Accident Insurance Act 1994 and the National Injury Insurance Scheme (Queensland) Act 2016

- the detailed requirements set out in the Annual report requirements for Queensland Government agencies.

A checklist outlining the annual reporting requirements can be accessed online.

Yours sincerely,

Neil Singleton

Insurance Commissioner

About us

Queensland Compulsory Third Party insurance scheme

Queensland’s Compulsory Third Party (CTP) insurance scheme is governed by the Motor Accident Insurance Act 1994 (MAI Act).

The scheme protects motor vehicle owners, drivers and passengers from being held financially responsible if they injure someone in a motor vehicle accident. It also enables people who are injured to claim fair and timely compensation for their injuries and access prompt and reasonable medical treatment and rehabilitation.

Motor vehicle owners pay their CTP insurance premium when they pay their vehicle registration through the Department of Transport and Main Roads (DTMR). DTMR remits the applicable premium to the licensed CTP insurer nominated by the motor vehicle owner. This minimises administration costs, is convenient for motorists and reduces the incidence of uninsured vehicles.

Motor Accident Insurance Commission

The Motor Accident Insurance Commission (MAIC) regulates Queensland’s CTP insurance scheme.

This involves a number of important functions:

- licensing and supervising CTP insurers and monitoring their compliance

- establishing and revising standards about the proper management of claims

- keeping the statutory insurance scheme under review and making recommendations for its amendment

- developing and maintaining a claims register and statistical database for the purpose of providing management information

- fixing the range within which each insurer must file their premium and recommending to government the levies payable

- contributing funds towards research and education to reduce the number of motor vehicle crashes and facilitate rehabilitation of injured people

- maintaining a helpline service for motor vehicle owners and injured people

- administering the Nominal

The Nominal Defendant (ND) acts as a licensed insurer in the CTP insurance scheme for claims that involve motor vehicles that are unidentified or uninsured. It also meets the claims costs associated with licensed insurers that become insolvent.

Queensland’s CTP insurance scheme is complemented by the National Injury Insurance Scheme, Queensland (NIISQ) which was established on 1 July 2016. NIISQ provides necessary and reasonable lifetime treatment, care and support to people who sustain eligible serious personal injuries in motor vehicle accidents on Queensland roads, regardless of who was at fault. MAIC also has a legislative function pursuant to Chapter 5 of the National Injury Insurance Scheme (Queensland) Act 2016 (NIISQ Act) to monitor the efficiency and effectiveness of the National Injury Insurance Agency, Queensland (NIISQ Agency) which administers NIISQ.

On 2 June 2021, the Queensland Future Fund (Titles Registry) Act 2021 made changes to the governance arrangements of the NIISQ Agency, resulting in removal of the board and the appointment of the Insurance Commissioner as the new Chief Executive Officer responsible for management of the NIISQ Agency. In line with statutory requirements of the NIISQ Act, the NIISQ Agency is required to produce its own annual report, which can be viewed at niis.qld.gov.au.

MAIC has been located in Brisbane since it commenced operations on 1 September 1994 as a statutory body reporting to the Treasurer and is located at 275 George Street. MAIC and the Nominal Defendant are positioned within the Economics and Fiscal division of Queensland Treasury.

Our aspiration

We aspire to ensure Queensland benefits from the best CTP insurance scheme in Australia by delivering:

- affordable financial protection for motorists

- recovery for claimants

- opportunity for service providers

- economic growth and skills building in the community.

Our purpose

Our role is to:

- regulate and improve Queensland’s CTP insurance scheme

- monitor and make recommendations on the NIISQ

- manage the Motor Accident Insurance and Nominal Defendant funds for the benefit of the Queensland

Our objectives

We aim to:

- deliver a financially sound CTP insurance scheme

- strengthen insurer supervision and compliance

- develop and promote best practice claims management

- embed insights-enabled decision making that delivers value to motorists, claimants and the CTP insurance market

- create a positive, engaged community of internal and external stakeholders.

To support the Queensland Government’s objectives for the community, built around the Unite and Recover – Queensland’s Economic Recovery Plan, we also:

- back our frontline services in key areas such as health, education and community services through reasonable funding of road trauma related public services

- invest in skills by ensuring Queenslanders have the skills they need to find meaningful jobs through investing in driver licensing initiatives and back-to- work programs.

Our opportunities

We are exploring emerging technology resulting in:

- a reduction in road trauma

- simplified motorist processes

- simplified and digitally enabled claimant processes

- increased collaboration with stakeholders resulting in broader data sets and improved data analytics

- improved reporting capabilities leading to better monitoring, insights and decision making.

Our key risks

We focus on mitigating key risks:

- failure to identify and respond to unethical practices resulting in premium increases and poor claimant experiences

- failure to identify and respond to issues of non- compliance, damaging the integrity of the scheme

- scheme failure to respond to environmental or external shocks.

Our success measures

Our success is indicated by:

- premiums are affordable and respond to change through a robust quarterly premium setting process and dynamic stakeholder engagement

- improved performance across industry measured through industry adoption of audit recommendations

- claimant benefits are greater than scheme delivery costs

- engaged stakeholders measured through the delivery of insightful reports and positive stakeholder feedback

- responsive and targeted engagement to increase stakeholder awareness and understanding of CTP

Insurance Commissioner’s report

It is pleasing to report that Queensland’s CTP scheme remains fair and affordable, but MAIC remains alert to a range of challenges that have required close monitoring.

Several licensed insurers have raised increasing concerns about aspects of scheme experience and broader inflationary pressures. MAIC is monitoring these closely and responding appropriately however we are also concerned that while premiums remain affordable, motorists are not seeing the benefit of competition as each quarter all insurers continue to set their premiums at the maximum allowable level.

During the year MAIC commissioned independent research with over 200 claimants. The feedback was generally positive but also identified areas for improvement that MAIC is now actioning, notably – accessing early treatment and rehabilitation, speeding up access to compensation, improving understanding of the overall claim process, and

improving levels of customer service by insurers. The compensation regime itself is sound, the opportunities are focused on improving the processing of claims within that regime.

MAIC has also remained focused on delivering our key initiatives:

- exploring ways to improve First Peoples claim experience and road safety initiatives

- enhancing digital claim processes to help simplify and speed up overall claims processing

- investing in research and initiatives to reduce the incidence and effects of road trauma

- maintaining our strong focus on protecting the scheme against the insidious practices of claim

Over the coming year we will continue to progress these key activities as well as looking at delivering the next stage of the MAIC and Nominal Defendant innovation roadmap and identifying broader opportunities to improve scheme performance.

The MAIC and NIISQ teams are now co-located, representing an exciting step in helping us deliver the best of both opportunities under the banner ‘Walking Together’, especially where injured people have claims against both the CTP scheme and the NIISQ scheme.

My thanks to everyone at MAIC and the Nominal Defendant for their sustained commitment throughout the course of the year.

Neil Singleton

Insurance Commissioner

Report card

| Highlights | Performance indicators | Notes | Target | Outcome |

|---|---|---|---|---|

| Objective | 1. Deliver a financially sound CTP insurance scheme | |||

Maintain an affordable and efficient scheme for Queenslanders |

Highest annual CTP premium for Class 1 vehicles (cars and station wagons) as a percentage of average weekly earnings |

See Note 1 |

<45% | 21.4% |

Premium bands and levies set within legislative timeframes |

100% | 100% | ||

Premium bands set at a level to ensure scheme viability |

100% | |||

Deliver customer focused, digitally enabled services |

The Digital Innovation and Improvement program delivered significant claim portal usability improvements for insurers. |

Achieved | Achieved | |

| Objective | 2. Strengthen insurer supervision and compliance | |||

Embed a dynamic insurer supervision regime |

Delivered 21/22 schedule of audits and reviews |

Achieved | Achieved | |

Refined insurer compliance reporting processes and tools |

Achieved | Achieved | ||

Worked with insurers to improve PIR data quality |

Achieved | Achieved | ||

Soundness of prudential regime maintained |

Achieved | Achieved | ||

| Objective | 3. Develop and promote best practice claims management | |||

Focus on the prevention of unethical practices, through monitoring and investigating claim farming (car crash scamming) and fraud |

Worked with affiliated law firms to develop video-based fraud training packages to be rolled out 2022/23. |

Achieved | Achieved | |

Continued MAIC claim farming investigations and commenced proceedings |

Achieved | Achieved | ||

Encourage best practice claims management through the implementation of clear standards and guidelines for insurers |

Released updated guidelines and standards for CTP insurers relating to rehabilitation, reasonable and appropriate decision making, and contacting legally represented claimants. |

Achieved | Achieved | |

Percentage of Nominal Defendant managed claims finalised compared to the number outstanding at the start of the financial year |

50% | 54.8% | ||

Percentage of Nominal Defendant claims settled within two years of compliance date2 |

See Note 2 |

50% | 62.1% | |

Percentage of Nominal Defendant claims with general damages paid within 60 days of the settlement date |

95% | 95.3% | ||

| Objective | 4. Embed insights enabled decision making that delivers value to motorists, claimants and the CTP insurance market | |||

Continue to improve data analytics capability and use it to make informed decisions |

Continued evidence-based data shared through publication of quarterly and annual CTP Scheme Insights reports |

Achieved | Achieved | |

Improve stakeholder knowledge and timeliness in decision making by optimising existing PowerBI reports which meet their needs |

Achieved | Achieved | ||

Targeted investment on identified research and grants |

Continued to invest in research and grant priorities which deliver scheme benefits |

Achieved | Achieved | |

CARRS-Q contract was renewed for another three years at $3,750,000 |

Achieved | Achieved | ||

| Objective | 5. Create a positive engaged community of internal and external stakeholders | |||

Improve community understanding of CTP insurance |

Percentage of motorists who understand that CTP covers injuries caused from vehicle accidents |

New measure | 65% | |

Engaged with First Peoples’ health and community services providers and community members to improve understanding of CTP insurance |

Achieved | Achieved | ||

Provide a flexible, safe and respectful workplace where our people have the knowledge, tools and skills to fulfill their roles |

Percentage of staff who identified that training they completed improved their performance |

80% | 91% | |

Percentage of staff who were able to access relevant learning and development opportunities |

78% | 94% | ||

Continued to promote flexible work practices, support arrangements and other practices to help staff through pandemic and emergency situations |

Achieved | Achieved | ||

- The average Affordability Level for the 2021–22 financial year is 21.4%. The Affordability Level as at 30 June 2022 is 21.3%.

- Claims can take two to three years to settle; consequently, it is difficult to estimate the number of claims that will be finalised in any given period.

Levies and administration fee

Queensland’s CTP insurance premium contains levies and an administration fee to help cover the costs involved in delivering different components of the CTP insurance scheme.

These levies and administration fee are calculated annually and include:

- the statutory insurance scheme levy

- the Nominal Defendant levy

- the hospital and emergency services levy

- the National Injury Insurance Scheme, Queensland levy

- an administration

In setting these levies, advice is sought from the receiving agencies and the State Actuary’s Office.

Statutory insurance scheme levy

The statutory insurance scheme levy covers the estimated operating costs of administering the MAI Act and also provides funding for research into accident prevention and injury mitigation. From 1 July 2021, the levy remained unchanged at $1.50 per policy and the levy collected $7.1 million in 2021–22.

Nominal Defendant levy

The Nominal Defendant levy varies by vehicle class and covers the estimated costs of the Nominal Defendant scheme which provides funds to pay for claims relating to uninsured (unregistered) or unidentified vehicles. The levy is set having regard to an actuarial assessment of claim trends. From 1 July 2021, the levy for Class 1 vehicles remained unchanged at $8 with $36.4 million collected in 2021–22.

Hospital and emergency services levy

The hospital and emergency services levy covers a reasonable proportion of the estimated cost of providing public hospital and public emergency services to people who are injured in motor vehicle crashes, who use such services and who are claimants or potential claimants under the CTP insurance scheme. The levy amount calculated varies by vehicle class. From 1 July 2021, the hospital and emergency services levy increased by 25 cents to $18.40 for a Class 1 vehicle. The collected income from the levy for the financial year was $83.9 million of which $71.3 million was apportioned to Queensland Health, $2.8 million to Queensland Fire and Emergency Services (QFES) and $9.8 million was allocated to Queensland Police Service (QPS). Collecting the levy in this way removes the need for hospitals and emergency services to issue invoices to CTP insurers for each treatment provided to victims of road crashes. This saves significant administration burden for service providers and licensed CTP insurers.

National Injury Insurance Scheme, Queensland levy

The National Injury Insurance Scheme Queensland levy (NIISQ levy) varies by vehicle class and covers the estimated costs of the NIISQ which provides necessary and reasonable lifetime treatment, care and support to people who sustain eligible serious personal injuries in motor vehicle accidents in Queensland. The NIISQ levy increased to $103.30 for a Class 1 vehicle in 2021–22 and collected $508.3 million.

Administration fee

The administration fee is the fee payable to the Department of Transport and Main Roads for delivering administrative support for the CTP insurance scheme. The administration fee was $8.60 per policy in 2021–22 and collected $40.1 million.

Premium levy and fee collection

1 July 2021 to 30 June 2022

| Description | $ (‘000) |

| Total insurance premiums collected* | 1,753,421 |

| Nominal Defendant levy | -36,380 |

| Statutory insurance scheme levy | -7,099 |

| Hospital and emergency services levy^ | -83,863 |

| Administration fee (Transport fee) | -40,138 |

| NIISQ levy+ | -508,266 |

| Insurer’s premiums# | 1,077,675 |

Notes:

* Net of cancellations.

^ From 1 July 2016, emergency levies collected were remitted separately to relevant entities. In the past the emergency levies were remitted as one payment.

+ National Injury Insurance Scheme Queensland levy.

# Includes GST.

Levies received for the period 1 July 2021 to 30 June 2022 are on a cash basis.

Achievements

Combating car crash scammers

CTP scheme amendments were introduced in 2019 to proactively address the insidious practice of car crash scamming (also known as ‘claim farming’), where people are harassed and pressured into pursuing a CTP claim. Two years on, those reforms are continuing to prove effective.

Car crash scamming complaints from Queensland motorists have continued to trend down from more than 1,300 complaints in 2019, with 295 car crash scams being reported in 2021–22. Our team actively investigates these complaints and will prosecute where appropriate.

In an Australian first, on 19 May 2022 the MAIC commenced prosecution proceedings for various alleged claim farming offences.

We are committed to preserving the rights of genuinely injured people and the integrity of the Queensland CTP scheme, which is widely regarded as one of the most stable and affordable in the country.

Possible instances of car crash scamming activity is reported by a variety of stakeholders for MAIC investigation. Queenslanders can play their part by hanging up and reporting car crash scammers at maic.qld.gov.au/hangup.

Preparing for cooperative and automated vehicles

Cooperative and highly automated vehicles have been trialled for use on Queensland roads. We partnered with the Department of Transport and Main Roads and the Queensland University of Technology to implement and evaluate these cutting-edge technologies.

Australia’s largest public cooperative vehicle trial ran in Ipswich over 12 months and was completed in September 2021. 355 participants used their own vehicles, with specialised vehicle stations installed in each car. Communications with roadside infrastructure and cloud systems allowed the vehicle stations to deliver enhanced safety warnings to drivers via audio and visual alerts, such as an advanced red light warning. The data gathered has been the subject of robust study, confirming the expected safety benefits. Data across the eight safety cases tested showed adoption of this technology in all cars would yield a 20 per cent reduction in fatal and serious injuries.

A related initiative, the Cooperative and Highly Automated Driving Pilot, is trialling automated vehicles. A prototype highly automated vehicle, ZOE2, has been demonstrated on Queensland roads in Logan, Ipswich, and Bundaberg. 197 Queenslanders experienced a ride in ZOE2, in full self-driving mode. Testing automated vehicles in both urban and regional areas is imperative to ensure they can operate safely on our roads as adoption increases on Queensland’s road network.

Improving the experience of managing CTP insurance claims

Our focus on enhancing the claims experience for people lodging claims, their legal representatives, and industry stakeholders has continued to evolve. In 2021–22 we were able to work with stakeholders to understand their different needs when accessing claims information on our website and improve the user experience for those managing CTP insurance claims.

The Queensland CTP claim portal now allows each law firm to control the registration and access of their own staff members. Each law firm can register as a business in the QLD CTP claim portal and create their own internal workgroups. The new improvements allow the law firm to internally control the portal registration of their staff members and assign staff to appropriate workgroups, allowing members to view, edit and submit forms created in that workgroup.

This tool was co-designed with stakeholders embracing the latest technology to more easily and promptly guide people through their journey to recovery. Visit maic.qld.gov.au to learn more.

Improving outcomes for First Peoples

During 2021–22, we have continued to work towards our goal of ensuring the Queensland CTP scheme is safe, respectful and accessible to all people injured in motor vehicle accidents. We continue to consult with Elders, key stakeholders and community groups to build cultural and CTP scheme understanding and to improve our services for First Peoples.

This financial year we:

- attending a series of engagements and

meetings in Yuganbeh Country on the Gold Coast to build community awareness of how to access CTP insurance

- continuing to provide support for Griffith University to explore First Peoples and CTP insurance

- continuing to provide support towards Police Citizens and Youth Welfare Association (PCYC’s) pilot of ‘Changing Gears’, a First Peoples specific adaption of the ‘Braking the Cycle’ learner driver mentor This pilot will occur in Napranum and if successful will open up opportunities to potentially apply this program in other key remote and regional Queensland communities.

- continuing to distribute brochures and posters featuring artwork that brings the Queensland CTP insurance story to life to highlight the importance to drive safe and drive deadly. These free resources continue to be used by partners across Queensland to promote greater awareness of CTP insurance and to help First Peoples get strong again if they have been impacted by a car crash.

The free suite of First Peoples resources is available at maic.qld.gov.au/for-drivers/first-peoples-ctp.

Managing Nominal Defendant claims prudently

The Nominal Defendant continues to deliver important protection for Queensland road users who are injured by an unidentified or uninsured vehicle. Nominal Defendant claims require a particularly stringent approach to claims management, especially where the involvement of an unidentified vehicle is alleged. The Nominal Defendant has strived in support of MAIC to enhance the experience of claimants, and their legal representatives, throughout the claims experience. Members of the Nominal Defendant team have worked closely with the development of the online claim process. Sharing their comprehensive knowledge of the claims process as well as rehabilitation services, the Nominal Defendant is excited to be a part of this innovation that aims to improve customer experience. Over the past decade, the Nominal Defendant levy paid by all motorists has decreased or remained stable evidencing the efficiency of the Nominal Defendant Fund.

Monitoring the NIISQ

In accordance with our obligations under the National Injury Insurance Scheme (Queensland) Act 2016 we monitor the efficiency and effectiveness of the NIISQ Agency, Queensland which administers the NIISQ. The National Injury Insurance Agency, Queensland (NIISQ Agency) assesses, decides and funds necessary and reasonable lifetime treatment, care and support for people who sustain an eligible serious personal injury in a motor accident in Queensland, on or after 1 July 2016.

The cost of administering NIISQ during 2021–22 was $446.22 million. As at 30 June 2022, NIISQ has 441 interim and lifetime participants. Further information about NIISQ and NIISQ Agency’s operations can be found in the NIISQ Agency Annual Report.

Investing in road safety and rehabilitation

| Institution | Title |

| University of Sunshine Coast |

|

| Queensland University of Technology |

|

| Griffith University |

|

| Police Citizens and Youth Welfare Association |

|

| Queensland Trucking Association |

|

| Department of Transport and Main Roads |

|

| Transport New South Wales |

|

| Sunshine Coast Council |

|

| Gold Coast City Council |

|

Prevention of road crashes

We support a range of research and education activities contributing to an effective CTP insurance scheme. Investments range from targeting the prevention of road crashes to facilitate a corresponding reduction in claims, through to initiatives focused on improving the treatment, care and rehabilitation of those injured in road trauma.

During 2021–22, negotiations were concluded with Queensland University of Technology in relation to extending funding to the Centre for Accident Research and Road Safety Queensland (CARRS-Q). A three-year funding extension was provided from 1 January 2022 to allow this centre to continue its road safety research program. Established in 1996 as a joint initiative between MAIC and QUT, this funding extension will bring this collaboration to over 25 years. Recognised on an international scale, CARRS-Q has delivered the evidence base to support many important road safety policies in Queensland such as the introduction of alcohol interlocks, motorcycle training reforms, autonomous and cooperative vehicle technologies and commissioning of a driving simulator to facilitate important off-road research. We look forward to what this collaboration can continue to deliver over the next three years.

During this financial year, our project with Gold Coast City Council, which was focused on the piloting of a comprehensive traffic safety analysis platform to provide enhanced road safety insights, particularly around near misses, was successfully finalised. This pilot confirmed a number of areas for potential enhancement at the selected sites as a means of reducing crash risk. On the basis of this, Gold Coast City Council have recently committed to expanding use of this technology to a further 20 different locations within their jurisdiction. This will provide an additional information source for use in terms of future planning to mitigate crash risk and as a tool to influence road safety infrastructure investment.

We also continue to work closely with the Department of Transport and Main Roads and the Queensland Police Service as the lead government agencies for road safety on areas of mutual benefit. Active collaborations include the development of a new campaign focused on motorcycles, funding for targeted road safety enforcement and the expansion of automatic number plate recognition technologies to detect unregistered vehicles.

Maximising recovery

| Institution | Title |

| University of Queensland |

|

| Griffith University |

|

| Queensland University of Technology |

|

| Metro North Hospital and Health Service |

|

| Metro South Hospital and Health Service |

|

| Spinal Life Australia |

|

| Queensland Brain Institute |

|

| Children’s Health Foundation |

|

| Emergency Medicine Foundation |

|

| Bionics Queensland |

|

| Prince Charles Hospital Foundation |

|

The activities we supported in rehabilitation research reflect the spectrum of injuries that can result from road crashes, from musculoskeletal injuries through to severe and lifelong injuries including spinal cord and brain injuries. In addition, we fund research that focuses on improving healthcare from point of injury, through to emergency department, hospital care, and community-based rehabilitation services.

A highlight of this year was confirmation of recurrent funding for the Acquired Brain Injury Transitional Rehabilitation Service at the Princess Alexandra Hospital to become a permanently health funded statewide service. MAIC provided the initial five-year pilot funding to establish this service and allow a business case around its efficacy to be developed. Centered on maximising outcomes and increasing the level of independence for adults with brain injury, through targeted therapeutic support post hospital, this model proved to be highly successful in terms of delivering outcomes for numerous adults with brain injuries. With road trauma being a leading cause of traumatic brain injuries, the permanency of this service will be of significant benefit to injured motorists, CTP claimants, their families and carers, MAIC and Queensland Health.

We also entered into a new collaboration with the Prince Charles Hospital Foundation. As a result of this, funding has been provided towards a pilot project, which will focus on redesign of the Intensive Care Unit, as a means of measuring its efficacy in terms of enhancing patient experience and assisting clinicians in providing the best care possible. With road trauma becoming a common cause of admissions to Intensive Care, any enhancements realised will have flow on benefits to claimants in the Queensland CTP scheme.

Governance

Our people

We strive to create a positive workplace environment where our people are engaged, committed and highly capable. Employees remained agile in 2021–22 with COVID-related restrictions reduced, vaccination requirements implemented and successful flexible working arrangements continuing.

During the year, our employees moved to a new location, with minimal work interruptions and consistent support provided simultaneously to our stakeholders.

Employees were also provided with the opportunity to participate in various cultural training programs and attend a smoking ceremony correlating with the move to the new work location.

The health and wellbeing of our team is essential and during 2021–22 we emphasised the importance of an appropriate work-life balance and supported flexible workplace practices. We further supported our employees through strong employee performance management and development programs, regular check-ins, through the Working for Queensland survey, and workplace health and safety strategies.

We met our obligations under the Public Service Ethics Act 1994 by ensuring our staff completed Treasury’s suite of online training modules, including modules related to the Code of Conduct and Human Rights. The online training package is rolled out to all new staff.

Our employee expenses and key executive management personnel and remuneration information can be found in the Financial Information (page 20 for MAIC, and page 46 for the Nominal Defendant). To see MAIC’s workforce profile, including full-time equivalent (FTE) staff and permanent separation rate, view the annual report of Queensland Treasury.

Our values

We align our behaviour and operations with the five Queensland public service values:

Customers first

- Know your customers

- Deliver what matters

- Make decisions with empathy

Ideas into action

- Challenge the norm and suggest solutions

- Encourage and embrace new ideas

- Work across boundaries

Unleash potential

- Expect greatness

- Lead and set clear expectations

- Seek, provide and act on feedback

Be courageous

- Own your actions, successes and mistakes

- Take calculated risks

- Act with transparency

Empower people

- Lead, empower and trust

- Play to everyone’s strengths

- Develop yourself and those around you

Human Rights

As part of our commitment to furthering the objectives of Queensland’s Human Rights Act 2019, we:

- completed Human Rights Certificates to accompany amendments to the Motor Accident Insurance Regulation 2018

- ensured all new staff learnt about their human rights obligations via our employees induction and orientation programs

- delivered complaints management training to the Nominal Defendant

- maintained a process to consider whether an individual’s human rights have been affected directly or indirectly when assessing a complaint about a decision made by MAIC or the

Nominal Defendant

- embedded a commitment to human rights into our strategic and operational plans

- continued our work with the First Peoples’ initiative to support Aboriginal and Torres Strait Islander peoples through the CTP claims process and related road safety initiatives

- continued our focus on employee health, safety, wellbeing and human rights by supporting flexible work arrangements for employees

- participated in Queensland Treasury’s Legislative Community of Practice with a key objective of the group being to continue embedding human rights across the wider organisation

- circulated the Queensland Human Rights Commission Training Bulletins and the Human Rights Policy and Legislation Network Newsletter issued by the Department of Justice and Attorney- General across the organisation.

No human rights complaints were received during the reporting period 2021–22.

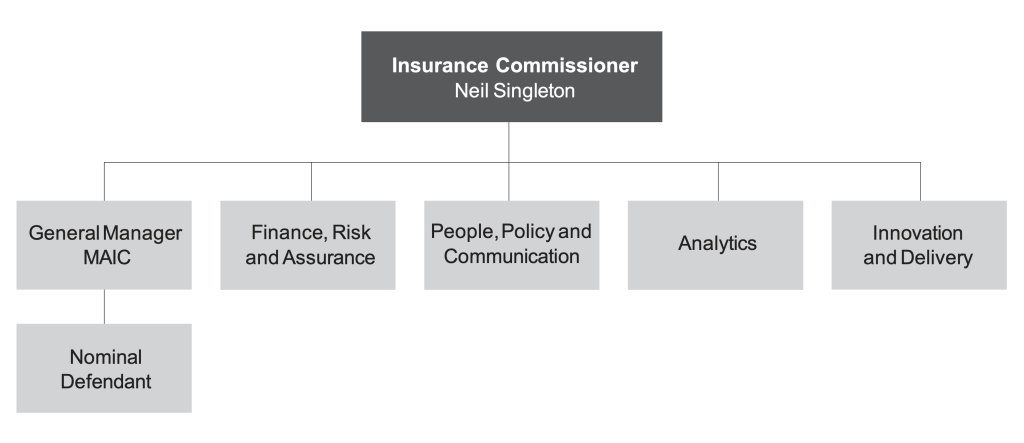

Our leadership team

The Insurance Commissioner sets the direction for MAIC, the Nominal Defendant, and National Injury Insurance Scheme Queensland (NIISQ) and reports to the State Parliament through the Treasurer and Minister for Trade and Investment.

In mid-2021, as a result of the Queensland Future Fund (Titles Registry) Act 2021, NIISQ was placed under the stewardship of the Insurance Commissioner, who now also acts as Chief Executive Officer for the NIISQ Agency.

He is supported by the leadership team, which includes General Manager Motor Accident Insurance Commission; Director Finance, Risk and Assurance; Director People, Communication and Policy; Director Analytics; and General Manager, Innovation and Delivery.

Our leadership team is responsible for setting the strategic direction of MAIC, the Nominal Defendant, and NIISQ overseeing operational performance, determining operation policy and project management.

The leadership team supports the Insurance Commissioner, as the accountable officer, to meet legislative requirements and accountabilities as well as identify and manage key areas of risk. As at 30 June 2022, the leadership team comprised of:

Neil Singleton

Insurance Commissioner

B. Business (Insurance), MBA

Neil was appointed as Insurance Commissioner in December 2010. Neil has over 30 years of insurance experience across a broad range of management and executive positions. Neil’s responsibilities include providing strong strategic leadership to ensure a viable, affordable and equitable CTP insurance scheme in Queensland.

David Vincent

General Manager Motor Accident Insurance Commission

Appointed in 2002, David has over 25 years’ insurance experience including roles in personal injury claims management and underwriting, along with positions involving insurance regulation and government policy development. David is responsible for leading the strategic management of the Nominal Defendant claims unit, the supervision of licensed insurer claims management compliance and performance and managing claims related legislative functions.

Anh Bui

Director Finance, Risk and Assurance

B. Bus, LLB, FGIA, CPA

Anh joined the NIISQ Agency as Director Finance, Risk and Assurance in November 2021, and is passionate about leading teams and providing public value through quality services. She is responsible for leading diverse teams across a broad range of strategic and operational functions including financial control, budgeting, procurement, governance and risk management

As a qualified accountant and governance professional, Anh has over 20 years’ experience in financial services, is a member of CPA Australia and has also been admitted to the legal profession.

Anh is a Fellow of the Governance Institute of Australia and is currently completing the Executive Master of Public Administration with ANZSOG.

Vicki Vanderent

Director People, Policy and Communication

B. Business, MBA, Grad. Cert Business (Behavioural Economics)

Appointed in 2006, Vicki leads the People, Policy and Communication functions for MAIC and NIISQ Agency.

Together with her team, Vicki strives to improve employee and participant experience and provide strategic and administrative policy support. With a passion for culture and community, Vicki loves to co-create experiences to support people to learn, grow and thrive.

Vicki has more than 20 years’ experience across government, university and private sectors.

Youyou Luo

Director Analytics

B. Actuarial Studies, PhD (Finance)

Youyou leads the MAIC and NIISQ Agency’s data analytics, levies advice, business intelligence and scheme reporting functions. She has a research background and has worked in data analytics roles across government organisations including transport, education and human services.

Youyou is passionate about turning data into insights that inform government policy, decision making and service delivery.

Peter How

General Manager, Innovation and Delivery

Dip (Proj Mgt), B. Comm, Grad Dip (Commercial Computing), MBA, MAICD

Peter has comprehensive Executive Leadership experience in government and private enterprise across a range of industries with a particular focus on innovation and incubation, organisational performance, agility and growth. He is also a qualified company director and board advisor.

Peter’s energy, enthusiasm and ability are readily on show as leader of MAIC’s Innovation and Delivery team.

Organisational Structure

Risk management

We are committed to effective risk management and have adopted Queensland Treasury’s framework for proactively identifying, assessing and managing risks. Our risk management approach ensures:

- we meet our statutory responsibilities under the MAI Act, the NIISQ Act and other legislation

- risk management is integrated into organisational activity

- corporate governance processes, including systems of internal control, are assessed and enhanced.

Everyone in MAIC and the Nominal Defendant is responsible for managing risk. A robust risk management framework is integrated into all Treasury business activities and systems; and our leadership team is accountable for risks that may affect our ability to achieve our strategic objectives. Risks are managed through our corporate governance framework providing the foundation for effective decision-making, sound management and clear accountability.

A risk register is maintained and reviewed by the leadership team biannually. Risks are monitored with risk controls and treatment strategies assigned to risks where appropriate. Treasury’s Executive Leadership Team reviews the MAIC risk register from a consolidated Treasury perspective and MAIC has external auditors which review the register annually. Our commitment to business continuity management ensures continuity of key business services which are essential for or contribute to the achievement of our objectives.

We participate in Treasury-wide risk and accountability management through representation on the Audit and Risk Management Committee. We also have an active Internal Audit program in place provided by the Treasury Internal Audit function.

Audit and Risk Management Committee

Insurance Commissioner, Neil Singleton, is a representative on Treasury’s Audit and Risk Management Committee.

The Audit and Risk Management Committee (ARMC) supports Treasury’s accountable officer – the Under Treasurer – to meet the responsibilities under the Financial Accountability Act 2019 (QLD), the Financial and Performance Management Standard 2009 and other prescribed requirements.

The role of the committee is to provide independent assurance and assistance to the Under Treasurer on Treasury’s risk and control frameworks and external accountability responsibilities as prescribed in the relevant legislation and standards.

The committee also provides oversight for select Treasury related entities that sit within Treasury’s broader portfolio (but prepare independent financial statements) which in 2021–22 included the MAIC and the Nominal Defendant.

2021–22 Audit and Risk Management Committee

Chair:

Independent member

Members:

- Assistant Under Treasurer, Social Policy

- Insurance Commissioner

- Commissioner and Registrar, Queensland Revenue Office

- Independent member and finance expert

The Under Treasurer, Deputy Under Treasurer, Social, Intergovernmental and Corporate, Head of Corporate, Chief Finance Officer (CFO), Chief Risk Officer, Queensland Audit Office (QAO) and Internal Audit (including Head of Internal Audit) have standing invitations as observers to attend all ARMC meetings. Treasury officers are invited to attend meetings as required.

Key achievements for 2021–22

In 2021–22, the ARMC met five times and fulfilled its responsibilities in accordance with its charter and approved work plan. Key achievements included:

- endorsing the 2020–21 financial statements for Queensland Treasury, MAIC and Nominal Defendant

- endorsing the 3-year strategic Internal Audit Plan and monitoring 2021–22 internal audit activity

- reviewing the effectiveness of the department’s risk management framework and overseeing the management of significant business risks

- monitoring progress of the implementation status of internal audit recommendations

- considering issues raised by QAO including recommendations from performance audits and Treasury related reports to Parliament.

Internal and external accountability

Our governance framework includes both internal and external accountability measures. Internal audit is an integral part of the corporate governance framework by which Treasury maintains effective systems of accountability and control at all levels. Internal audit provides assurance to the Under Treasurer that the entity’s financial and operational controls are operating in an efficient, effective, economical and ethical manner, and assists management in improving Treasury’s business performance.

Externally, MAIC and the Nominal Defendant are audited by QAO in accordance with the Financial Accountability Act 2009. MAIC and the Nominal Defendant have achieved unqualified audits since the Commission commenced operations in 1994.

More information on Treasury’s Audit and Risk Management framework including information about the committee are detailed in Queensland Treasury’s annual report.

Information systems and recordkeeping

Our recordkeeping framework aligns with Treasury’s Information Management Framework. The framework aims to ensure our record management practices are consistent with other offices within the Treasury portfolio and are compliant with current legislation and best practice record keeping standards. These include Public Records Act 2002, Information Privacy Act 2009, Right to Information Act 2009, Information Standard 18: Information Security, Information Standard 38: Use of ICT Facilities and Devices and Records governance policy.

MAIC and the Nominal Defendant are both within the scope of Queensland Treasury’s Information Security Management System (ISMS) and are included in Treasury’s annual information Security Return. As such, during the mandatory annual Information Security reporting process, the Under Treasurer attested to the appropriateness of the information security risk management within Treasury to the Queensland Government Chief Information Security Officer, noting that appropriate assurance activities have been undertaken to inform this opinion and Treasury’s information security risk position.

Motor Accident Insurance Commission financial summary

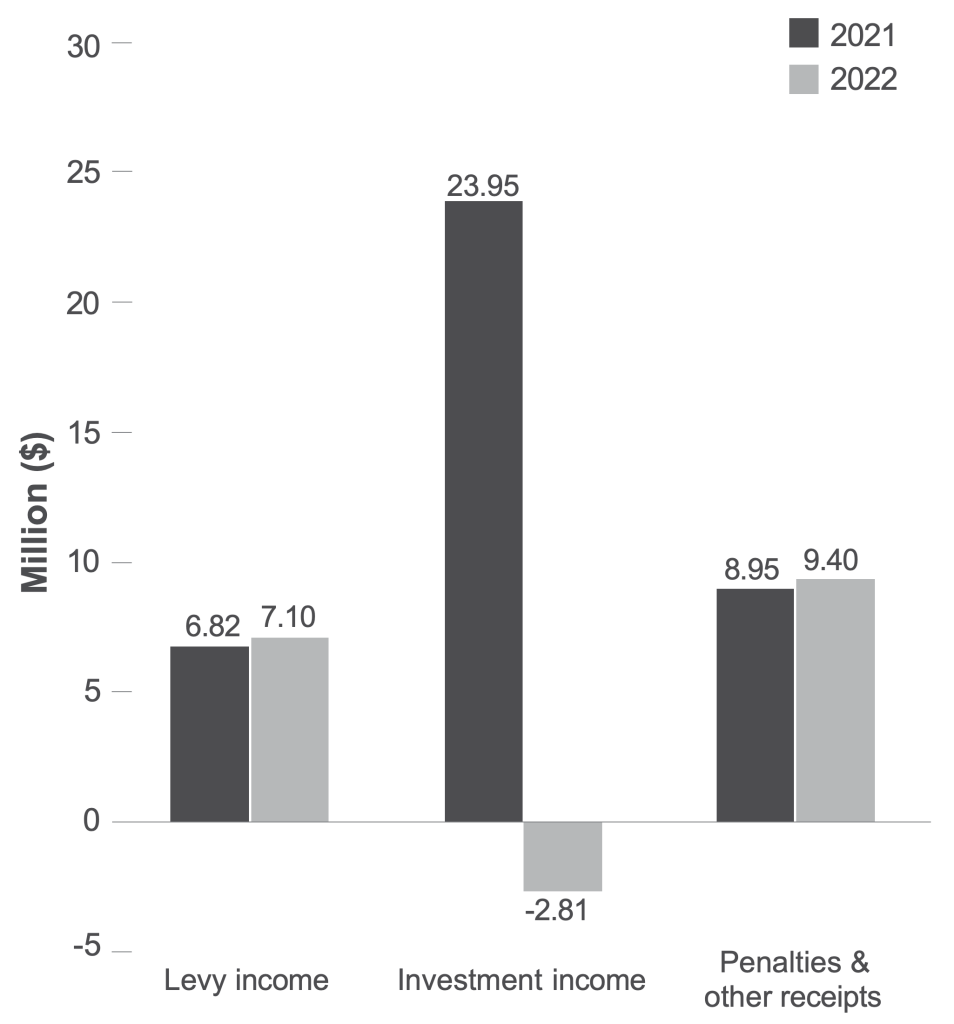

The operating result for MAIC for the year ended 30 June 2022 was a deficit of $20.07 million compared to the prior year’s operating surplus of $2.32 million. The decrease was driven by negative investment returns on financial assets. MAIC continues to hold a significant financial asset balance to fund the operating losses experienced.

The investment returns on financial assets were $2.81 million loss compared to prior year’s gains of $23.95 million. This reflects the volatility and downturn in the equity markets in 2021-2022.

The Statutory Insurance Scheme levy per vehicle remained unchanged from 1 July 2020 at $1.50 per annum. Penalties and other revenue increased by $0.44 million to $9.40 million. User charges revenue increased by $0.43 million due to the provision of corporate support services to the NIISQ Agency.

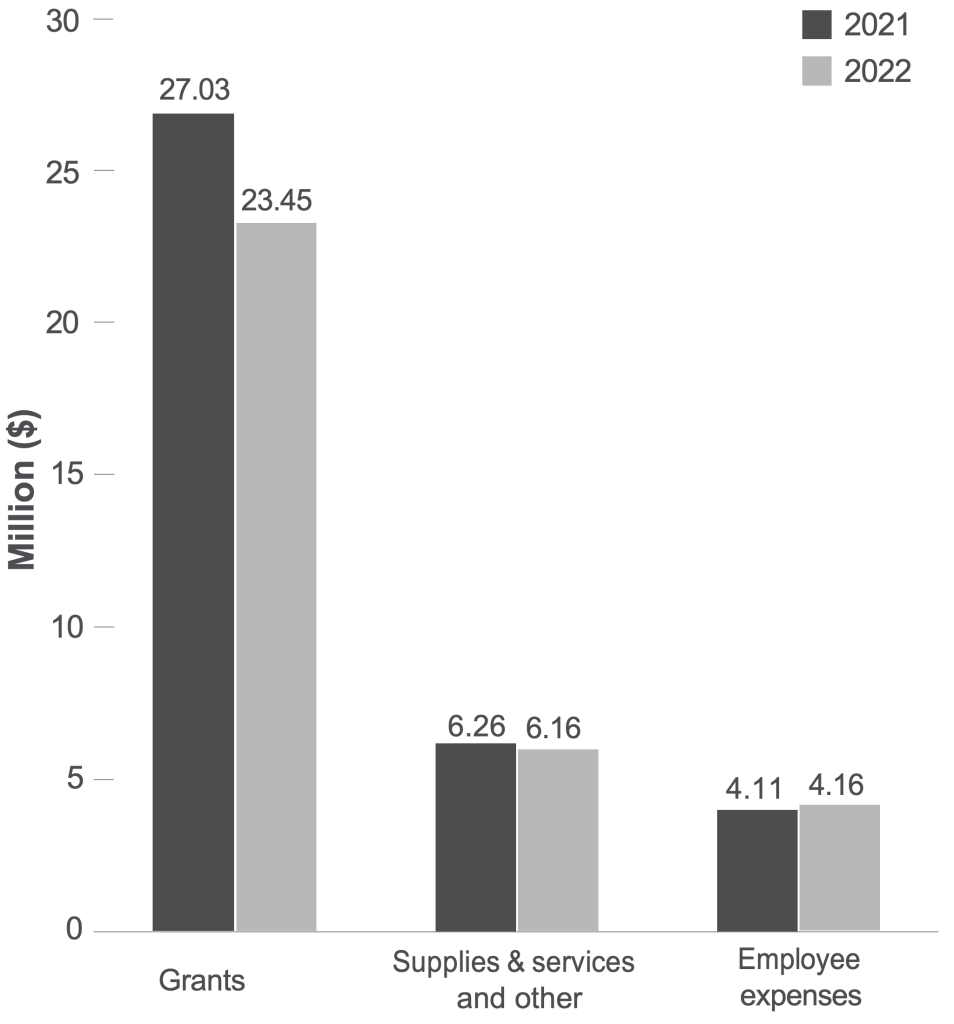

Total expenses decreased by $3.65 million to $33.76 million in 2021–22. MAIC’s largest expense item relates to $23.45 million grants spent on the continued funding of research programs to reduce the incidence and mitigate the effects of road trauma. The decrease in grants expense of $3.58 million was largely due to the completion of contracts funding rehabilitation initiatives research and strategic accident prevention research. Details of grant funding are provided in Appendix 4.

Other operating expenditure decreased by $0.11 million to $6.15 million primarily due to lower than anticipated expenditure on improving the CTP claim lodgement process.

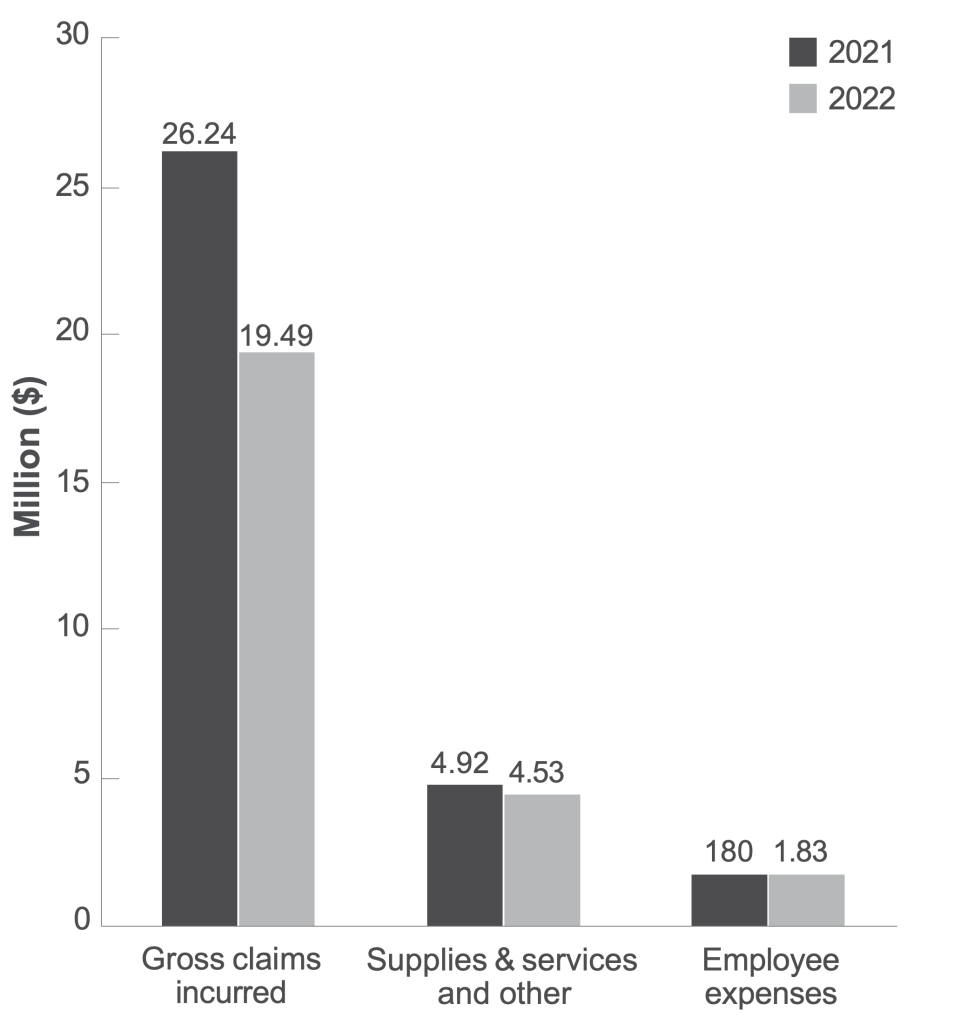

Income

Expenses

Motor Accident Insurance Commission financial statements

Nominal Defendant financial summary

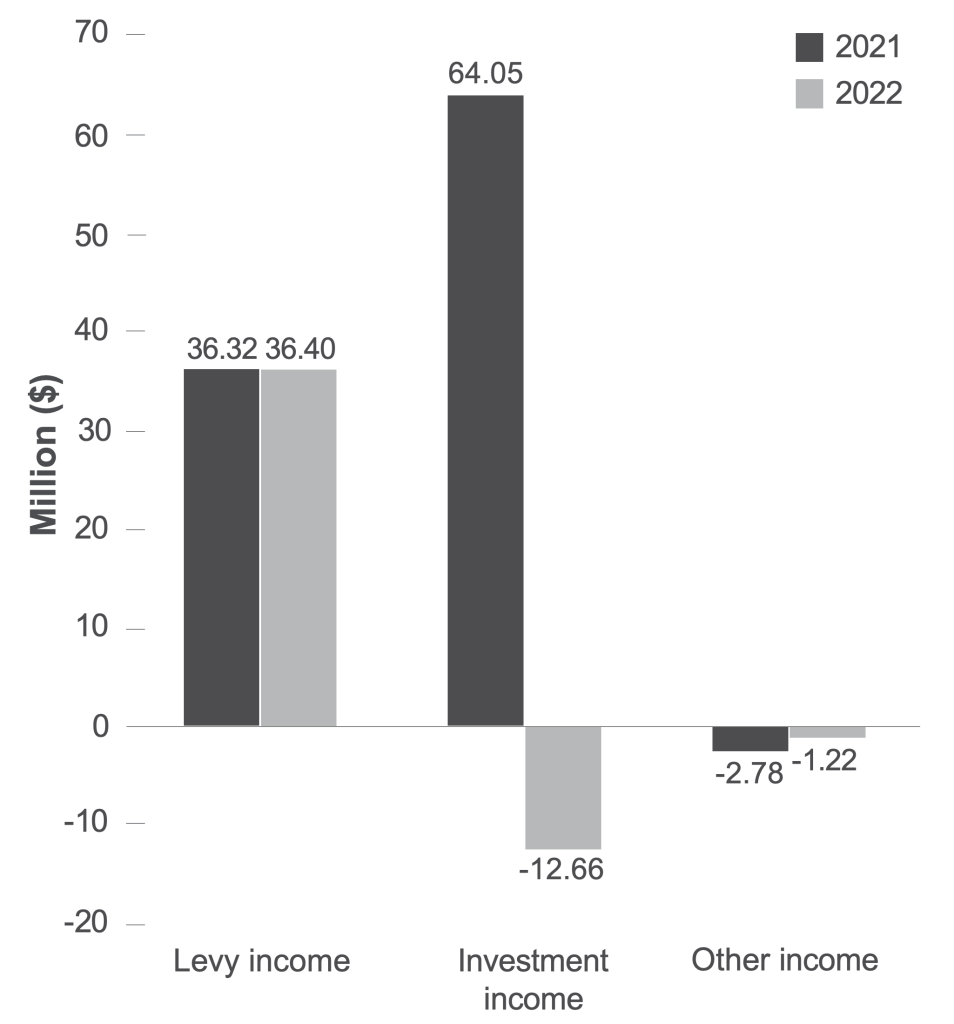

For the year ended 30 June 2022, the Nominal Defendant had a total income of $22.51 million and expenses of $25.85 million resulting in an operating deficit of $3.34 million, compared to the prior year’s operating surplus of $64.62 million.

The $67.96 million decrease in the operating result was driven by negative investment returns on financial assets. Total investment losses on financial assets were $12.67 million compared to prior year’s gain of $64.05 million. This reflects the volatility and downturn in the equity markets in 2021-2022.

The Nominal Defendant levy remained at $8.00 per Class 1 vehicle in 2021-2022 and generated income of $36.40 million, representing a $0.08 million increase from the prior year. Actuarial assessments at 30 June 2022 resulted in an increase of $1.58 million in reinsurance and other recoveries from prior year.

Total expenses decreased from $32.96 million in 2020-2021, to $25.85 million in 2021-2022. This is primarily a result of lower claim costs. The Nominal Defendant’s gross outstanding claims liabilities were actuarially assessed at 30 June 2022 to be $124.97 million, a decrease of $12.89 million from the prior year. Nominal Defendant claim payments were $32.38 million (prior year $32.59 million) and claim recoveries were $1.36 million (prior year $0.27 million).

Claim payments of $2.96 million were made in the preceding year in relation to FAI claims resulting from the insolvency of the HIH Group of companies in 2001. All claims relating to FAI were finalised in 2020-2021, and as such, there are no outstanding claims liability or claim payments in relation to FAI for the year ended 30 June 2022.

The Nominal Defendant is in a fully funded position with financial assets more than sufficient to meet all obligations arising from the outstanding claims liability.

Income

Expenses